Reputation

Badges 5

Editor Reporter Enthusiast NewbieWhen purchasing a property through a Florida county tax deed auction, pursuing a Quiet Title Action is almost always essential. This legal process ensures that no one can later challenge your ownership or claim any interest in the title.

While the county may clear certain liens that are subordinate to the tax lien, they do not guarantee a fully marketable title.

Without a Quiet Title, you cannot obtain title insurance or find a buyer when you decide to sell. For more insights, you can c...

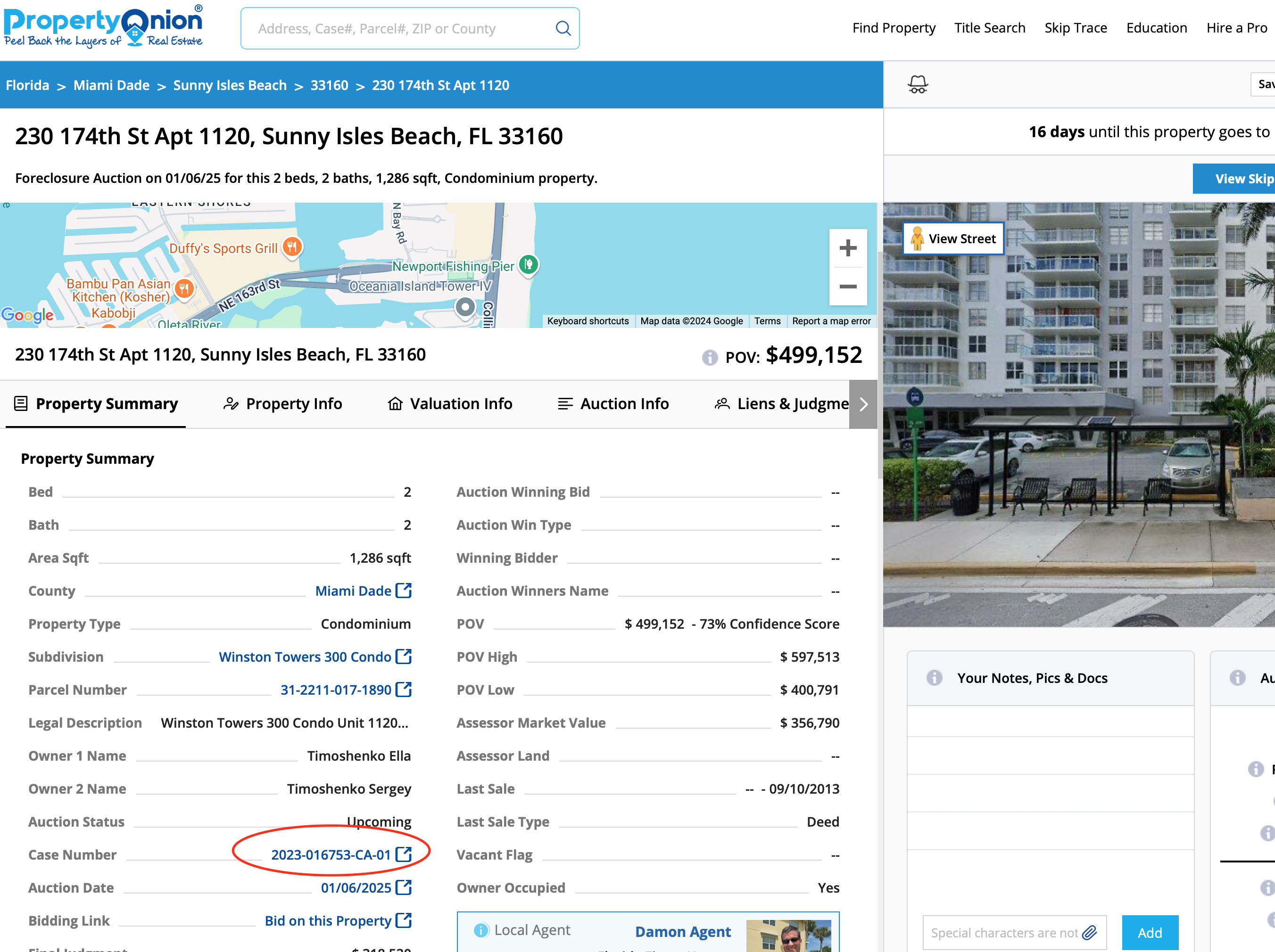

Simple answer is that the property had other liens that would not have been cleared making this a losing proposition. Just look at the plaintiffs, they were a private party, not a big bank. So this tells me this was not a first position mortgage, and there's another large mortgage here.

