Tax Certificate and Tax Deed Sales

There are many ways to invest in real estate. But two lesser-known ways are buying tax liens and tax deeds. These investments can be highly lucrative when done right, but they can also be hard to understand. Many people mix up the terms tax deed and tax lien without knowing the difference.

So, let’s break them down. Here’s all you need to know about tax certificate and tax deed sales to get started with investing in them:

What Is a Tax Lien?

A tax lien is a legal claim issued against a property when the owner fails to pay their property taxes. According to Florida statutes, property taxes are payable on November 1 of each year, and if they are not paid by April 1 the following year, the property is considered tax delinquent.

At that point, the county or municipality issues a tax lien on the property, which represents the unpaid property tax balance. To recoup these real estate taxes, the government will advertise the property for three consecutive weeks before holding a public auction to sell the tax lien in the form of a certificate.

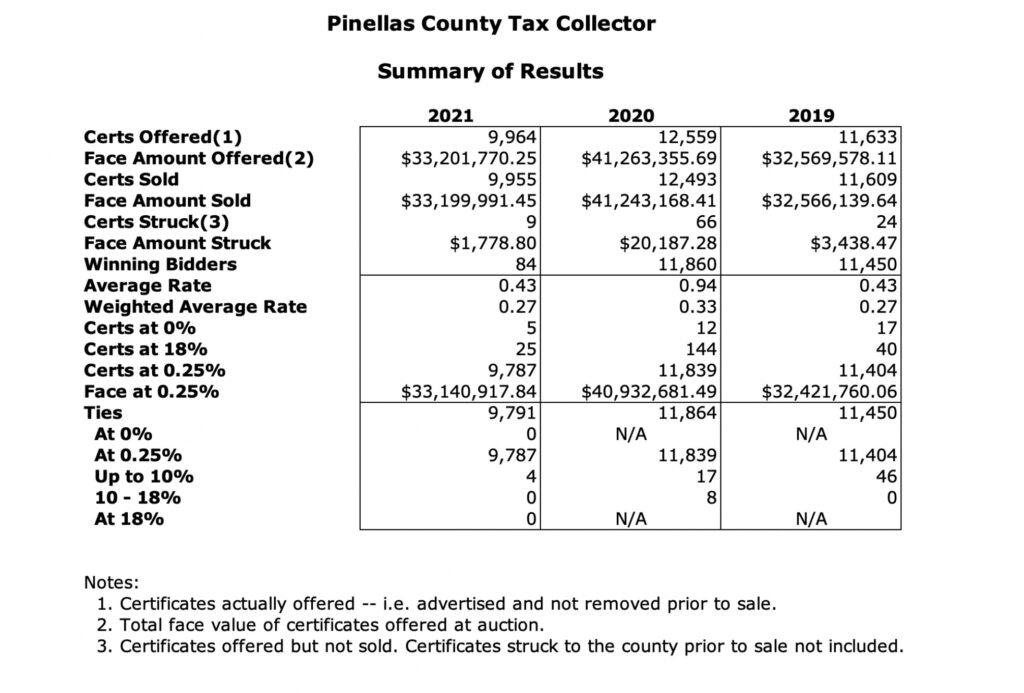

At the tax lien certificate auction, investors come to buy the tax certificate. But instead of bidding on a price, they bid on an interest rate. The opening bid starts at 18% and goes down from there.

The incentive to buy a tax certificate is to earn interest on it. As the tax certificate holder, you pay the homeowner’s overdue property taxes in return for collecting the amount plus interest later.

According to Florida law, homeowners have two years from the tax certificate sale to redeem the certificate. Once they do, the lien is removed, and the certificate holder is reimbursed the cost of the certificate plus the accrued interest. If, after two years, the tax lien remains unpaid, the investor can file a tax deed application, and the property itself goes to a public auction to be sold in the form of a tax deed.

That’s the simplest way to describe how tax certificates and tax certificate sales work. In the next section, we’ll cover tax deeds and tax deed sales, which are closely related but different.

What Is a Tax Deed?

A tax deed is a legal document granting ownership of a property to the government when the owner fails to pay their property taxes.

The local county or municipality will put the tax deed up for auction at a tax deed sale 3-6 months after a tax deed application is filed. During that period, the property owner can still pay the delinquent taxes in full plus interest and fees to stop the tax deed sale from taking place.

If the taxes are not paid, the property is included in a list of properties to be auctioned off and sold to the highest bidder. The county or municipality sets the minimum bid at whatever the outstanding taxes plus interest, fees, and sales costs, and investors bid up from there.

In some cases, the successful bidder can walk away with properties available for taxes for only a few thousand dollars! But buyers must be able to pay for them in full within a minimum time after the tax deed sale—typically one business day.

