Cryptocurrency and Real Estate are a Thing?

Cryptocurrency. It’s undoubtedly one of the most popular buzzwords in financial and investment circles, not to mention more significant segments of the general population. For some, the word “cryptocurrency” evokes feelings of excitement, and for others, nothing more than an eye roll. It seems that everyone has a strong opinion either for or against this advancing concept.

Real estate. Those who are into real estate investing love discussing the endless strategies to amass, flip, and transform their houses, buildings, lands, and properties. It’s no wonder that the realms of crypto and the real estate industry are intersecting.

Cryptocurrency and real estate investing are like the modern-day “you got peanut butter in my chocolate” commercial from the 80s. When these two topics come together, both sides of the aisle have rapid twitches of braingasms. The possibilities of these two investing niches coming together are both exciting and terrifying at the same time.

What Is Cryptocurrency?

Even if you’ve heard this buzzword thrown around by your colleagues, friends, or family members, you might be a little unsure of what cryptocurrency is precisely. Don’t worry; you’re not alone.

The easiest way to think about cryptocurrency is to envision a virtual currency. This currency is not issued by any central authority, which means it can’t be influenced or manipulated by governments. This virtual currency is secured so that it is impossible to counterfeit.

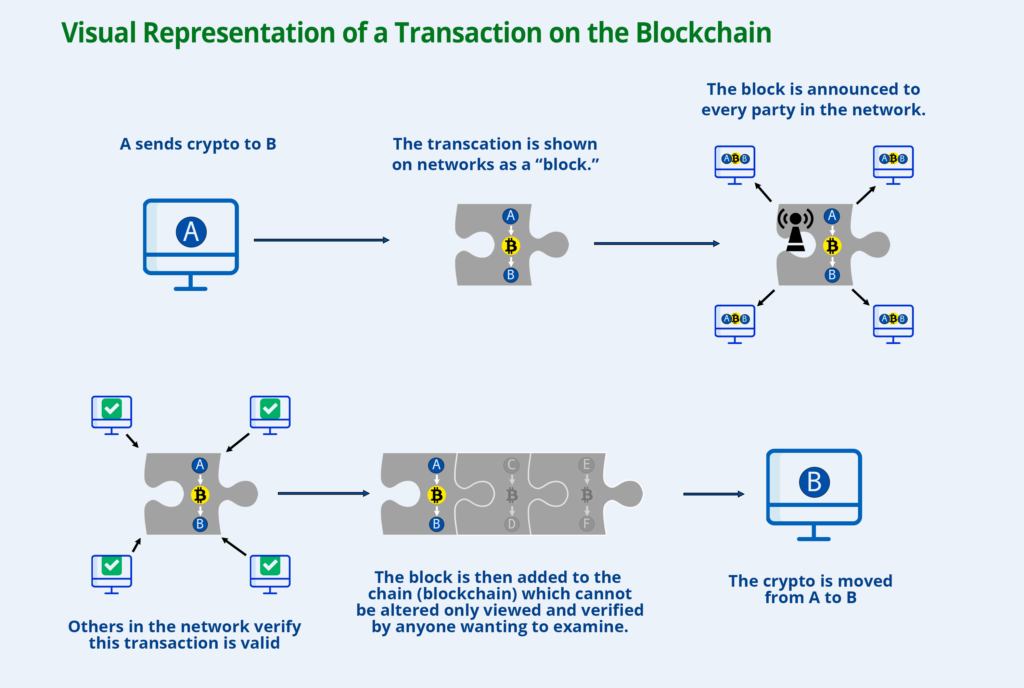

Cryptocurrencies typically exist in databases based on blockchain technology. Blockchain platforms collect information in groups called “blocks.” When the storage capacity of a block is full, a new block is used. Each block links back to the previous block, creating a chain. Think of this as a ledger of transactions that stays with that data forever. Anyone can verify the contents of each block.

You might consider cryptocurrency simply digital assets. These assets are much like real estate assets, but cryptocurrency doesn’t have a physical version, at least not yet. These assets have value because there are a limited number of them and because cryptocurrency can be used in exchange for many goods and services, including the real estate market.

How Can Cryptocurrency Be Used in the Real Estate Market?

While cryptocurrency is often considered an emerging technology, it’s actually been around for over a decade, with roots that go back even further. It only feels new because other industries are starting to see the benefits of using a blockchain-based currency.

According to Newsweek, an apartment in Ukraine was the first property bought and sold using the blockchain in 2017. Modern home buyers are using cryptocurrency for their real estate buying and selling needs.