If you are interested in ff you’re bidding at a foreclosure sale on a second mortgage, you need to understand how the payout waterfall works. The clerk doesn’t apply overages to the first mortgage balance...

I have worked with Canadians many times when I was flipping condos here in Palm Beach County. Obviously there are plenty of Candian snowbirds here, and they tend to like to winter together here in the various condominium developements.

I think it's a fine idea, but it all depends on what exactly you mean by "connect" when you said "I would like to be able to connect Canadian investors" - are you speaking in a way an agent would, are you an investor? A friend helping friends? The devi...

There are a few reasons for this.

Firstly the lien listed in the "Liens & Judgements" section could be a different lien than the one foreclosing.

Secondly often times mortgages are "assigned" to other banks, basically they are bought and sold and the foreclosing party ends up being a different name than the original mortgage company listed on the face of the mortgage document. This is evident when the new bank files legal docs against the mortgagor and you see a new name there whic...

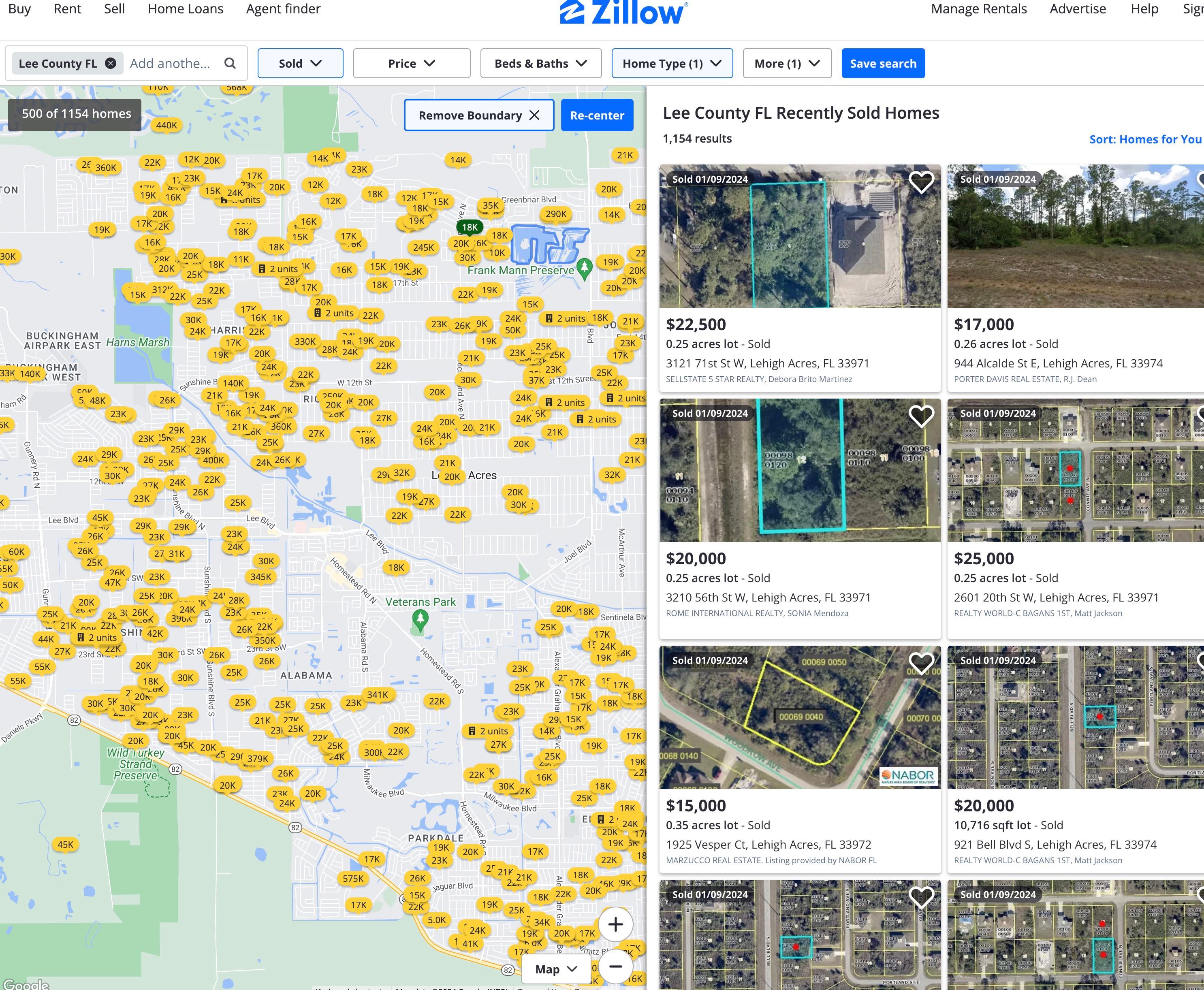

I agree with Phil's comment, Lee is a great place in Florida to grab some land. Look how many Land sales they had in the past 90 days, it's insane!

In Florida, You can get loans once these properties are sold at auction and you have your title. There's no lenders that can give you the money you need before the auction since they can't put a lien on it, and there's no closing. Once you have title there are many lenders that will lend you up to 100% of the value of the property value after repair. So that means if the propety is worth $400,000 fixed up, and it needs $100,000 worth of work, you can get a loan for up to the full $400,000.

Properties are classified into different categories based on their quality not just by investors, but by property appraisers as well, location, and characteristics, commonly referred to as Class A, B, C, and D.

Class A properties are the highest quality buildings, often newly constructed within the last 15 years, featuring top-notch amenities, high-income tenants, and prime locations. These properties demand the highest rents and typically have the lowest vacancy rates, making them a ...

they are updated when the county puts up the appraiser parcel id link The county tends to change details like the address until they do this Some counties post links to correct property 90 days out, some only 10 days out.

