Miami-Dade County Busted Selling Fake Properties to Retired Teacher!

Angelia Levy had been looking forward to her retirement years for quite some time. She had both dreams and well-intentioned plans for how she would spend her days after working hard all her life. She expected to live comfortably and build passive income through her investments while giving back to her community through her ministry work.

Angelia Levy had been looking forward to her retirement years for quite some time. She had both dreams and well-intentioned plans for how she would spend her days after working hard all her life. She expected to live comfortably and build passive income through her investments while giving back to her community through her ministry work.

Sadly, this is not an article about funding retirement through real estate investing. Angelia purchased a property that didn’t exist from the Miami-Dade County tax deed auction. The county knew it didn’t exist, and they sold it to Angelia Levy anyway.

How Does Someone End Up with a Nonexistent Property?

As the pandemic slowed down, schools reopened and children returned to the classroom after a year of learning at home. Parents have a newfound appreciation for teachers, especially a teacher like Angelia, who works full time to educate children with disabilities.

For 20 years, she has dedicated eight hours per day to her students. During the lockdown, she transitioned seamlessly to teaching online, even though she says the constant screen time gives her a headache.

Angelia gradually began to prepare for her retirement, but she knew her modest savings would not be enough to support her. She would need a boost. She turned to real estate investing to generate the extra cash flow that she would need.

Instead of receiving her retirement funds monthly, Angelia opted to accept a lump sum. She then purchased a courtyard condominium that she hoped to rent out to a tenant. She also considered living in her condominium temporarily and making improvements to increase its value.

Either way, she would use the money from her investment to buy and improve more properties. The potential for growing wealth was limitless if she could just get started. The excitement was still evident in her voice as she spoke in retrospect about her plans.

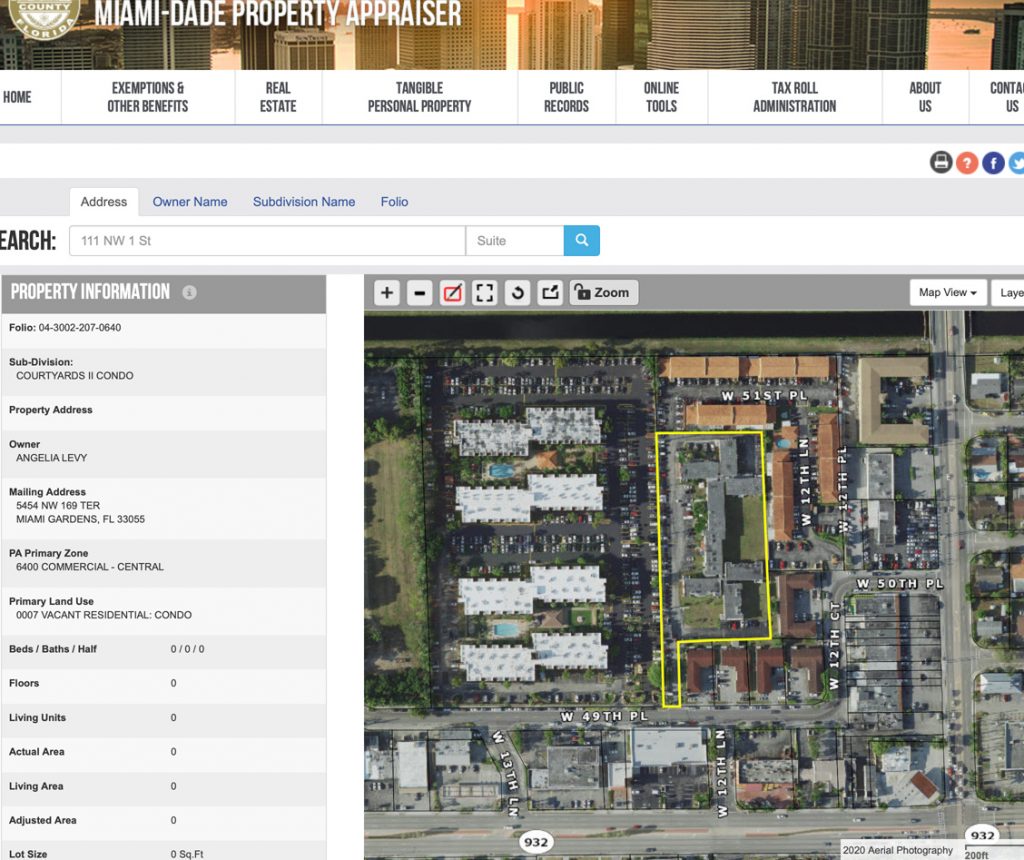

Courtyard of Hialeah II Apartments, Unit 202, Bldg J, 4979 W 49th Pl Hialeah, FL 33012 was listed on the Miami-Dade County auction site. This apartment community was built in 1965 and contains 60 units. As far as listings go, there was nothing remarkable about it. The description was similar to every other condominium up for auction.

