Florida Real Estate Forecast for 2022 and 2023

When discussing our Florida real estate forecast for the next two years, you must understand there are many different scenarios that could play out. Not even my crystal ball can predict what lies ahead for real estate, especially over the next two years, but let’s get together and delve a little deeper with facts and no politicizing.

The Russian & Ukrainian War of 2022

The undeniable fact is that Russia is at war with Ukraine. In a short period of time, this has had an undeniable effect on the global economy. We’ve experienced record inflation rates, including soaring gas prices and food prices as Ukraine provides about 40% of Europe’s wheat basket.

There have also been increased construction supply costs because Ukraine, along with Belarus, Poland, and Germany, is one of the principal manufacturers of window systems for developers in the U.S.

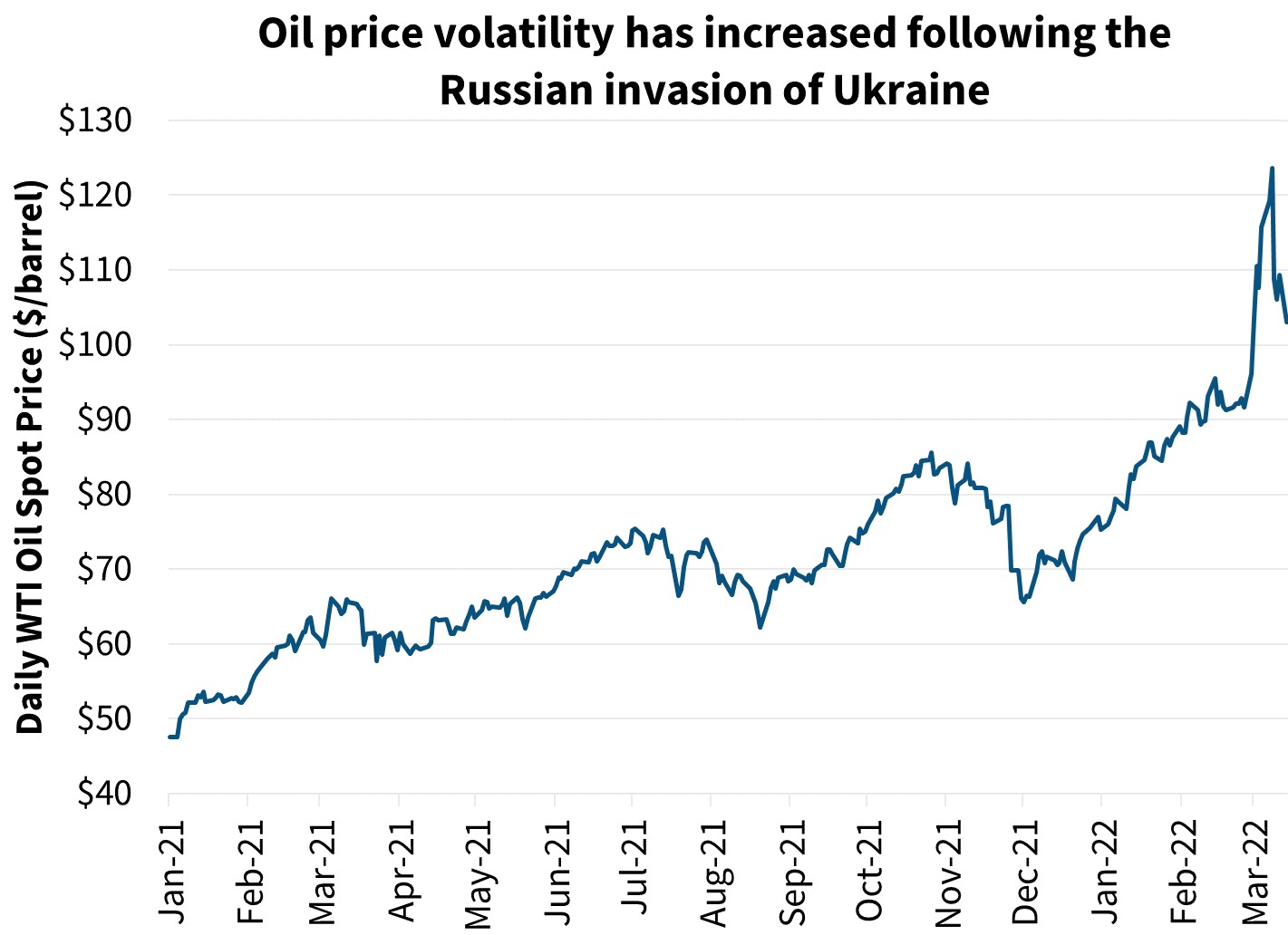

Consider too that although Russia’s economy is relatively small, its impact on global energy markets is huge. An executive order made on March 8, 2022, put in place sanctions that prohibit the importation of Russian-origin oil, liquified natural gas (LNG), and coal into the U.S.

