Understanding Foreclosure Auctions in Florida

What is a County Foreclosure Auction VS Typical Foreclosures?

A foreclosure auction is a public sale where properties that have defaulted on their mortgage but are not yet owned by the lender are sold to the highest bidder. These auctions occur before the lender takes full possession of the property. When a homeowner fails to make mortgage payments, the property is placed up for auction by the county to satisfy the outstanding debt.

At the auction, third-party bidders can win the property and take possession directly from the current title owner. If no third-party bidders meet the required price, or if the bank outbids others, the property then goes back to the lender. This process ensures that properties go through a public auction before they can be repossessed by the lender, offering investors a chance to acquire them at potentially lower prices.

These auctions are distinctly different from REO (Real Estate Owned) foreclosure and typical bank auctions that most people are familiar with. In REO auctions, the lender has already repossessed the properties after failing to sell at the foreclosure auction. The bank now owns the property and often tries to recoup its losses by selling it at a higher price point to cover expenses like liens, taxes, and repairs.

In contrast, county foreclosure auctions occur before the lender takes full possession of the property. This means that third-party bidders have a direct opportunity to acquire the property from the current title owner without the complications of dealing with a bank as the seller. These auctions often present better investment opportunities because the properties are typically sold at more competitive prices, with less interference from the bank in setting the terms of sale. Understanding this distinction can help investors make more informed decisions and secure better deals in the foreclosure market.

Finding foreclosure auctions in Florida can sometimes feel like searching for a needle in a haystack, but the right resources can streamline the process and lead you to hidden opportunities.

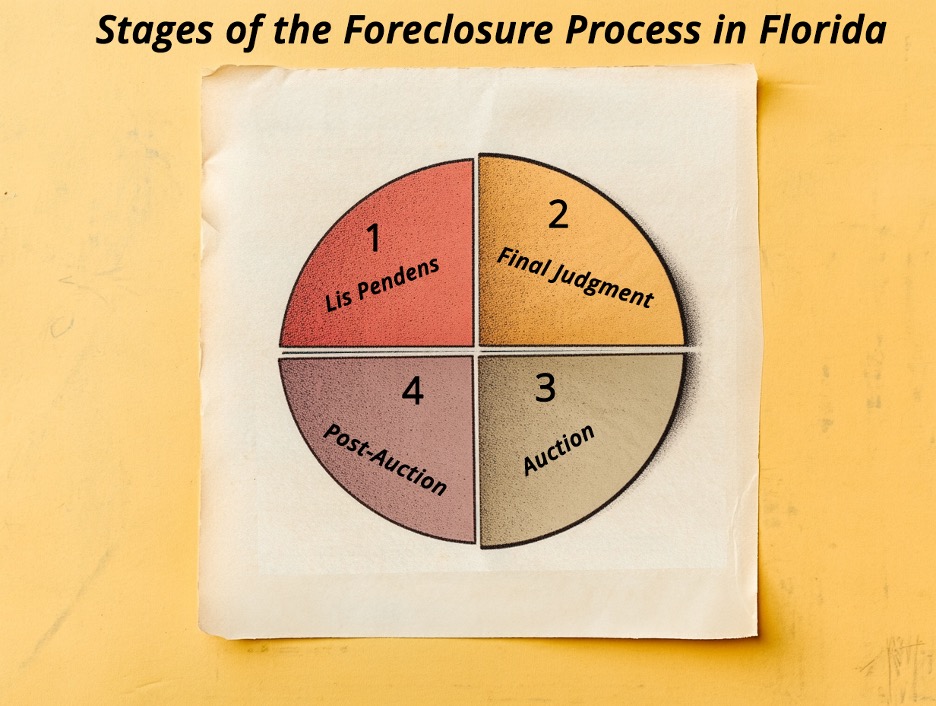

Stages of the Foreclosure Process in Florida

- Notice of Default (Lis Pendens): If the homeowner fails to make the overdue payments, the lender files a notice of default with the county records office. This notice is a public declaration that the property is in foreclosure, and it initiates the legal process.

- Notice of Sale: If the borrower doesn’t rectify the default, the court will create a final judgment and set a date for the auction. The notice of sale is published in local newspapers or online and is posted on county websites, indicating the time, date, and location of the auction.