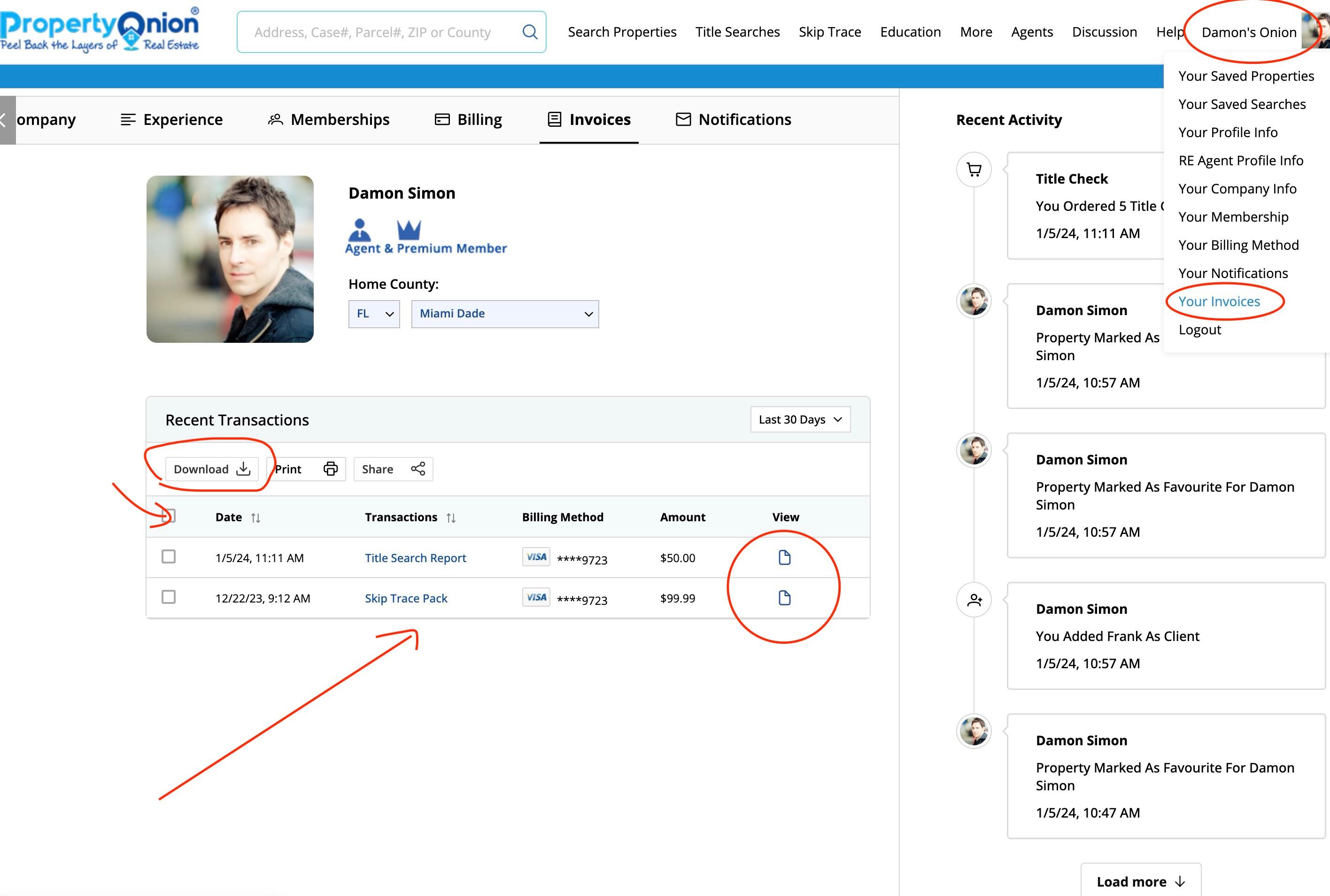

Super easy, just goto the "My Onion" menu in the upper right, click on invoices, and then you cna view/download each one from there.

I don't believe this is possible, if it is, it's a well guarded secret. You can buy an HOA lien and fight off the mortgage foreclosure with various defense strategies utilizing a knoweldgeable legal team.

You should read "HOA Foreclosure Play for Big Profits at the County Auction" that Tony wrote a while back.

ABSOLUTELY! All you have todo is click the red heart icon on the property detail page, spreadhseet view or the thumbnail view. This will add the property to your favorites here. When it's status changes from "Upcoming" to "Sold" or "Canceled" you will get an instant email notification.

Here is a video tutorial on how to add a save property.

.

Next: Research Properties (Two Options)

**Optio...

That's a good one!

Using an LLC (Limited Liability Company) to buy foreclosures is a common strategy among real estate investors, and for good reason—it offers liability protection, keeps your personal assets separate, and can streamline tax and partnership arrangements. But whether it’s the best option depends on your goals, risk tolerance, and how you structure your investing.

Here are a few points to consider:

✅ Benefits of Using an LLC:

Liability protection: If someth...

Yes, your understanding is correct:

Most private liens such as mortgages, judgment liens, and mechanic's liens are typically extinguished by a county tax deed sale.

However, governmental liens, including those imposed by the county, municipal government, or special taxing districts, usually survive a tax deed sale.

Important nuances:

Liens held directly by the county or city, such as code enforcement liens, municipal assessments, or special district charges, generally remain attached ...

Once you win and pay the balance, the clerk still has to go through their process before you officially get title. First they’ll issue a Certificate of Sale, then there’s a 10-day window where objections can be filed. If nothing gets contested, the clerk will then issue and record the Certificate of Title in your name. In most counties I’ve seen, you’re looking at around 2–3 weeks from auction day before the deed is in your name, sometimes faster if the clerk is efficient.

As for the forme...

When the HOA (or the county clerk on their behalf) puts the property up for foreclosure auction, they’re basically putting their judgment up for bid. They can either set the opening bid at whatever they feel makes sense, or they can come in and actively bid during the sale up to the amount they’re owed.

