Florida’s Home Insurance Nightmare: How Skyrocketing Costs Are Squeezing Real Estate Investors

Florida’s homeowners insurance crisis has escalated to a breaking point, creating serious challenges for property owners and real estate investors alike. With premiums skyrocketing and insurance carriers either leaving the state or tightening their terms, the situation is set to get worse before it gets better. What’s more troubling is that the real estate insurance market is plagued by an epidemic of inflated claims driven by insurance adjusters and unscrupulous contractors looking to make a profit. To turn the tide, we need stricter regulations and limitations on these manipulative practices.

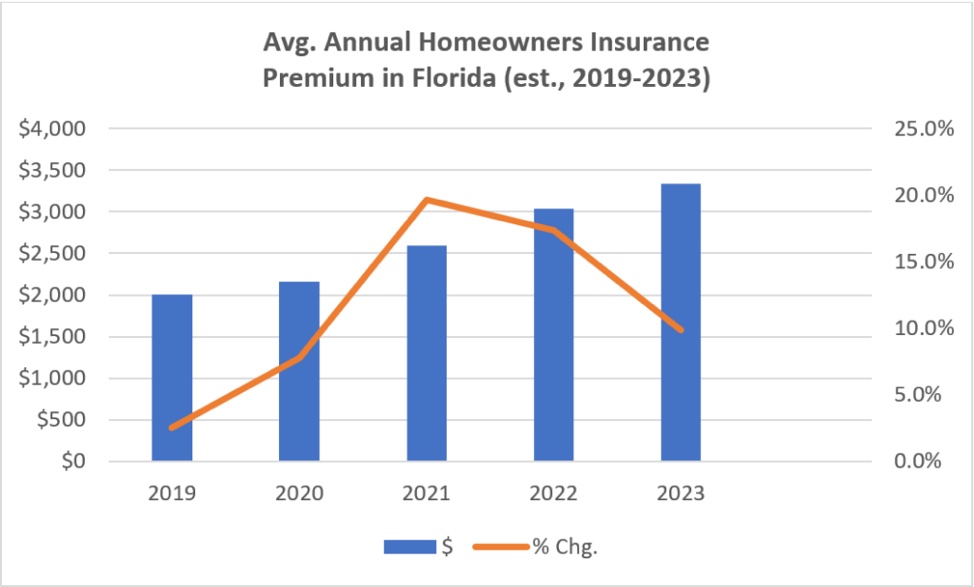

Rising Homeowners Insurance Costs in Florida

Based on recent data from Redfin and the National Bureau of Economic Research (NBER), the homeowners insurance crisis in Florida has reached alarming levels. Nearly 70.3% of Florida homeowners report that they or their area have been directly affected by rising home insurance costs or changes in coverage, compared to just 44.6% of homeowners nationwide. In California, over half of homeowners (51%) experienced similar challenges, highlighting the severe impact of insurance issues in these high-risk states. These statistics underscore the widespread struggle of homeowners in states prone to natural disasters, where insurance carriers have been increasingly reluctant to provide coverage due to escalating risks and high claim volumes.

Florida’s insurance market specifically has seen a drastic increase in premiums, with the average annual rate for homeowners reaching $10,996 in 2023 — substantially higher than the national average of $2,377. Southern Florida, in particular, has seen some of the most significant increases, with premiums often ranging between $4,000 and more. This sharp rise in costs can be attributed to the state’s high reinsurance exposure, which is at 40% — the highest in the country. This means that a substantial portion of the risk is passed on to reinsurance companies, leading to even higher costs for policyholders as insurers seek to manage their potential losses from severe weather events like hurricanes. The NBER study also warns that these premiums could continue to rise as climate risks intensify, potentially leading to even greater financial strain on Florida homeowners and real estate investors.

This increase in premiums not only burdens individual homeowners but also directly impacts real estate investors, forcing them to reevaluate their investment strategies in a volatile insurance landscape.

According to industry reports, Florida represents nearly 79% of all insurance litigation in the United States, even though it accounts for only 9% of the nation’s homeowner insurance claims.