In a survey published by Mansion Global, almost 12% of respondents claimed that their crypto investments helped them get the down payment to purchase their first home, which is especially impressive considering the current real estate market.

What’s amazing is that simply relying on crypto investments is just scratching the surface of what’s possible when we see effects from the blockchain in real life.

Rental Properties

One of the most popular real estate investments involves owning property that is then rented to others. Whether it’s a simple house or small apartment building, many property owners find that becoming a landlord is a great way to increase cash flow and reach financial independence.

The ability to use cryptocurrency in the rental game is right around the corner. Companies like Expedia already offer customers the ability to rent short-term properties using crypto. Property owners may find it advantageous to accept Bitcoin, for example, to cover the rent.

Since the currency is transferred in real-time, there’s no need to wait for a check to clear or to worry about a receipt getting lost in the mail.

Buying and Selling

We’re seeing more and more real estate listings around the world allow buyers and sellers to utilize cryptocurrency as the leading figure in the real estate transaction. This simple process would mean buyers could purchase a property without having to fill out a mountain of paperwork to warrant the title.

Instead of spending all day at the title agency, you could quickly complete your closing with the click of a few buttons. The transaction is recorded into the blockchain for everyone to verify.

Cryptocurrencies make the entire closing process much more manageable. All involved parties could be instantly paid via cryptocurrency. Lawyers, real estate agents, title agents, abstractors, and sellers would have all their work done to verify on the blockchain.

Once all parties verify the work in the public ledger, which is the blockchain in this case, their payments are released instantaneously. All transactions are recorded on the blockchain, and everyone can verify this data instantly or for the next transaction.

Each time a verification of mortgage or title is needed, the data is instantly available to anyone in the same blockchain.

Initial Coin Offerings (ICOs)

ICOs are becoming more popular among real estate investors and property sellers. An ICO is equivalent to a company looking to raise money through an initial public offering (IPO).

Investors can buy into an ICO. They will receive a cryptocurrency token that represents a stake in the company or for a specific project. It can also be attached to a utility from the company, like software or service.

In the real estate market, investors or really anyone with property can offer fractional ownership via a token. The idea of fractional ownership is nothing new, but tokenizing real estate is much more secure and less expensive when created on the blockchain.

Tokenizing deals is an excellent way for smaller investors to get in on new deals. These investors would own a share of the property via the token. They would also be able to sell that token to cash out whenever desired, just like any other crypto coin.

The Downsides of Cryptocurrencies in the Real Estate Market

While there are some significant advantages to using crypto in the world of real estate investing, it’s not a perfect system. Just like with any investment, you want to have a complete understanding of the pros and cons associated with where you put your money.

In the same way that the stock market fluctuates daily, cryptocurrency can go up and down without notice.

Another potential issue with cryptocurrency in the real estate market involves security. Yes, the blockchain is exceptionally secure. At the same time, there are plenty of hackers, scammers, and other cybersecurity threats trying to take advantage of less-experienced investors. It’s easy to promise someone virtual currency in exchange for PR/marketing work or other services with no intention to pay.

With so many kinds of cryptocurrencies launching each month, it’s easy for investors to get caught up in buying tokens left and right. That means there are plenty of opportunities for a fake company to offer an ICO that’s not attached to anything and is essentially worthless. By the time you realize it, that company is gone, and so is your money.

The last area where using crypto and real estate investing can be unfavorable deals with taxes. Congress is typically slow to adopt and understand new technologies and trends.

You can expect new tax codes pretty much every year. That could make tax season even more stressful than it already is. Make sure you work with a tax professional who understands cryptocurrency to understand any potential tax implications involved with your crypto deal.

The Future of Real Estate Investing

It’s an exciting time for those who love crypto and those who are passionate about real estate investing. Imagine removing all of the paperwork from buying property. Picture everyone involved with the transaction getting paid instantly and securely. Allowing cryptocurrencies to be part of the real estate market means making transactions much faster and more efficient, even at an international level.

At the same time, a mostly unregulated market means there will be no shortage of those trying to take advantage of the situation and new investors. There could be unknown tax implications down the road. It’s also unique enough that it might take a while to fully understand how it works before you can jump in.

While any new technology comes with a learning curve, there’s plenty to suggest that blockchain-based cryptocurrency offers plenty of opportunities for real estate investors, new and old.

If you’re interested in adding cryptocurrency to your portfolio, take some time to learn the market. It’s also worth meeting with a tax professional or lawyer who can help navigate you through the process. Take the leap and start exploring America’s great digital gold rush today.