Fixing the Economic Inequality in the Black Community with Real Estate

With the backdrop of the Pandemic, we have seen a renewed demand for racial and social justice. Entire books will be written about the social injustices on the Black communities based on this year’s events, however ever, that is not the focus of this article. Much of the outcry of injustice is rooted in the economic disparages seen in the Black communities. A large part of the solution is financial education, affordable homeownership, and investing primers for first-time homebuyer and investors.

There was a push to open up lending to Minorities during the Clinton era, which culminated in the housing crisis in the last decade. We need to take the hard-learned lessons of the housing crisis and help Black communities stand up financially and achieve their own financial freedom revolution.

History of the Community Reinvestment Act

Banks used to use formulas to decide which areas to invest in. Banks would write loans in “good” investments, areas with high rates of payment compliance & returns, and avoid “poor neighborhoods” that had higher rates of foreclosures and missed payments and lower-income residents. Banks would no longer write loans on entire neighborhoods regardless of the applicants’ credit score, income, or overall creditworthiness. This resulted in whole minority neighborhoods, especially Black communities “redlined” by banks, made ineligible for mortgages and other lending tools by the bank.

Then in 1977, the Community Reinvestment Act or the “CRA” was passed to help this problem. It was enacted to reduce discrimination in the credit and housing markets. Despite the Fair Housing act of 1968, the Equal Credit Opportunity Act of 1974, and the Home Mortgage Disclosure Act of 1975, discrimination was still a big problem. One would think this would clear the issue, but alas, it did not.

The Clinton administration used parts of the 1989 Financial Institutions Reform Recovery and Enforcement Act to bolster enforcement of the Community Reinvestment Act. They added some teeth to the previous legislation by creating public evaluations of lending institutions to assure compliance. It basically pulled down Big Bank’s pants and allowed everyone to examine their lending practices and the awful way some banks were treating minorities.

This still wasn’t enough to loosen bank’s grips on its purse strings when it came to lending to these neighborhoods. Further legislation was released in 1991, 1992, 1994, 1995, 1999, and this opened up the lending floodgates. Unfortunately, this also created some monster lending products initially designed to stem losses by lending to “sub-prime” borrowers and later to take advantage. A Combination of legislation that swung the pendulum too far to the left and predatory businesses caused the era of “NINJA Loans” where the only thing needed to qualify is that the person was alive, no income, no job, no assets required. This would eventually lead to the housing crisis of 2007, but this is a topic for historians to debate who was to blame, not this article.

The Housing Crisis Effect on Black Communities

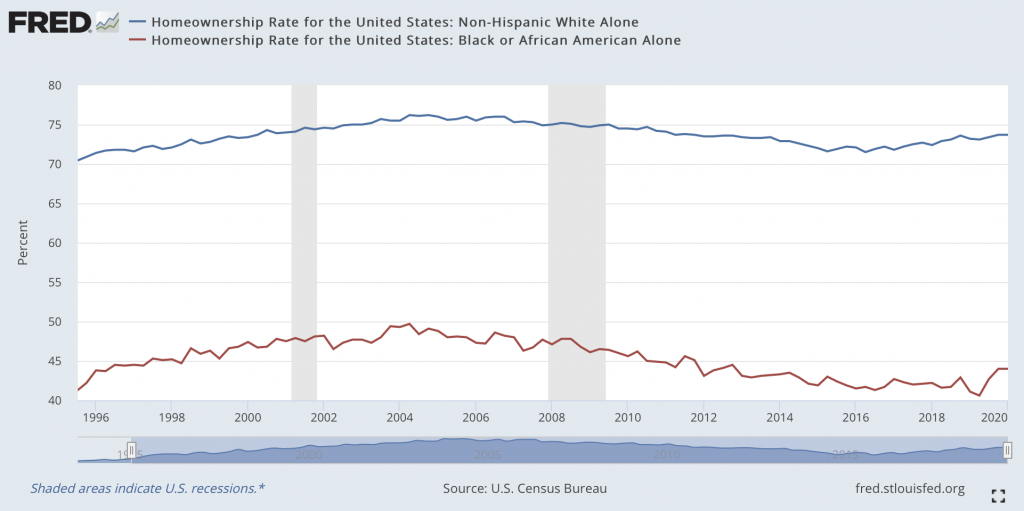

The housing crisis reset the financial clocks of a disproportionate number of Black families. Minorities were foreclosed on nearly 3x as often as white homeowners. Just before the 2007 foreclosure crisis, Black homeownership was nearing an all-time high of 50%, while around 76% of white households were homeowners. In 2019 white homeownership had risen to 73.1%, and Black homeownership is bottoming out to 41% in 2019, a 30-year low. It seems as if the black households were left behind on the economic recovery.

