How ChatGPT Can Help Real Estate Investors

ChatGPT, the AI language model developed by OpenAI, has been making waves in the world of consumer tech and beyond. As a powerful AI tool capable of understanding and processing human language and “conversing” with users as an all-knowing chatbot, ChatGPT has been hailed as the next big tech breakthrough.

With its ability to analyze data, answer questions, and provide insights across a wide range of topics and industries, ChatGPT is quickly becoming an essential tool for businesses and individuals alike.

Real estate investors can benefit greatly from ChatGPT’s capabilities — it’s a tool that will help you make informed decisions and maximize returns.

In this article, we explore how ChatGPT is a boon for real estate investing and how it is revolutionizing the industry.

First, let’s understand the tool that is making waves worldwide.

By combining ChatGPT’s treasure trove of historical data with other reputable sources of up-to-date information, you can gain a well-rounded view of the real estate market and make informed investment decisions.

How ChatGPT Works

ChatGPT was built using a technique called deep learning. It was fed over 45 terabytes of data: text from books, articles, websites, and many other sources. The model was trained to identify patterns and learn the rules of the language. As it processed more data, it generated more accurate and coherent responses.

ChatGPT is equipped with a vast amount of current knowledge, so it is well-suited for providing appropriate information and guiding understanding on a wide range of topics, including real estate investing.

The most recent version of ChatGPT has been trained on text data until 2021. Its creators continue to refine and improve the model — it will become even more powerful as it is fed more data and undergoes more training.

How ChatGPT’s Knowledge Cutoff Date Is a Pro and a Con for Real Estate Investors

“My knowledge cutoff date is September 2021, so any information or events that occurred after that time are outside of my scope,” is how ChatGPT responds when prompted with questions about real-time data or events.

However, the model is still an incredibly powerful tool that can provide valuable insights for investors. Why else would it be touted as a Google killer?

ChatGPT has a wealth of knowledge about real estate investing until the cutoff date. It can provide information about how the real estate market has performed over time and the impact of recent economic and societal trends. This is valuable for investors seeking guidance on navigating the market.

On the other hand, the cutoff date limits its usefulness for those seeking fresh insights and up-to-the-minute trends in real estate investing, such as real-time MLS data, property rates, and the like.

By combining ChatGPT’s treasure trove of historical data with other reputable sources of up-to-date information, you can gain a well-rounded view of the real estate market and make informed investment decisions.

This is a game-changer — before ChatGPT, one needed to sort through dozens of search engine queries and multiple tabs, which was very time-consuming and overwhelming.

ChatGPT Use Cases for Real Estate Investors

General Information on Real Estate Investing

ChatGPT can provide information on various elements of real estate investing, such as:

- Different types of investments, such as residential properties, commercial properties, raw land, and real estate investment trusts (REITs).

- How to evaluate potential properties based on location, market trends, property condition, and potential rental income.

- Common real estate investing strategies, like buy and hold, fix and flip, and wholesaling.

- Identifying properties at risk of foreclosure or have already been foreclosed upon.

- Advice on legal requirements and steps involved in purchasing properties.

- Navigating the auction process.

- Insights on the risks and rewards of buying properties through tax deed sales and other methods.

A Patient and Comprehensive Guide for Novice Real Estate Investors

For new real estate investors who want to learn the basics, ChatGPT can be an invaluable tool. The model can explain concepts in detail and respond to follow-up questions. It also provides relevant examples and analogies for easy understanding.

This is a game-changer — before ChatGPT, one needed to sort through dozens of search engine queries and multiple tabs, which was very time-consuming and overwhelming. ChatGPT provides a more streamlined and efficient way of accessing information. The model’s vast knowledge base and ability to process natural language mean that you can ask questions in a conversational manner without the need for specific search terms or keywords.

It’s important to note that ChatGPT’s responses must be verified using reliable sources. There is always a possibility that it may overlook or omit information. Nonetheless, ChatGPT’s capabilities make it an indispensable resource for new investors who need a reliable source of information about the basics of real estate investing.

While ChatGPT can be a valuable tool for real estate investors, there are areas where its capacity to provide insights and advice may be limited.

Real Estate Investment Decisions

ChatGPT is also an excellent resource for investors deciding on potential real estate investments. ChatGPT has collated historical data on factors, such as location, property type, and other vital considerations, that can impact the success of an investment.

For example, ChatGPT can provide guidance on whether a particular town or city will likely experience growth or decline in the future, which could impact the value of properties over time.

When asked: “Can you tell me the most likely city that will experience real estate growth in Florida based on the data you have?”, it responds:

I can tell you that historically, some of the cities that have experienced strong real estate growth in Florida include Miami, Tampa, Orlando, and Jacksonville. These cities have been popular destinations for retirees, investors, and young professionals looking for job opportunities and a good quality of life.