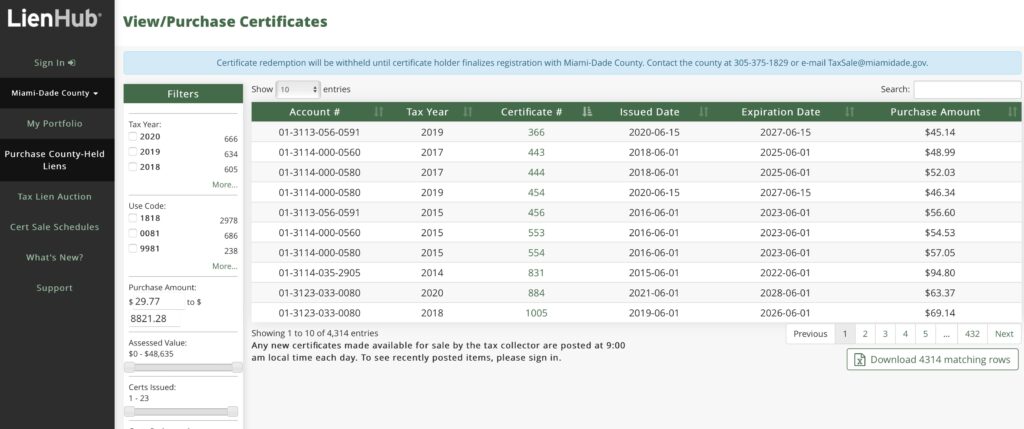

After the tax deed sale, the government uses the money to satisfy the outstanding property taxes on the tax deed (plus interest and fees) and then gives any surplus to the original property owner. Any tax deeds that don’t sell in Florida will be placed on the “Lands Available for Taxes” list for immediate purchase.

In summary, buying a tax lien is an investment in the property owner’s tax debt, while buying a tax deed is an investment in the property itself. Both can be suitable investments. On the one hand, tax liens require relatively low capital and work and yield stable returns with some risk. On the other hand, tax deeds need more capital and work (e.g., rehab and reselling) and have the potential to yield even greater returns with some risk.

Now that you know the basics of how tax lien sales and tax deed sales work, let’s cover the advantages and disadvantages of both types of investments.

Pros of Investing in Tax Lien Certificates

Here are the benefits of investing in tax lien certificates at a tax certificate sale:

● Low capital requirement—It is often possible to buy a tax certificate for as little as a few hundred dollars, which means a low barrier to entry compared to other forms of real estate investing.

● Potential for high ROI—When bidding on a tax certificate, you could lock in an interest rate of up to 18%, and that’s much better than the stock market’s average 10% return long-term.

● Less volatility—Because the tax lien has a fixed interest rate and isn’t subject to the market, your investment is less volatile, too. You’ll have a solid understanding of your return by the end of the redemption period.

● Tax liens have priority over other liens—Homeowners are required by law to pay off any tax liens before their mortgage and other liens. So their debt to you will come first.

Cons of Investing in Tax Lien Certificates

There are some of the potential downsides to investing in tax lien certificates at a tax certificate sale:

● Illiquid investment—Your money could be tied up in the tax lien for a couple of years. There’s no sure way to liquidate your investment early after a tax certificate sale, even with secondary markets like eBay and other after-market platforms.

● One-time payout—When you do get paid, it’s a one-sum payment. That includes the accrued interest. You won’t receive any compensation until the homeowner pays in full or the redemption period expires.

● Competition—You could face competition from corporate entities like banks and hedge funds who like to attend tax certificate sales to buy up tax liens to add to their investment portfolios. This drives down the interest rates to as little as a few percent.

● Risk of homeowner bankruptcy—If the homeowner goes bankrupt, your payout could be delayed or reduced since bankruptcy judges have the power to change the payment schedule and interest rate.

● Risk of owning unwanted property—If the property goes to a tax deed auction and nobody bids for it, you could end up with a property that nobody wants. Maybe it’s a sliver of land, or it has environmental damage. If nobody buys it at the tax deed sale, chances are your tax certificate will be more of a liability than an asset since you’ll have to continue paying taxes on it.

Pros of Investing in Tax Deed Certificates

Now, here are some of the benefits of buying the property itself through a tax deed sale:

● Equity—One of the main benefits of buying tax deeds is getting properties for pennies on the dollar. Because the government cares only about getting their tax deed money, they set the minimum bid to the value of the outstanding taxes (plus interest and fees). So even if you have to bid up a little for a tax deed, you could end up with a steep discount on the property’s actual value.

● Potential for high ROI—Once you own the tax deed property, you can turn around and sell it for more. Or you could rehab it and rent it out. There are many ways to turn a hefty profit when buying the tax deed property at a low price.

Cons of Investing in Tax Deed Certificates

Lastly, here are some of the drawbacks of investing in tax deed certificates:

● Requires a lot of upfront capital—When you buy a tax deed property, you have to pay for it in full (in cash), typically in 1 business day. So you’ll need to have a lot of capital upfront, and financing a tax deed deal is impossible.

● Inspecting property before bidding is not allowed—Unlike with other real estate purchases, you don’t have a legal right to enter a tax deed property before bidding on it. You might end up with unwelcome surprises!

● Competition—As with tax liens, you may face tough competition from banks and hedge funds who like to buy up tax deed properties.

● Hidden liens—There may be hidden liens on the property, including municipal fines, code violations, IRS liens, and more. If you buy the tax deed, you must clear these before you have a marketable title.

Whether you invest in tax liens or tax deeds, you want to be cautious and do your due diligence by studying the property as thoroughly as possible.

Visit your local county recorder to review the tax deed files. You might uncover hidden liens or other issues with the property. Whatever you do, never invest based on curb appeal alone. A property may look good on the outside, but it could have significant problems on the inside.

You’ll also want to research the area. Like any real estate investing, investing in tax liens and tax deeds is very location-specific. So, know what tax liens and tax deeds typically sell for by studying local competitors and asking them questions at public auctions.

If you can do all that, you’re off to a good start in becoming a successful tax lien or tax deed investor!

Hi I want to know about tax deed sales how long I have to be waiting for me to submit it to be able to be owner warranty

On the property or I have to do a Quite title please let me know my number (removed)