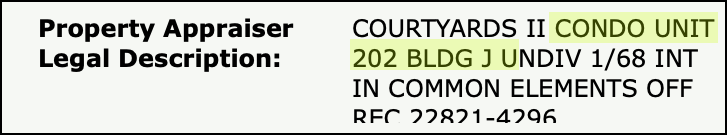

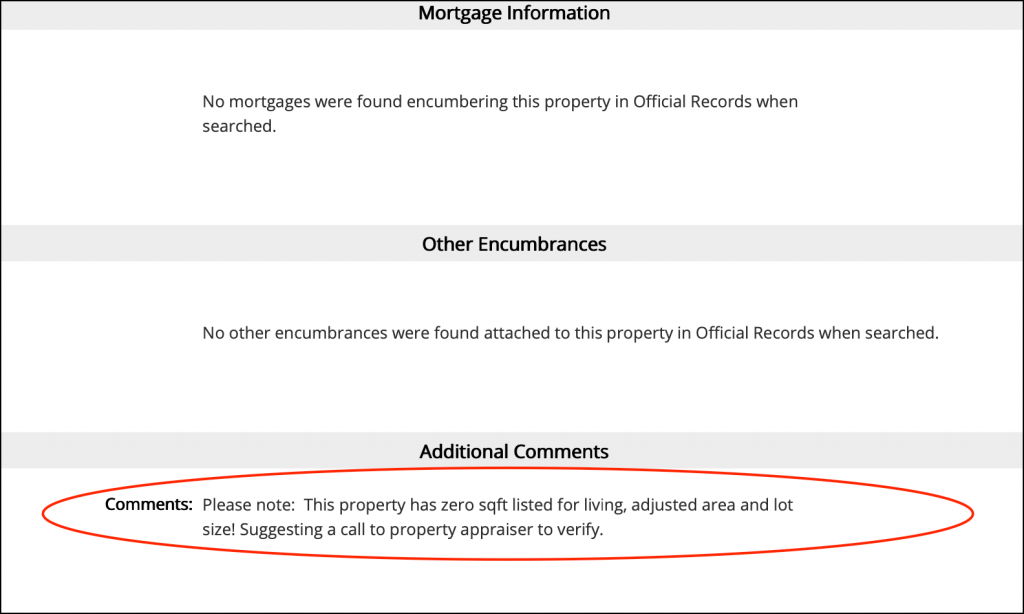

There are many ways to assess whether a property is a suitable deal, and PropertyOnion.com features many articles, videos, and even ebooks about how to do your due diligence. Had Angelia been a member of PropertyOnion.com, she would have been able to search the address in our database and see that the condo she was basing her retirement on was zero square footage of land. In the property stats, the property would have shown as land and not as a building.

She could have also ordered a title search from PropertyOnion.com, and the chain of title would have raised many red flags. She would have noticed that there had been three sales by the clerk of courts, which might have prompted her to consult a real estate attorney. A $50 title report could have saved her thousands of dollars, as you can in this title search our abstractors quickly spotted the red flag of zero sqft under air, and lot size.

Regrettably, Angelia had not come across PropertyOnion.com yet, but she did know that proper research is needed when buying distressed properties. Without many leads to go on, Angelia went to the site of the condominium and attempted to view the property before bidding on it. The gate was closed, and she was unable to gain entry to Building J. She did her best to look around anyways and could see Building A, Building B, and so on.

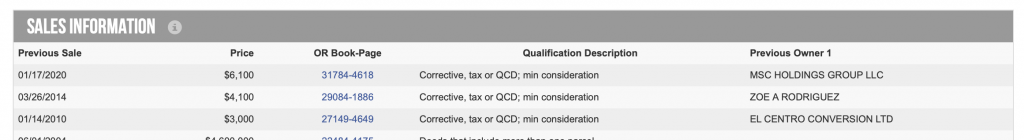

She liked what she saw. The buildings were well kept, modern, and bordered an inviting courtyard with a lush green lawn. And so, on January 16, 2020, Angelia Levy bid alongside several others and won Unit 202 in Building J for $6,100.

An Investment Gone Bad

A week later, Angelia and a friend visited the property to view her new condominium. Expectations were high when they arrived and began to search for Building J. As before, she noted each building. She saw Building A, B, and C, but where was Building J? She began to get concerned. After much inquiry, she consulted a real estate agent, who confirmed every investor’s worst fear.

There is no Building J. There is no Unit 202. There is no investment.

For $6,100, Angelia purchased nothing but a harsh lesson. The harshness of this lesson had not fully set in at the time of the discovery because common sense dictated that this was a mere error that could be easily set right. A hassle, yes. An inconvenience, certainly. But not a tragedy.

Miami-Dade County property appraiser: “The County has every right to sell non-existent property to the public.”

Angelia prepared herself to make some phone calls and get this all straightened out. If only that had been the case.