It also prohibits any U.S. person from making new investments in Russia’s energy sector. The order specifically prohibits crude oil, petroleum, and petroleum fuels that are manufactured, produced, processed, or extracted in the Russian Federation.

Both the U.S. and UK have imposed sanctions against large Russian financial institutions. The European Union implemented proposals banning seven Russian banks from accessing the SWIFT system that processes international banking transactions. The combined moves essentially shut Russian banks out of the international financial system, making it extremely difficult for them to make or receive payments.

Shell Oil, B.P., McDonalds, and Apple have already divested assets and businesses in Russia. Coca-Cola has decided to fizzle out its product in the Russian market. Russia is being isolated from the rest of the world. It is unclear at this point if global real estate owners could even find buyers for assets they own in Russia or whether sanction rules would allow them to sell.

Russian Ownership of Real Estate in U.S. Markets

Sunny Isles Beach in Maimi-Dade County is known as “Little Moscow.” It has been a hot market for Russian investors buying luxury homes, but sanctions may lead to some offloading of assets if you can get in before sanctions are imposed. Residents have included Dmitry Rybolovlev, a billionaire who bought a mansion in 2008 for $60 million more than its asking price.

In 2016, FinCEN, the Financial Crimes Enforcement Network, confirmed that Miami and Manhattan were two of the most attractive U.S. locales for money launderers who use opaque shells. They imposed a requirement that U.S. title insurance companies record the name of the actual people behind the shells that used all-cash purchases across major metropolitan areas, including Miami. As a result of the FinCEN initiative, shady cash-only deals in Miami and Manhattan dropped by 70%!

The Jills Zeder Group at Coldwell Banker Realty, which deals in luxury properties, said the steady stream of Russian buyers in Sunny Isles Beach slowed five years ago because of fluctuations in the ruble and as FinCEN’s targeted orders were put in place. New construction and a sense of Russian community there may continue to attract new buyers, but the fallout from the war in Ukraine could also dissuade the cautious.

“I think it’s kind of a wait-and-see approach to see how things play out,” Jon Mann said. “I don’t think there’s going to be a wave of buyers coming here with additional scrutiny from the Biden administration with the sanctions they’ve put in place — I don’t think they’re going to want a microscope on their large cash transactions here.”

Effects of War & Inflation on Real Estate Forecasts

How could all these factors affect the real estate forecast for the next two years? Inflation over the last decade has been running at an average of 1.8%.

Inflation is an average increase in the prices for goods and services in a given economy over a set time, usually calculated year on year. Essentially, it’s the decrease in the purchasing power of the dollar over time. That’s why the latest inflation figures are putting a huge dent in purchasing power.

Inflation hit another multi-decade high in February 2022 with the CPU rising to 7.9% on an annual basis, up from 7.5% in January 2022.

During periods of high inflation, one positive is rising prices for rental property rates. During high inflation, it can be difficult to get a mortgage. High mortgage rates mean buyers have less purchasing power, so some will continue to rent. Housing prices tend to rise during high inflation, but real estate has an intrinsic value — people still need roofs over their heads, so hard money lending could prove very favorable if interest rates rise.

Rental property will likely have a higher-than-normal demand and return. Note that investing where banks may be offloading higher-than-normal quantities will result in less competition and lower prices. REITs will likely follow the appreciation and market demands similar to physical real estate and may be a good portfolio investment. Having funds to seize an opportunity such as a foreclosure or tax deed when it arises will be critical as homes may go into foreclosure during times of high inflation.

In a short space of time, a stable global world order seems in doubt, which could also ultimately affect interest rates too. Many analysts are revising up their inflation forecasts. Here in the U.S., the latest figures are running at plus 7.5% and are expected to hit a high of 8% in April, according to Oxford Economics analysts.

High Inflation Will Slow Markets

Prolonged and sustained bouts of inflation can do serious damage to the economy. In 1973, the Yom Kippur War unleashed an energy price shock that slowed the global economy for a decade. This Ukrainian crisis could do something similar.

“A protracted period of severe tensions is still the more likely scenario, risking more permanent damage to the European economy, which means that risks to the outlook have now moved firmly to the downside,” Oxford Economics said, predicting that policymakers would delay interest rate rises until early 2023 in an effort to smooth out the bumps. The consultancy is still tipping “a robust recovery in GDP growth in Q2 and Q3 this year” but is prudently slicing the top off its forecasts.

Charles Hecker, a partner at global consultancy Control Risk and a specialist in geopolitical dangers, states “Behind the inflation risk sits the likelihood that the global economy will become slower and stickier. Friction will increase, caution become the norm, and geopolitical risks loom large in a way they haven’t for three decades. We will see investors and businesses being more careful, there will be more foresight. Being more cognizant about the way we invest will be critical.”