- Auction: The auction is conducted online or in person, where the property is sold to the highest bidder. Bidders must meet specific requirements, such as having cash or certified funds to participate.

- Post-Auction (REO Sales): If no acceptable bids are received, the property becomes “Real Estate Owned” (REO) by the lender. The lender then attempts to sell it through traditional real estate channels.

Common Terms You Should Know

- REO (Real Estate Owned): A property that has failed to sell at auction and is now owned by the lender.

- Lis Pendens: A public notice filed with the county indicates a property is in foreclosure.

- Trustee Sale: The public auction of a foreclosed property.

- Opening Bid: The starting price for the auction, typically set by the lender based on the outstanding loan amount and any additional costs.

How to Locate Foreclosure Auctions in Florida

Finding foreclosure auctions in Florida can sometimes feel like searching for a needle in a haystack, but the right resources can streamline the process and lead you to hidden opportunities. Here’s how you can efficiently track down upcoming auctions and get a head start on securing valuable investment properties.

County Websites: Your Direct Source for Auction Listings

Most Florida counties maintain a dedicated section on their official websites that lists upcoming foreclosure auctions. These listings are typically managed by the county clerk’s office or the court’s foreclosure department, making them one of the most accurate and up-to-date sources of information. Regularly checking these county websites lets you stay informed about new properties hitting the auction block. This approach gets you to the source, but you will quickly see that a massive amount of legwork is needed to find the data on these properties you need to bid and make money.

Online Auction Platforms: One-Stop Shops for Foreclosure Listings

The digital age has brought auction opportunities to your fingertips. Websites like Auction.com have additional information on some of the county foreclosure properties, but they only list the properties brought to auction by their clients. Their clients in Florida are specific banks, so you can get some idea of what is going to auction, but you do not have a clear picture.

Third-Party Services: Comprehensive Foreclosure Databases

For investors who want to take their search to the next level, subscribing to third-party foreclosure auction services like PropertyOnion.com can be a game-changer. They are the only service that provides daily updated lists of properties headed to county foreclosure auction, complete with insights on property values and lien information. They offer advanced search features that let you filter auctions by location, property type, property specs, and value range, making it easier to hone in on deals that match your investment criteria. With one subscription, you can search over 200 data points with complete title search reports and skip traces on the same platform.

Understanding the property’s legal status, its market value, and any hidden issues can mean the difference between a profitable investment and a costly mistake.

Key Counties for Foreclosure Auctions in Florida

Florida’s diverse real estate landscape means that foreclosure opportunities vary significantly from county to county. Knowing where to focus your search can help maximize your investment potential. Here are some of the hottest spots for foreclosure auctions in the state:

Miami-Dade County: A Foreclosure Hotbed

Miami-Dade County consistently ranks as one of Florida’s top regions for foreclosure activity. Its high foreclosure rates offer a steady supply of residential and commercial properties at auction, making it an attractive destination for investors seeking diverse opportunities. From luxury condos to multi-family units, the range of options in Miami-Dade means there’s potential for significant returns no matter your investment strategy.

Broward County: Profitable Deals Await

Broward County boasts a robust foreclosure market with various properties that cater to new and seasoned investors. Its strategic location and strong rental market make Broward ideal for those looking to capitalize on buy-and-hold strategies. The competition can be fierce, but well-prepared investors can find deals that promise excellent profit margins.

Palm Beach County: Florida’s Fastest-Growing Market

Palm Beach County is currently the hottest real estate market in Florida, experiencing tremendous growth and investment opportunities. Its booming economy and rising property values make it a prime target for foreclosure auctions, attracting investors looking for immediate returns and long-term gains. With a diverse range of properties, from high-end residential to lucrative commercial spaces, Palm Beach offers significant potential for savvy investors aiming to capitalize on its rapid expansion.

Focusing on these key counties and utilizing the right resources can uncover valuable opportunities and secure properties that fit your investment goals. Whether new to the auction scene or a seasoned pro, having a solid game plan for finding foreclosure auctions in Florida is crucial to your success.

