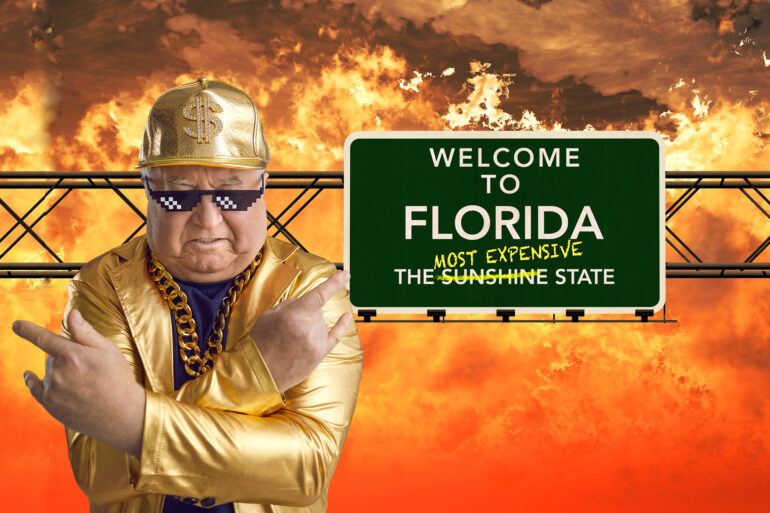

2022 Florida Housing Now Most Expensive in the United States!

According to a recent CBS report, Florida is now the most expensive place to live in the U.S. This comes not long after research by Realtor.com showed that Miami was the least affordable city.

What’s going on? Has Florida’s real estate market really surpassed those of NYC, Chicago, San Francisco, and other metro areas?

Rent has been rising by the double digits nationwide, but rent increases have been most pronounced in the Sunshine State. For example, monthly rents in Naples, Sarasota, and Tampa are all up between 29% and 39% in the past two years!

In this article, we’ll explore why Florida has been hit by rent hikes the most and what the future holds for its real estate market moving forward.

Let’s get started!

What Made Florida the Most Expensive Housing Market?

Part of what’s fueling Florida’s real estate market is its rapid population growth. Over 200,000 people are added to the state’s population each year!

Most recently, the state experienced a surge of new residents from pandemic relocations. People who started working from home realized they could live wherever they want, and Florida has a lot to offer:

- Beautiful weather

- A booming economy

- Zero income tax and low property taxes

- And a relatively low cost of living (up until recently)

Between 2020 and 2021 alone, 300,000 people moved into Florida. Now it’s growing faster than every other state but Texas.

Even big businesses see the appeal. Goldman Sachs, Elliott Management, and Virtu Financial all decided to relocate to Florida in the last few years.

Naturally, the increased demand for Florida real estate from out of state is driving up housing costs. And since Florida law prohibits rent control, which could put a cap on rent hikes, rents continue to skyrocket.

Another reason for the expensive Florida real estate market is the nationwide housing shortage. Pandemic supply chain issues, a lumber shortage, and a construction worker shortage have all slowed down the building of new homes, leaving the U.S. about 3 million homes short of demand.

When you combine all the factors above, it’s easy to see how Florida quickly became the most expensive housing market in the U.S. For a long time, residents enjoyed relatively low housing costs, but savvy remote workers and investors have caught on and driven up prices.

What Has the Impact Been So Far?

So far, people working in the tourism and service sectors have been hit by the expensive Florida real estate market the hardest. Lower-income families working in the cities are spending upwards of 60% of their income on housing when experts consider anything over 30% unaffordable.

According to Realtor, “the median rent for a typical 0-2 bedroom unit in Miami, Florida is twice as high as the estimated maximum affordable rent for the median household.”

Not surprisingly, some residents are leaving Florida to move to more affordable states. After living in the Sunshine State for 30 years, 70-year-old Michele DeMoske-Weiss plans to move to Washington state or Pennsylvania to be closer to her children. “I’m leaving as soon as I can get out,” she said.

But moving isn’t feasible for many who work in the service or tourism industries. These jobs can’t be done remotely, and moving long distance costs a lot of money that many families simply don’t have. They’re stuck paying the higher rent.

What Will Happen to Florida’s Real Estate Market Next?

Eventually, Florida’s hot real estate market will be due for some correction. Rent increases could slow down gently or the entire market could crash. We might even see Florida turn into a swanky real estate market like that in California. Only time will tell.

For now, all we know is that with the rising housing costs, some renters will be squeezing their budgets to get by or moving away, and the migration into Florida from other expensive areas will most likely slow down.

If you’re looking to take advantage of Florida’s real estate market while it’s hot, check out PropertyOnion.com’s property search map, where you can find plenty of foreclosures and tax deed properties to invest in at low prices.