Real Estate Market in 2022 & 2023

Over the next two years, these factors could have a huge effect on our real estate forecast for the Florida market. Home sales and prices in Florida are still rising, and inventory is super tight. The number of buyers paying cash for single-family homes has increased by almost half, according to a November 2021 report from WFLA.

In Q3 2021, every metropolitan area in the state has seen home prices increase by double digits. The median cost of a home purchase was $355,000. Because of the increase in cash buyers, contract time dropped 65.5% from 29 days to 10 and time to sell dropped almost 30%, from 73 days to 52 days before purchase.

The delay in building new homes as a result of higher material supply costs and subsequent price increases for available homes are just some of the factors contributing to the housing and inflation crisis still sweeping the U.S. Combined with the Ukraine/Russia conflict, this will have an impact on property prices over the next two years.

Zillow predicted a home price growth rate for 2022 up to 16.4% but recently estimated it to peak at 21.5% in May and then decline to 17.3% at the end of the year — those are some bullish stats! Since the lows of the post-recession market and the corresponding building slump, the value of housing in the United States has more than doubled.

The most expensive third of homes account for more than 60% of the total market value. The market value hit the $40 trillion mark in June of last year and has been gaining an average of more than half a trillion dollars per month since. It is predicted inventory will remain tight and there will not be enough homes to satisfy demand, therefore continuing a red-hot housing market where homes sell within hours of being listed and for well over asking price.

Even with rising mortgage rates and higher prices, the housing market should remain strong due to increasing demand as more millennials are projected to buy houses in 2022. Millennials make up the largest share of homebuyers in the U.S., according to a 2020 survey from the NAR. According to a new study by Realtor.com, buying is more cost-efficient than renting in a growing number of the largest cities in the country. This is encouraging news for the millions of millennials who are approaching peak homebuying age.

Fannie Mae predicts that a double-digit home price rise will continue until the middle of 2022, but it won’t be until 2023 that home value appreciation recovers to the pre-pandemic rate of 5%. Some prospective investors may be pessimistic about the 2023 market. They predict that the average 30-year mortgage rate will rise modestly to 3.5% by the end of 2023, up from 3.7% pre-pandemic. Low borrowing costs provide buyers with minimal relief as prices climb, which is good news for investors trying to flip properties.

Fannie Mae also anticipates that price growth will be slower than usual in 2023. A slowing in the home price appreciation and possibly increased inventory could help avoid a real estate market disaster in 2023. Many potential purchasers, particularly millennials, have been priced out of the market as home prices have grown at an exponential rate.

Many buyers need to get into a larger home because they have a growing family. Those interested in purchasing homes are looking at the enticing low mortgage rates. Housing inventory will remain low — despite plenty of new construction, the number of homes for sale will still fall well short of demand in 2022.

Top Real Estate Markets Poised for Growth

The country’s 50 largest markets are expected to grow strongly in 2022, and sellers should expect to remain in the driver’s seat. Zillow expects Tampa and Jacksonville to top the list, followed by a slew of reasonably priced and rapidly growing Sun Belt markets.

Job-rich, low tax states such as those in the Sun Belt are attracting many Americans. Zillow and U-Haul both cited Florida and Texas as hot relocation destinations in separate reports, while United Van Lines listed Florida and South Carolina among the top states for inbound migrations.

Lawrence Yun, chief economist for NAR, says “Sun Belt States are more affordable and generally have a lower tax burden and more job creation.” The cooler markets predicted are New York, Milwaukee, San Francisco, and San Jose due to fewer new jobs.

“The pandemic has prompted many buyers from New York, New Jersey, and California to move to paradise,” said Nicol Jenkins, a Realtor from Fort Lauderdale, Florida.

For my two-year forecast, I suggest that purchasing flip homes to rent would be a very good strategy. With inflation rising dramatically, interest rates predicted to rise, and the dollar being worth less, now would be a good time to invest in that flip property. During high inflationary times, it is a great investment strategy to have passive income and constant cash flow. There are many potential renters out in the market, so research and check your numbers before you invest.

A real estate forecast relies on many different variables and uncertainties. According to the Fannie Mae Economic and Housing Outlook released on March 17, 2022, monetary policy and geopolitical uncertainty add risk to the housing outlook. A significant further rise in mortgage rates could price many potential buyers out of the market and could increase the number of foreclosures.

A more pronounced economic slowdown over the next couple of years could reduce housing demand, but it is expected that housing will hold up comparatively well relative to past recessionary periods due to low supply.

My crystal ball is going back in the closet for a little while. It’s a very challenging time to determine a real estate forecast for all you investors out there. The world stage has changed so dramatically over the past month, and it has taken us all by surprise. We all had hopes and dreams that post-COVID things would return to some normalcy, but there is hope that this too will pass.