FEMA Ruling Gives FL Investors a Chance to Purchase Distressed Hurricane Properties

Hurricane Ian was possibly the costliest storm in Florida history and the second costliest nationally when adjusted for inflation.

Risk management company RMS puts the total insured losses caused by the hurricane at $67 billion and estimates another $10 billion in losses due to storm surge and inland flooding for the National Flood Insurance Program (NFIP).

As devastating as Hurricane Ian was, it also created opportunities for investors to snag distressed properties from motivated sellers. What’s more, a little-known NFIP regulation, called the FEMA 50% rule, may open the door to even more property deals than usual.

“If the cost of improvements or the cost to repair the damage exceeds 50 percent of the market value of the building, it must be brought up to current floodplain management standards.”

In this article, we’ll go over what the FEMA 50% rule is and what makes Florida’s Gulf Coast an attractive real estate market to invest in right now (as well as some of the challenges of investing in Florida beachside properties).

Let’s get started!

What Is the FEMA 50% Rule?

The FEMA 50% rule—aka the Substantial Damages and Substantial Improvements rule—refers to an NFIP regulation that says:

“If the cost of improvements or the cost to repair the damage exceeds 50 percent of the market value of the building, it must be brought up to current floodplain management standards.”

This rule applies to residential and commercial properties that were built before December 31, 1974 (or prior to the date when the community had to participate in NFIP) and that are located in an officially designated Special Flood Hazard Area (areas with a 1% annual chance of experiencing a flood). In other words, many of the areas impacted by Hurricane Ian.

If a property that is subject to the FEMA 50% rule isn’t brought up to code, it can’t be insured.

Most of the time, properties subject to the FEMA 50% rule need to be lifted above flood level to be brought up to code. However, this takes a lot of money.

To determine if a property is subject to the 50% rule, you must divide the cost of the project (including all materials, labor, built-in appliances, overhead, and profit) by the market value of the building (the structural elements minus the land, plans, surveys, building permits, and non-permanent parts of the structure, like driveways, pools, and seawalls, etc.).

To find a property’s market value, homeowners can either get a new property appraisal done or go to their county appraiser’s office, which maintains the assessed value of the property for tax purposes.

For example, if the improvement/repair project costs $60,000, and the market value of the property is $100,000, then the formula would look like this: $60,000 / $100,000 = 0.6 (60%)

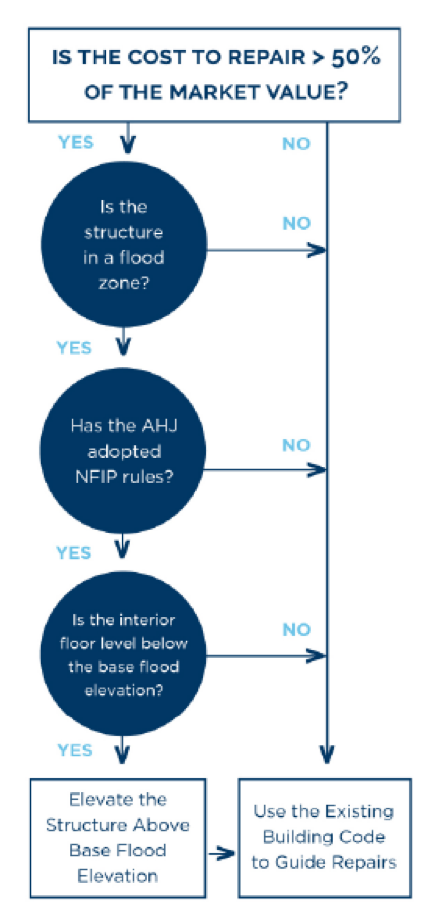

In this case, the project is equal to 60% (over 50%) of the property’s market value, so it would be subject to the FEMA 50% rule. From there, homeowners need to (if they haven’t already) verify if the property is in a flood zone, whether the Authority Having Jurisdiction (AHJ) has adopted NFIP rules, and whether the interior floor level is below the base flood elevation. Here’s a helpful flowchart published by the consulting firm J.S. Held that illustrates this process:

Source: https://jsheld.com/insights/articles/femas-commonly-misinterpreted-50-rule

Most of the time, properties subject to the FEMA 50% rule need to be lifted above flood level to be brought up to code. However, this takes a lot of money. According to HomeGuide.com, it costs $10,000 to $40,000 to raise a house and $20,000 to $100,000 to lift a house and replace its foundation.

As a result, many homeowners are forced to sell their houses, and they’ll often be desperate to sell fast, so they can put the sale money toward another house to live in. This creates an opportunity for investors to sweep in and buy the distressed property at a bargain price. As an investor, you should be on the lookout.

If the state were a country, it would be the 15th largest economy in the world. The high labor force growth and low unemployment rate (2.5%) create a healthy job market that attracts hundreds of thousands of new move-ins every year.

Other Reasons to Invest in the Florida Real Estate Market Right Now

On top of the distressed properties and motivated sellers brought on by Hurricane Ian, there are many other reasons to invest in the FL real estate market right now. Here are a few to consider:

- Favorable tax laws. Florida has no state income tax, and you don’t have to pay any capital gains taxes on your investments either.

- Rapid population growth. Florida is one of the fastest-growing states in the US. Between 2000 and 2010, its population grew by 17.6%. At that rate, the state population will go from 22,085,563 today to nearly 26 million by 2030.

- Booming economy. Florida has a GDP of over $1 trillion. If the state were a country, it would be the 15th largest economy in the world. The high labor force growth and low unemployment rate (2.5%) create a healthy job market that attracts hundreds of thousands of new move-ins every year.

- Thriving tourism industry. Florida is one of the top tourist destinations in the US and across the world. There’s a reason it’s called the “sunshine state.” Its sunny weather, beaches, amusement parks, and unique cultures attracted 1.3 million overseas travelers in Q1 of 2022 alone, a nearly 169% increase from Q1 of 2021.

Taken together, these qualities make Florida an ideal place to invest in real estate. Property values are bound to go up as the state continues to bring in more businesses, homebuyers, and renters. Whether you choose to buy and hold for the long term or flip a distressed property, you’re bound to make a good return on investment.

At the same time, investors need to be aware of state and local building codes before taking on any renovation projects—especially in flood zone areas. While housing regulations, like the FEMA 50% rule, can help you find distressed properties, you need to have a deep understanding of building and zoning regulations to successfully repair or renovate one.

Find a Distressed Florida Property with PropertyOnion.com

Now that Hurricane Ian has taken its toll, many damaged properties will be hitting the market soon (if they haven’t already). However, they may not be listed on the MLS.

Use PropertyOnion.com’s property search tool to find your next off-market property today! We collect listings from foreclosure and tax deed auctions from across the state to make it easy for you to find the best deal.