There were positive signs of significant improvement for Black households at the beginning of 2020. A record 3.4 percentage jump in homeownership was recorded according to the most recent quarterly data from the U.S. Census Bureau’s Housing Vacancy and Homeownership Survey.

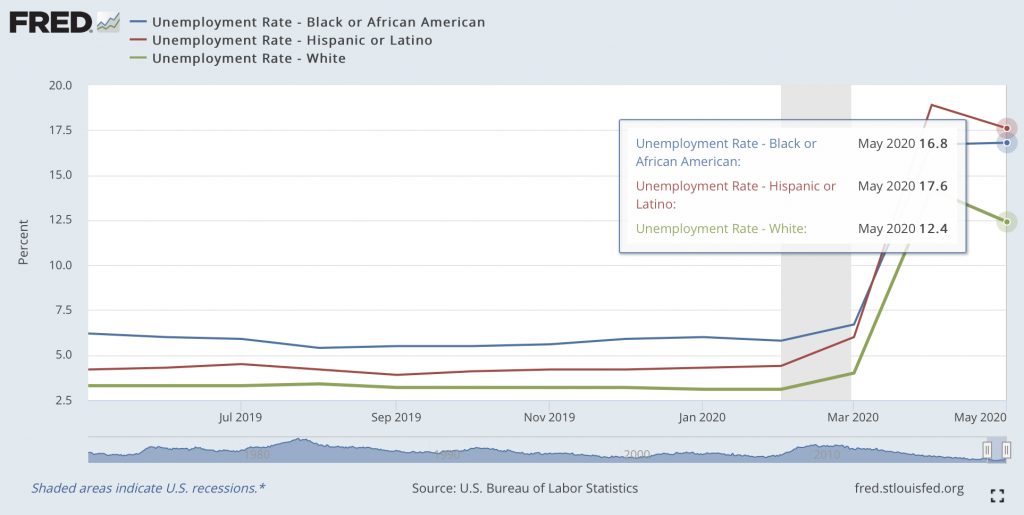

Unfortunately, before any real gains could be appreciated, the current Pandemic has more than likely stomped out this black homeownership rally again. The Pandemic has disproportionately affected minority unemployment rates, and has increased it to 16.8% for Black workers, 17.6% for Hispanics. This is a stark contrast to the 12.4% unemployment rate for all workers.

The mistrust of black families and the banks runs deep and is generational, and the housing crisis further entrenched the idea that the bank is out to get them. Without using banks, you cannot build financial health like credit scores, good saving habits, and more. The housing crisis featured predatory loans that targeted minority and low-income customers. It is evident that homeownership has declined since the great recession due to the bad taste predatory lending and banking practices left in many black communities.

Solutions to Consider Encouraging Equality through Prosperity

To combat and economic disparities, we must encourage financial literacy in black communities. Requiring schools to teach personal finance classes as part of its curriculum would be a boon towards breaking cycles of poverty. One of the most significant financial decisions in a person’s life happens immediately after or even during their senior year of high school. At this time, a student typically enters into one of the largest debt contracts of their lifetime if they go to college with easy to get student loans. If people do not go to college, they have to begin making perusal finance and debt decisions to survive. At this time, the young person dips into the multi-generational financial literacy of their family, and often in the black community, it’s a history of financial mistrust, financial abuse, and bad financial habits. Unfortunately, this is the perfect storm for a continuation of poverty for the next generation of Black families.

We should strive for programs that not only allow for cheap first-time home buyer loans, but also programs that teach people why they should use it, and what they can use it for. It’s not that there is no assistance for those who want it, it’s that there are people in these neighborhoods that don’t trust the financial system they need to be a part of to enjoy financial freedom.

Imagine if widespread programs showed people in impoverished communities how to use all the available government assistance programs to lift themselves out of poverty for good. Programs that teach how to use an FHA loan & Down Payment assistance programs to buy your first house with no out of pocket money. How to purchase properties with no money of your own, fix it with someone else’s money and then sell it for a profit. How to buy a duplex with little to nothing down, then live in half, rent out the other to pay the mortgage, and have stream of income.

Studies show that the most effective means of building wealth, even generational wealth is through homeownership. As we have seen when we simply force banks to make loans to anyone that wants it, the system breaks. We must teach people how to use debt responsibly and take advantage of these loans for long term financial success. The disparity in the wealth gap between white and black households can easily be pinpointed as the 30%-point difference in homeownership. Through financial education and homeownership, we can close this gap and help every American prosper for generations.