The Role of Inflated Claims and Manipulative Practices

A major contributing factor to Florida’s homeowners insurance crisis is the rampant issue of inflated claims and fraudulent activities led by unethical contractors and insurance adjusters. While adjusters do perform a critical role in assessing damage and ensuring fair claims, the current system has been hijacked by bad actors seeking to maximize their profits.

Contractors, particularly in roofing and restoration, often team up with adjusters to persuade homeowners to file exaggerated claims. These roofing companies encourage property owners to look for damage they might not have even noticed, suggesting they can get a “big payout” from their insurance. This practice is not just limited to legitimate claims but sometimes involves deliberately causing minor damage to inflate the scope of the repairs.

These artificially trumped-up claims place a massive financial strain on insurance companies, leading to increased premiums for everyone. According to industry reports, Florida represents nearly 79% of all insurance litigation in the United States, even though it accounts for only 9% of the nation’s homeowner insurance claims. This disproportionate number highlights the impact of aggressive legal tactics and fraudulent activities.

To address the Florida homeowners insurance crisis, it is essential to implement stricter regulations and oversight of claims practices and adjusters.

The Impact on Real Estate Investors

For real estate investors, the rising cost of insurance and the unpredictability of policy renewals in Florida create a complex landscape. When investors cannot accurately predict their expenses, it affects their ability to assess the profitability of new acquisitions and the sustainability of their current holdings. Properties that might have been lucrative investments are now seen as liabilities due to the inability to secure or afford insurance.

Many investors are now forced to seek properties with updated features, such as newer roofs and hurricane-resistant windows, just to ensure that they can get insurance coverage. Even then, they face higher deductibles and increased scrutiny from insurers, who are becoming more selective about the properties they are willing to cover.

This situation has led some investors to consider pulling out of the Florida market entirely, as the unpredictability of insurance costs makes it difficult to project long-term returns on investment. The crisis is not just a problem for new investors but also for those who have already built a portfolio in the state. Rising premiums and non-renewals can turn previously stable investments into financial burdens overnight.

Why Regulations Are Needed

To address the Florida homeowners insurance crisis, it is essential to implement stricter regulations and oversight of claims practices and adjusters. There must be a focus on eliminating inflated claims that are pushed by unscrupulous contractors and insurance adjusters who manipulate the system for profit. While these adjusters serve an essential purpose in helping property owners recover from genuine losses, their role has been tainted by those who exploit legal loopholes for financial gain.

Regulatory bodies should impose clear guidelines to limit the ability of contractors to influence homeowners into filing fraudulent or exaggerated claims. This can include restrictions on contractors soliciting repairs or claims directly from property owners and increased scrutiny on adjusters working closely with these companies. There also needs to be a cap on the payouts that can be claimed without substantial proof of actual damage, reducing the incentive for inflating repair costs.

The Florida homeowners insurance crisis is a multi-faceted problem with no easy solutions.

Moving Toward a Sustainable Insurance Environment

For Florida’s homeowners and real estate investors, the only way forward is through comprehensive reforms aimed at stabilizing the insurance market. This includes reducing the litigious nature of the state’s insurance landscape, where aggressive legal tactics are driving up costs for everyone. Recent reforms, such as the passage of Bill 2-A, have shown some promise in slowing down the rate hikes by limiting the filing window for claims and reducing the payouts for attorneys’ fees.

However, more needs to be done. We must continue pushing for reforms that hold all parties accountable — from contractors and adjusters to insurers and policyholders. By creating a more balanced and transparent insurance market, we can protect both property owners and investors from unfair practices that inflate costs and destabilize the market.

The Road Ahead for Investors

The Florida homeowners insurance crisis is a multi-faceted problem with no easy solutions. As it stands, real estate investors must navigate an unpredictable environment where securing affordable insurance has become a significant hurdle. Until we see meaningful changes in how claims are handled and stricter regulations on inflated damage assessments, the situation is likely to worsen before it improves.

For investors, the key takeaway is to stay informed and proactive. Investigate properties thoroughly for potential risks, ensure they meet the latest building codes, and engage with insurance providers early in the process to secure the best possible rates. As the market continues to adapt, those who stay ahead of these changes and advocate for fair practices will be better positioned to thrive in Florida’s challenging but still promising real estate landscape.