Hi Reva,

Thanks for your question! I’m happy to clarify how this Florida foreclosure auction worked based on the information you provided.

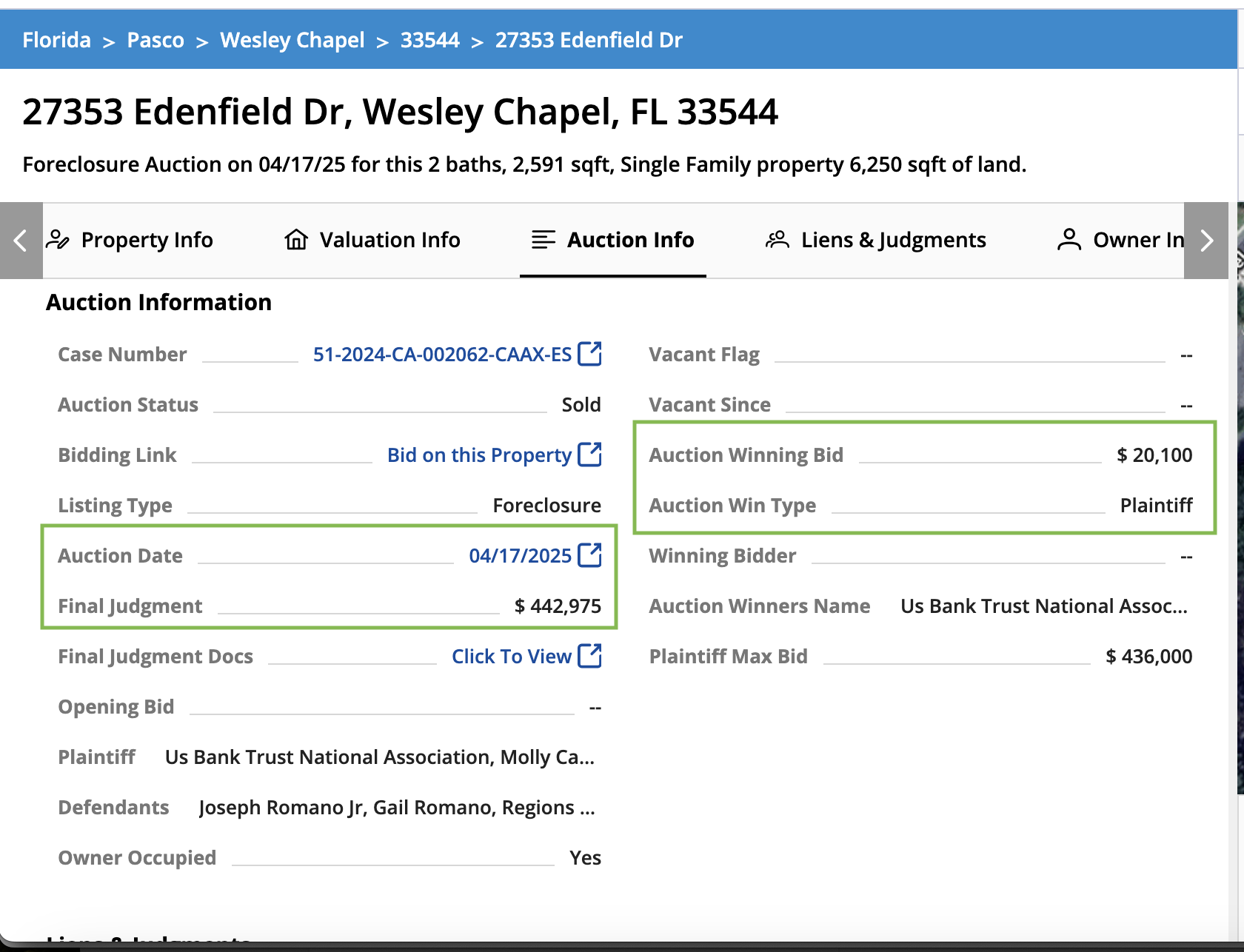

Quick answer: The bank is allowed to bid with other bidders, this property has a huge mortgage on it and probably other encumberances, so 3rd party bidders had no room to make money if they bought, so no one bid. The bank takes it back and then resells it as an REO on the MLS or however they recover their money at that bank.

Here are the detailed answers to your questions:

1. Can the Plaintiff be part of the auction process?

Yes, absolutely. In fact, it’s very common. The plaintiff is typically the bank or lender who filed the foreclosure case. They always participate in the auction by entering a credit bid—this means they bid using the debt owed to them instead of cash. In this case, the plaintiff is US Bank Trust National Association.

2. Am I correct that in this bidding, the plaintiff got hold of the property for ~$20K?

Not exactly. The Auction Winning Bid shows $20,100, but the Plaintiff Max Bid was $436,000, and the Final Judgment was $442,975. That $20K figure just means no third-party bidder offered more than $20,100, so the property went back to the plaintiff (the bank) by default.

It's important to note: the plaintiff doesn’t really pay $20,100 — this is just the top competing bid. The bank reclaims the property under their judgment amount, which is often much higher. The $20,100 is just what was bid publicly by another party, not the cost the bank pays.

3. What are their responsibilities right after the bidding is successful?

Since the plaintiff (the bank) took the property back, they’ll typically do the following:

Obtain the Certificate of Title from the county clerk (usually within 10 days).

Secure the property (change locks, winterize if needed, etc.).

Evict any occupants if necessary (though this appears to be owner-occupied).

List the property for resale, usually through a local real estate agent (you may see it listed as an REO or bank-owned property later).

They don’t pay the auction amount. Instead, they write off the difference between the judgment and what they ultimately recover after resale.

Let me know if you'd like help understanding this case further!

Most foreclosures are bought by the bank.

Hi Reva, great question. This is actually a very common scenario in foreclosure auctions, and this example helps to make things much clearer.

Yes, the plaintiff, which in this case is the bank, is part of the auction process. They are always included because they hold the lien and have the right to bid. Technically, what they are doing is placing a bid to either recover the cash owed to them or, if that fails, take back the property and try to sell it on the open market.

In this specific case, the plaintiff, US Bank Trust, was owed about $442,975. This includes the unpaid loan, interest, penalties, legal fees, and other costs. They submitted a maximum bid of $436,000, which tells us that they were willing to accept a small loss in order to move on and take the money. This is fairly common in foreclosure auctions.

Someone at the auction, a third-party bidder, placed a bid of 20,000 dollars, probably hoping the bank would sit it out and waive their bidding rights. Sometimes this actually happens, and bidders get incredible deals. But in this case, the bank decided to bid. The auction system, which in Pasco County is run by RealAuction, uses an auto-bid system. That means the bank didn’t need to place their full $436,000 dollar bid. Instead, they just had to go one increment higher than the highest third-party bidder. That’s why the winning bid shows 20,100 dollars. It only beat the other bid by 100 dollars, which was enough for the bank to win the property back.

So to answer your question, no, the plaintiff did not buy the house for 20,100 dollars. As Damon said, that is just the technical amount recorded as the winning bid. In reality, the bank is recovering the property in exchange for forgiving the full debt.

Now, regarding responsibilities, once the auction is complete and the bank wins, they become the new owner. They now have to maintain the property, pay taxes, handle any HOA dues or property violations, and eventually sell the property. They will probably clean the title and list the home through a real estate agent as an REO, meaning Real Estate Owned.

In the end, the bank did not want the house. They wanted their money. But since no one was willing to pay enough to cover the debt, they took the property and will now try to recover whatever they can through a resale.

Thanks Fernando, the explanation is super clear. I really appreciate you elaborating the answers for me!

Pro since 12/25

Pro since 12/25