Once the bidding is over, the winning bid is considered payment toward their judgment. In other words, they’re accepting that final bid as satisfaction “in lieu of” the full amount they wer...

The bidder/winner is not responsible for any of it, they get the certificate of title and they are done.

When a property sells at foreclosure for less than the final judgment amount, the lien holder has the option to pursue a deficiency judgment, but it is not automatic. After the sale is confirmed, the lender decides whether to waive the deficiency or file a separate action to collect it.

If you look at the lien amount on this property, I believe it was $243k, so although the FJ was ...

You are correct that a first mortgage does not transfer to a new owner. What happens in a Florida county foreclosure or HOA foreclosure is that the first mortgage remains as a superior lien unless it was foreclosed, which is rare.

You now own the property subject to the first mortgage. You are not personally liable on the note, which is why the lender is telling you that you have no borrower relationship with them. That part is normal.

As the current title holder, you will receive notice ...

Don’t mistake the lack of a lis pendens for a clean slate. A lis pendens is just a notice of active litigation, but the underlying lien is created by the recorded mortgage in the county’s Official Records. In Florida, an HOA foreclosure typically only wipes out junior interests. If that URA loan was recorded prior to the HOA’s claim of lien, it remains attached to the property. You aren't just buying the house; you're buying the right to pay off that debt, and since HOA foreclosures trigger "...

Yes, the "HOA Foreclosure play" is a good way to make money but you need the proper structure in order to make a profit. We work with a service that does this, it basically costs about $6900, plus attorney fees, and then they orchestrate negotiations and/or foreclosure defense using a team of attorneys and professionals that specialize in this. Typically banks especially big ones do not give disocounts unless they have to. These guys comb mortgages and docs and give them a reason to. Can ...

There are some rules regarding attorneys advertising in that section we are having our legal team advise us how to do it properly. We have personal experience with a few attorneys listed below, they are capable of anything in the legal real estate realm, and have been guest on our webcasts in the past.

Jeff Harrington of Harrington Legal Alliance

https://myhlaw.com

Susan Bakalar

Bakalar & Associates, P.A

https://www.assoc-law.com

Natalia Ouellette-Grice, Esq.

https://lcolawfl.com

In most HOA-auction situations, the reverse mortgage does not get wiped out. You typically take title subject to that senior lien, and HUD (or HUD’s servicing contractor) can still foreclose if it is not resolved.

Is it “negotiable”?

Usually not in the normal sense. If this is an FHA-insured HECM, HUD’s rules drive the outcome more than “deal making.” The main built-in “discount” concept is the FHA non-recourse framework. When a reverse mortgage is due and payable after death, the debt ...

Great question — and you’re spot on. Here in Florida, we’re definitely seeing some pressure on condo owners, especially with rising HOA fees, special assessments, and insurance hikes. That’s creating more distressed inventory and foreclosure opportunities, particularly in older buildings that need repairs or haven’t passed recertification inspections.

As for good markets right now:

Palm Beach County is currently one of the...

Ahh, the "Fuck you Affadavit" - as a wholesaler many moons ago, I would file these on my deals in case the buyer tried to sell it behind my back. They are quite the stinky documents, and in the couple cases of a seller trying to sell it out from under me, I would get a phone call from the title company asking me to release it, to which I would explain, "sure, for $5k I would be willing to release my interest after all the work I did on the deal and your seller renigged on it behind my back"

...

Hi Reva,

Thanks for your question! I’m happy to clarify how this Florida foreclosure auction worked based on the information you provided.

Quick answer: The bank is allowed to bid with other bidders, this property has a huge mortgage on it and probably other encumberances, so 3rd party bidders had no room to make money if they bought, so no one bid. The bank takes it back and then resells it as an REO on the MLS or however they recover their money at that bank.

Here are the d...

Yes, it’s possible. If you win the HOA foreclosure, you take title subject to the existing mortgage. You didn’t take out the loan, but the mortgage stays with the property, not the owner.