Preparing for the Auction: Research and Due Diligence

One of the most critical steps to ensuring a successful investment in a Florida foreclosure auction is thorough research and due diligence. Understanding the property’s legal status, its market value, and any hidden issues can mean the difference between a profitable investment and a costly mistake. Let’s break down the essential steps you need to take to prepare for a foreclosure auction confidently.

Title Research and Property Analysis

Comprehensive title research is a non-negotiable step in the auction preparation process. Without it, you risk inheriting legal complications or financial burdens that can drastically impact your investment’s profitability. Here’s how to conduct an effective title research and property analysis:

Use County Records: Unearth the Property’s Legal Status

Begin your research by diving into the county records where the property is located. Most county offices have online databases where you can access the property’s history, including any recorded liens, unpaid taxes, or legal disputes tied to the property. These records will reveal crucial information about the property’s ownership and any claims against it.

For investors actively tracking multiple properties, a title ownership change monitoring service can automate this process, sending you alerts whenever ownership changes are recorded on properties in your target areas rather than requiring manual checks.

For instance, unpaid property taxes can become the new owner’s responsibility, while other encumbrances like mechanic’s liens or HOA dues could significantly affect the property’s final cost. The more you know about these issues upfront, the better equipped you’ll be to make an informed decision when bidding.

Pro Tip: Always check for both primary and secondary liens. Secondary liens, like home equity loans or unpaid utility bills, might not always be as obvious but can still impact your financial obligations once you acquire the property.

Professional Title Search: Leave No Stone Unturned

While it’s possible to perform title research on your own, hiring a professional abstractor, title company, or real estate attorney can save you time and reduce the risk of missing critical details. Title professionals, like those we employ, have the expertise to dig deeper into public records and court documents, ensuring that you have a clear understanding of the property’s legal standing.

Professional title research will also identify potential issues that could delay the transfer of ownership or increase your costs. These issues could include unresolved probate claims, incorrect property descriptions, or legal disputes that may not be immediately visible in standard records. Given the high stakes of investing in foreclosure properties, this small upfront expense can provide peace of mind and prevent costly surprises down the road.

Pro Tip: Make sure if you hire someone to do the research for you that they are not just “farming out” the work to inexperienced out-of-state, or worse, out-of-country researchers. You will need someone with decades of experience in the county foreclosure arena; only a handful of services do. Make sure you understand how to read the search, and if you don’t, hire someone to teach you what it all means and how it translates to figure out how to find a profitable deal.

Comparable Market Analysis: Know the Property’s True Value

Understanding the property’s market value is crucial for determining how much you should bid at the auction. Conducting a Comparable Market Analysis (CMA) involves researching recent sales of similar properties in the same neighborhood to estimate the fair market value of the property you’re interested in.

Look at factors like the square footage, condition, age of the property, and recent sale prices of similar homes in the area. This analysis will give you a realistic idea of what the property is worth in its current state and after potential renovations. By doing a thorough CMA, you’ll avoid overbidding and ensure that your investment has the potential to deliver a strong return.

Pro Tip: Pay attention to market trends and seasonal fluctuations in property values. A hot market can drive prices up quickly, while slower periods might present opportunities to acquire properties below their true value.

Foreclosure auctions in Florida typically require all transactions to be completed with cash or cash-equivalent funds.

Evaluate Potential Renovation Costs and ROI

Once you have a sense of the property’s market value, it’s time to consider the renovation costs. Properties sold at foreclosure auctions often come with a range of repair needs, from minor cosmetic fixes to significant structural repairs. Estimating these costs accurately is essential for calculating your potential return on investment (ROI).

Always drive by the property, if possible, yourself, or at least hire someone to perform a drive-by inspection to assess its exterior condition. Look for visible signs of damage, such as a sagging roof, cracks in the foundation, or neglected landscaping. If you can’t view the property in person, use online tools like Google Street View or recent listings on real estate websites to gather as much information as possible.

Pro Tip: Prioritize high-impact renovations that will add the most value to the property. Upgrades like kitchen remodels, modernizing bathrooms, and enhancing curb appeal often provide the best ROI.

Assess the Neighborhood and Local Market Conditions

The value of a property is heavily influenced by its location and the surrounding community. Research the neighborhood to understand local market conditions, crime rates, school quality, proximity to amenities, and the area’s general trend of property values.