She called the property appraiser’s office, the tax collector’s office, and every department she could think of that would have bearing on getting her dilemma corrected. Each new number she called resulted in a transfer, a disconnect, a recommendation of a different person to contact, or an eternal wait on hold.

As Angelia desperately climbed her way through the phone tree, pieces of the puzzle began to come together. An employee at the property appraiser’s office explained that the condominium association did intend to erect Building J, but for whatever reason, they did not complete the project.

As soon as they knew that the building was not going to be constructed, all of the previously approved properties were deleted from the system. Unit 202, however, remained. Since Unit 202 hypothetically existed on paper, it began to accrue taxes, and this resulted in the tax deed sale.

Finding Support from the Team at PropertyOnion.com

Angelia continued to research the details of this strange situation long after many investors would have given up. A $6,100 loss is just the cost of doing business for many, but for her, it is the difference between enjoying her golden years and continuing on in the workforce for an undetermined number of years.

So she fought onwards, making phone calls and reading any resource she could find. It was this endless quest for answers that led her to a live webcast on PropertyOnion.com in October of 2020. The Florida Property Foreclosure webcast featured a panel of experts covering all of the information that Angelia had been looking for. After the webcast ended, she reached out to Tony Stern, co-owner of PropertyOnion.com, and his team. Tony was appalled by Angelia’s story, so he began to investigate the matter himself.

After confirming that Angelia’s account of the matter was unfortunately very true, Tony was determined to help. He spoke with a panel attorney who helps PropertyOnion.com’s members with their real estate–related issues: Jeff Harrington of Harrington Legal Alliance.

Equally disturbed by the bizarre injustice, he agreed to take on the case pro-bono. He started by contacting Luis Mendoza at the Miami-Dade tax collector’s office. Mendoza then referred Angelia and Jeff Harrington to Leslie Rodriguez at the Miami-Dade property appraiser’s office. If there was ever any hope that this simple error could be corrected and that Angelia would be back on her way to a happy retirement, that hope died at Leslie Rodriguez’s desk.

Rodriguez stated three very clear positions. Firstly, she asserted that the county has every right to sell non-existent property to the public. Secondly, if Angelia does not pay the upcoming yearly taxes on the non-existent property, it will be seized from her and sold at auction once more to yet another hapless victim. And lastly, Unit 202 is not the only one. There are more. There are other units that have never existed being bought and sold and taxed at Miami-Dade County auctions.

Angelia inquired if there was any way she could get her money back. After all, she had made a purchase and received nothing, so surely she could just be refunded the amount.

The property appraiser’s office matter-of-factly explained that there may be a situation in which Angelia would receive money for her property. If a plane were to crash into the building or some other great disaster occurred, Angelia would receive the same amount of money as the other condominium owners.

This was not comforting. Angelia argued that if she as a private citizen were to sell someone a condo, only for it to be discovered as non-existing and fraudulent, she would soon be arrested. Why, then, is it acceptable for our government to exploit a private citizen? “The government has the right to do anything” was the response she says she was given.

Roadblocks at Every Turn

Ever the optimist, Angelia Levy chose to make the best of a bad situation. She commenced mentally planning to build her own little residence on the land. It would be a modest, one-bedroom home and would involve investing more money, but she believed that, despite everything, she could be happy there. Her plans came to yet another screeching halt when she was informed that she had no right to build there, or even to stand there, because Unit 202 was on the second floor.

Angelia has zero land space. She expected to become a landlord, but instead she became the owner of a hypothetical courtyard condominium suspended in time and space.

Jeff Harrington and Tony Stern continue to work with Angelia on both pursuing legal action to recoup her lost investment and to change the laws that allowed this to happen to her. The non-existent properties being bought, sold, and taxed at Miami-Dade County auctions are not just being purchased by hardened real estate moguls and investment-savvy entrepreneurs. They are being bought by grandmas, widowers, single mothers, and struggling families, all hoping to change their circumstances.

The laws exist to protect each one of them as they move through their lives. We choose our government officials and appoint them to care for society’s most vulnerable citizens, of which Angelia certainly is.

Will the government intercede for those who purchase fraudulent properties? How can they? It was the government who sold the properties to them.

As Angelia pieces together her broken dreams of retirement, she says she is trusting God to work in her life. She is taking it one day at a time, and she is still working a 40-hour work week.

The county attorney’s office reached out to Jeff Harrington to inform him that Miami-Dade County stands firm in their position that Angelia is not entitled to a refund of her money, and she can expect to be taxed for the property that she still technically owns. After hearing Angelia’s story, we look to our elected officials and we wonder, where is the moral compass in their policies? Where is our government’s common sense? Perhaps, much like Building J, it never existed.

Have you purchased a tax lien certificate or tax deed for a property that doesn’t exist? We believe it is a deceptive and unfair practice for Miami-Dade County to raise money in this way…over and over again. We are putting together a class action to stop this unconscionable conduct. Please contact Harrington Legal Alliance at [email protected] or (561) 253-6690 to be included in the action.