ChatGPT can also be a proactive tool to help you find more investment opportunities and areas of potential value. The model may be able to identify undervalued properties in a particular area or provide guidance on emerging trends in the real estate market that could impact future investment opportunities.

When asked: “Based on past trends, where in Tampa, Florida, might I find undervalued properties?”, it repsonds:

In Tampa, some areas that have had lower real estate prices historically include:

- East Tampa: This area has historically had lower home prices and may be a good place to find undervalued properties.

- Seminole Heights: While this area has become increasingly popular in recent years, it still has some undervalued properties that may be worth considering.

- Sulphur Springs: This area has had lower home prices historically and could be a good place to find undervalued properties for investment.

- Drew Park: This area has a mix of residential and commercial properties and has had lower home prices compared to other areas of Tampa.

Investors can also use ChatGPT to analyze property data, such as price per square foot, rent levels, and vacancy rates, to help you identify properties likely to provide strong returns.

When asked: “Based on historical data, can you tell me how the price per square foot, rent levels, and vacancy rates have evolved in Tampa, Florida?”, it responds:

- The price per square foot of homes in Tampa, Florida, has generally trended upward over the past decade. According to Zillow, as of September 2021, the median price per square foot in Tampa was $202, which is an increase of approximately 6% compared to the previous year.

- Rent levels in Tampa have also trended upward over the past decade. According to RentCafe, as of September 2021, the average rent for an apartment in Tampa was $1,426, which is an increase of approximately 14% compared to the previous year.

- Vacancy rates in Tampa have generally trended downward over the past decade, indicating a strong demand for rental properties. According to the National Association of Realtors, as of the second quarter of 2021, the vacancy rate for rental properties in the Tampa-St. Petersburg-Clearwater metropolitan area was approximately 4.4%.

It provides the same numbers and insight when “Tampa” is replaced with “Drew Park.”

Note that ChatGPT’s responses should not be taken as gospel. The real-world factors influencing real estate investments can change quite rapidly. When making investment decisions, you must consider current market conditions, economic trends, and other real-world factors.

Do your own due diligence for your investments; use ChatGPT as a general guide instead of a word-for-word instruction manual.

ChatGPT’s Limitations in Helping Real Estate Investors

While ChatGPT can be a valuable tool for real estate investors, there are areas where its capacity to provide insights and advice may be limited.

Before you explore the possibilities of using ChatGPT for your real estate investments, consider the following as something of a disclaimer:

- ChatGPT is not able to provide real-time data or insights on rapidly changing market conditions, such as economic or political events that impact property value.

- While ChatGPT can provide guidance on historical trends and patterns, it cannot accurately predict future market conditions or changes in real estate values.

- ChatGPT’s ability to analyze property data and provide insights on potential investment opportunities relies on the accuracy and completeness of the data you provide.

- ChatGPT’s responses may not be tailored to your specific needs or circumstances, as it cannot understand personal preferences, risk tolerance, and other factors that may influence your decision-making process.

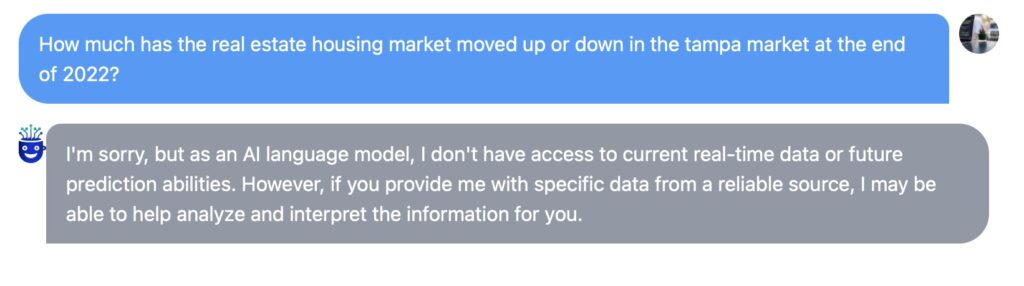

This graphic shows that it’s only as good as the data YOU, the investor, train with, so if a user doesn’t train properly, they get answers like this:

Conclusion

While ChatGPT can be a valuable resource for real estate investors, it’s important to use its insights and advice as part of a broader decision-making process. You must consider real-world factors, such as current market conditions and individual circumstances.

If you’re a real estate investor looking to take advantage of the many opportunities available in Florida, there are a wealth of resources at your disposal. Augment the insights and knowledge provided by ChatGPT with PropertyOnion.com’s service offerings around properties not listed on the MLS, foreclosure and tax deed auctions, wholesaler deals, and title searches.

Gain a competitive edge in the market and uncover opportunities others may overlook. Whether you’re a seasoned pro or just starting real estate investing, take your portfolio to the next level today.