Properties in up-and-coming neighborhoods can offer excellent growth potential, while those in declining areas might pose more risk. Knowing the local market will help you anticipate how quickly you can resell or rent the property and at what price point.

Pro Tip: Look for areas with new developments, improving infrastructure, or rising demand for rental properties. These factors can signal future appreciation in property values and a strong potential for profit.

Online Research: Leverage Digital Tools for Property Insights

Platforms like Zillow, Redfin, and Realtor.com can be invaluable tools for gathering information about the property you’re interested in. Use these resources to view previous listings, photos, and property details. This online research can give you an idea of the property’s condition, layout, and any recent renovations or damage that might have occurred. However, keep in mind that the property’s current condition may differ significantly from what is shown in older listings.

Pro Tip: Cross-reference online data with the latest information available from the county records to ensure you have the most accurate and up-to-date details about the property.

Hire a Local Agent: Get a Professional Opinion on the Property’s Value

Enlisting the help of a local real estate agent with experience in foreclosure properties can provide you with a valuable, professional assessment of the property’s market value and potential repair costs. An agent’s expertise in the local market can help you understand the demand for similar properties, the realistic selling price after renovations, and any unique factors affecting property values in the area. A knowledgeable agent can also guide you through the auction process, ensuring you make well-informed decisions.

Pro Tip: Choose an agent who specializes in foreclosure or auction properties to get the most relevant advice and insights that align with your investment strategy. You can find a list of these real estate agents in the Pro section of PropertyOnion.com.

Understanding Auction Rules and Procedures

Navigating the rules and procedures of foreclosure auctions can be complex, as every county in Florida has its own specific guidelines that participants must follow. Understanding these details is crucial for avoiding costly mistakes and ensuring a smooth bidding experience. Here’s a detailed breakdown of the critical aspects you need to know before diving into a county foreclosure auction in Florida.

Cash Requirements: Prepare Your Funds in Advance

Foreclosure auctions in Florida typically require all transactions to be completed with cash or cash-equivalent funds. Unlike traditional real estate purchases where buyers can secure a mortgage, auction properties often need to be paid for in full, usually within 24 hours of winning the bid. This means you must arrange your financing well before the auction day.

Most counties require bidders to deposit 5% of their maximum bid amount before the auction begins. For example, if you plan to bid up to $200,000, you would need to submit a $10,000 deposit to be eligible to participate. The balance of the winning bid must be paid promptly, usually by noon on the next business day after the auction. Failing to make this payment could result in the forfeiture of your deposit and the property being re-listed for auction.

Pro Tip: Ensure that your funds are easily accessible and can be transferred quickly to meet these tight deadlines. Many investors use hard money loans, private lenders, or their own cash reserves to cover these costs.

You must finalize the payment process immediately if you are the highest bidder at the auction.

Registering to Bid and Depositing Pre-Auction Funds

Before you can place any bids, you must register with the county’s auction system. Most Florida counties use an online registration process that is straightforward but must be completed before the auction date. During registration, you will provide your contact information and deposit funds equivalent to 5% of your maximum bid.

For online auctions, many counties use platforms like RealAuction.com where you can register, submit your deposit, and participate in the bidding from the comfort of your home. Bidders can pay the deposit via ACH transfer, cashier’s check, or other approved payment methods. Make sure that your deposit is submitted and cleared at least a few days before the auction to avoid any delays.

Pro Tip: Some counties also allow in-person deposits at the county clerk’s office if you prefer a more direct method. This can be useful if you’re concerned about potential delays with electronic transfers.

Bidding Process: How to Place Your Bid Like a Pro

Once you’re registered and your deposit has been accepted, it’s time to participate in the auction. Most counties in Florida now offer online auctions that mimic the traditional in-person bidding process, making it easy for investors to place their bids from anywhere. During the auction, properties are listed with opening bids, and participants can increase their bids in specified increments.

The bidding often becomes competitive with investors trying to outbid each other to secure the property. Some counties have a “plaintiff max bid,” which means the lender has a predetermined maximum bid that they are willing to go up to in the auction. If the bidding exceeds this amount, the property is awarded to the highest third-party bidder.