After the sale, you can request a payoff from the lender and pay it in full, or try to negotiate. If you don’t, the lender can later foreclose and wipe out your interest.

Bottom line: you can pay off the mortgage, but you’re buying the property with that mortgage still attached, so know the payoff befo...

I see this question come up a lot, and Ohio can be confusing because people mix up tax liens and tax deeds.

For Ohio tax deed sales (Sheriff sales), the answer is:

The owner can redeem up until the court confirms the sale, but there is no redemption period after confirmation.

The owner can pay everything owed before the Sheriff sale, no issue.

Even after the sale, the owner can still redeem until the court confirms it.

Once the court confirms the sale, redemption is over. The bu...

The “max bid” listed before a foreclosure auction is just the plaintiff’s maximum bid—typically the lender’s bid based on the final judgment amount owed.

It’s not the minimum price for the auction.

The actual opening bid (what the auction starts at) can be much lower, often covering just court costs and fees. If no one bids higher than the opening bid, the plaintiff usually wins with their max bid.

So, in your examples, the auction could still start lower than either amount liste...

Short Answer:

Unfortunately, yes, in most Florida counties the clerk will not refund the statutory court fees, even when a foreclosure sale is later vacated. The winning bid gets returned, but the administrative fees do not, because the clerk already performed the work the fee covers.

Why This Happens

When a sale is conducted, the clerk charges several fixed fees: the online sale fee, registry fees, credit card or wire fees if applicable, and document recording fees. These ...

I do believe they will need to file the satisfaction in official records. The county can take a week or longer to index it. You need to contact the bank or if you are not on title the owner needs to contact the bank to make sure they filed it, and if they could also send you a copy.

Hi! Yes, we do offer 1-on-1 Tax Lien, Foreclosure and Multifamily mentorship programs specifically for Tax Deed, Foreclosure and Tax Lien investing, and you're absolutely right — it is a detailed process with a lot of moving parts. That’s exactly why we created these programs: to help investors like you avoid costly mistakes and fast-t...

Your strategy of proactively identifying tax-delinquent properties and making direct offers to owners before they reach the tax deed auction can be a smart move—if done correctly. However, there are key risks and considerations you should be aware of before pursuing this approach.

Understanding the Risk of Existing Liens

When you buy a tax-delinquent property directly from the owner (before it goes to auction), you inherit all existing liens attached to the property. Unlike purchasing...

Correct on one part of your question.

Tax deed sales in FL will clear all existing liens other than governments as long as they are noticed before the sale properly.

Foreclosure sales only clear what is junior to their lien position. So a 2nd position mortgage foreclosing wouldn't clear the 1st mortgage, but a 1st position mortgage foreclosing would clear the other mortgage.

The HOA or condo association foreclosure wouldn't clear either of them when they foreclose. It's a song an...

Wow, that’s a crazy situation! I can totally see why you’re frustrated. Here’s what I’d suggest doing next:

First Things First:

Double-Check Your Documents: Make sure the property records and the legal description on your deed match up. It’s possible there’s been some kind of mix-up.

Talk to the Tax Collector’s Office: Since this was a tax deed sale, they might have more info or be able to point you in the right direction.

Reach Out to the Building Department: The city or county bui...

You Asked & We ALL Answered!

Most Popular Questions

- Mortgage Reporting on Title Search?

- Tax Deed vs Foreclosure Implications?

- Estimating the loan balance on a Reverse mortgage?

- Pre-Foreclosure Info...?

- Why is the Plaintiff name different from the Mortgage Lender??

Most Recent Questions

- Negotiating a Reverse Mortgage Assigned back to HUD?

- Taxdeed case not appearing on county website?

- NEGOTIATING MORTGAGE PAY OFF AND SUCCESS?

- City and county lien?

- URA SUBORDINATE LOANS?

Can you answer these questions?

- Looking for creative buyers, seller finance in Marion County, FL?

- PropertyOnion to incorporate working with probates??

-

20415 days ago

-

100one year ago

-

51one year ago

-

50one year ago

-

30one year ago

-

27one year ago

-

26one year ago

-

20one year ago

-

202 years ago

-

202 years ago