June Mortgage Delinquencies Hit 2011 Highs

Based on data from property research & information service giant Black Knight, the mortgage delinquency rate jumped to it’s highest level since 2011. The pandemic is starting to crack the once seemingly unstoppable pre-Covid-19 runaway bullish economy.

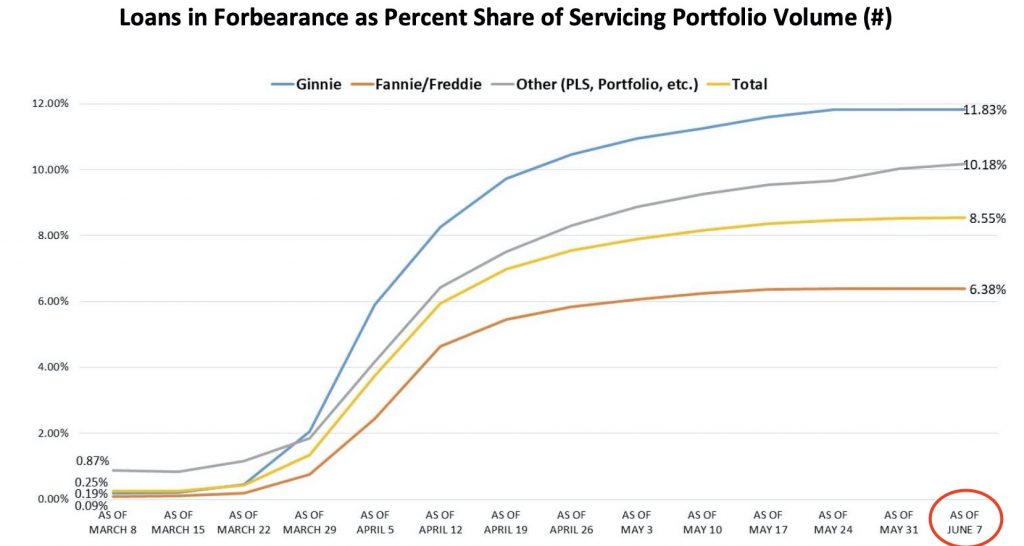

The numbers are staggering. Borrowers more than 30 days late have ballooned to 4.3 million from an already high April number of 723,000 delinquencies. According to Black Knight Inc., over 8% of all mortgages in The United States are now past due or in some stages of foreclosure.

It’s easy to understand why, as the Labor Department figures show, 20.5 million Americans have filed renewing claims for unemployment benefits the first half of June.

Of those homeowners in forbearance status, only 15% made a payment as of June 15th. This payment level is down from 28% from May and 46% from when the tracking began in April of 2020.

- Black Knight’s further breakdown of the delinquent mortgage data is as follows:

- Highest delinquency rates are in Mississippi, Louisiana, New York, New Jersey and Florida.

- New York’s rate jumped to 11.3% near it’s “Great Recession” peak of 13.9% in December of 2012!

- Florida’s delinquency share climbed to 10.5% from it’s previous peak of 25.4% set during the housing crisis in January of 2010.

With the county staring down the barrel of a “Second Wave” after attempting to open things back up, the likelihood of saving these mortgages from foreclosure is dwindling. The data is pointing to a big wave of foreclosures coming on the market. While the market is currently short on inventory, prices are being propped up by demand this has created.

Further demand is being produced by both families fleeing urban area Covid-19 hot spots and newly dubbed remote workers fleeing expensive city living in exchange for lower cost of living suburbs. Hopefully, this shift will keep housing prices afloat, and investors can quickly digest waves of foreclosures to keep the market stable.