Pro Tip: Develop a clear bidding strategy before the auction begins to avoid getting caught up in the excitement. Know your maximum bid limit based on your budget, and stick to it to prevent overbidding.

Winning the Bid: Finalizing the Purchase and Transferring Ownership

You must finalize the payment process immediately if you are the highest bidder at the auction. Most counties require the remaining balance of your winning bid to be paid by noon on the business day following the auction. In addition to the final payment, you will also need to cover additional fees, which may include:

Clerk’s Online Auction Fee: Typically around $60.

Documentary Stamp Taxes: Calculated as $0.70 per $100 of the bid amount.

Registry Fees: These can vary, but generally, they are 3% of the first $500 and 1.5% of the remaining balance.

For example, if you win a property with a bid of $100,000, you might owe an additional $1,440 in fees, which includes documentary stamp taxes and registry fees, along with any other costs specified by the county.

Once your payment is complete, the county will issue you a “certificate of sale,” confirming your property ownership. This certificate of sale will later be replaced by a “certificate of title,” formally transferring ownership to you once all paperwork is processed. This step can take up to 45 days, depending on the county’s workload and the specific auction guidelines.

Pro Tip: Make sure to verify all amounts due and pay promptly to avoid any complications or delays in receiving the title.

Legal Considerations After Winning the Auction

After winning the auction, some necessary legal steps follow to ensure that the property transfer is smooth and without any disputes. It’s crucial to:

Clear the Title: Ensure that any remaining liens or legal claims on the property are resolved. This step often involves working with a title company or a real estate attorney to handle any complications that might arise.

Evict Occupants (if Necessary): If the property is still occupied, you may need to initiate the legal eviction process explained here. Understanding the eviction laws in Florida is essential, as these can vary depending on the county and the foreclosure circumstances.

Property Insurance: Secure insurance for the property as soon as possible to protect your investment from potential damage or liability.

Pro Tip: Consider consulting a real estate attorney to navigate the complexities of the legal requirements and ensure that all title issues are adequately addressed before investing any additional funds into the property.

Bidding Strategies for Success

Successfully bidding at a foreclosure auction requires more than just a desire to win — it demands careful planning, a clear strategy, and the discipline to stick to your limits. Here are key tactics to ensure your bidding process is effective and profitable.

Setting a Budget and Sticking to It

One of the most crucial aspects of auction success is setting a clear budget well before the bidding begins. Foreclosure auctions move quickly, and without a predefined budget, it’s easy to get caught up in the heat of the moment and overspend. Here’s how to create a sound financial strategy:

Determine Your Maximum Bid: Start by conducting a thorough property analysis to estimate its current market value and the costs associated with any necessary repairs or renovations. Take into account factors like holding costs, potential resale value, and your desired profit margin. “The County Auction Bidder Guide” recommends crunching these numbers to ensure that your maximum bid aligns with your investment goals and doesn’t exceed what you can realistically afford.

Bidder Calculator

Our Bidder Calculator helps real estate investors quickly assess property opportunities at auctions. Input your costs and potential income to see projected returns for both flipping and renting scenarios. Make informed decisions with clear, instant financial projections for your investments.

Pay Offs Section

Other Expenses

Buy to Rent

Results

Buy to Flip

Buy to Rent

Factor in Hidden Costs: In addition to your maximum bid, you must consider any hidden expenses that may arise after acquiring the property. These can include liens, unpaid property taxes, HOA dues, and renovation costs that could significantly affect your overall investment. By factoring these elements into your budget beforehand, you’ll avoid unexpected financial surprises and safeguard your profit margin.

Pro Tip: Overestimate the costs and underestimate the potential resale price to build a financial cushion that protects you from unforeseen expenses.

There will always be more opportunities, and a disciplined investor finds better success than one who chases every deal at any price.

Winning Bidding Tactics: Strategies for Success

Once your budget is set, the next step is to develop a winning strategy that keeps you in control during the auction. Here are some proven tactics to help you stand out and secure the best deals:

Stay Focused on Your Maximum Bid: Our Downloadable County Auction e-books emphasize the importance of setting a maximum bid and sticking to it, regardless of how the auction progresses. Remember, it’s not about winning at any cost; it’s about making a smart investment that aligns with your financial objectives.

Enter the Bidding Late: A well-timed entry into the bidding process can be a strategic advantage. Jumping in late can sometimes catch other bidders off guard, disrupting their strategy and reducing the number of competitive counter-bids. This approach can give you a psychological edge over less experienced participants who might be unsure how to react.

Keep Emotions in Check: Getting emotionally invested in a property is easy, especially if you feel strongly about its potential. However, “Property Lien Search Made Easy” advises against letting your emotions dictate your decisions. Bidding wars can quickly escalate, leading to irrational bids that exceed your budget and jeopardize your investment’s profitability. Stay calm, collected, and focused on your predetermined financial limits.

The Power of Patience: It’s Okay to Walk Away

One of the hardest parts of bidding is knowing when to walk away. If the auction price goes beyond your maximum bid or if the competition becomes too fierce, don’t be afraid to step back. Our Downloadable County Auction e-books highlight that opportunities at foreclosure auctions are frequent and varied; missing out on one property doesn’t mean there won’t be another great deal around the corner.

Pro Tip: Enter each auction with the mindset that you will only bid within your predetermined limits. There will always be more opportunities, and a disciplined investor finds better success than one who chases every deal at any price.

By following these strategies, you can approach each auction with a plan that maximizes your chances of success while minimizing your financial risks. Proper preparation, realistic budgeting, and a disciplined mindset are your best tools to turn a foreclosure auction into a profitable venture.

While foreclosure auctions can be a gateway to profitable investments, they require careful planning and a solid understanding of potential risks.

Risks and Challenges in Florida Foreclosure Auctions

Foreclosure auctions can offer excellent investment opportunities, but they also come with significant risks. Understanding these potential pitfalls is crucial for making informed decisions and protecting your investment.

Hidden Costs and Liens

One of the biggest challenges in foreclosure auctions is the presence of hidden costs that can drastically affect your bottom line. The most common are unpaid property taxes, which become the new owner’s responsibility upon winning the bid. Failing to account for these liabilities could lead to unexpected expenses that reduce your profit margin.

Another potential issue is the existence of outstanding liens on the property. These might include mechanics liens, HOA dues, or even utility liens that were not resolved by the previous owner. A thorough title search is essential to identify any encumbrances that could complicate your ownership or increase your costs. Without this due diligence, you might inherit debts that could substantially diminish your return on investment.

Additionally, legal fees can also play a significant role in the financial equation. Costs associated with transferring the title, resolving disputes, or even evicting current occupants can add up quickly. These expenses are often overlooked but can be significant when acquiring a property through a foreclosure auction.

Property Condition and Rehabilitation Costs

Another significant risk in foreclosure auctions is the condition of the property itself. These homes are typically sold “as-is,” meaning what you see is what you get — along with any hidden problems. Many foreclosed properties have been neglected for extended periods, leading to common issues like mold growth, plumbing failures, roof damage, or even foundation problems. Addressing these problems can require substantial time and financial resources.

Vandalism and theft are also common concerns with foreclosed properties. Vacant homes often fall victim to stolen appliances, copper piping, or other valuable fixtures. In some cases, previous owners may even intentionally damage the property out of frustration over the foreclosure process. Repairing these damages can be costly and time-consuming, further eating into your profit margins.

Mitigating the Risks

To minimize these risks, due diligence is your best ally. Always conduct a comprehensive title search to uncover any hidden liens or tax obligations. Additionally, inspect the property yourself or hire a professional to assess its condition and estimate repair costs before placing your bid. Understanding these factors in advance allows you to set a realistic budget and avoid unpleasant surprises after the auction.

While foreclosure auctions can be a gateway to profitable investments, they require careful planning and a solid understanding of potential risks. By doing your homework and preparing for the unexpected, you can make smarter decisions and turn these challenges into opportunities.

Conclusion

Foreclosure auctions in Florida offer a unique opportunity to acquire properties below market value, but they come with their own set of risks and challenges. You can make the most of these opportunities by understanding the auction process, conducting thorough research, and employing intelligent bidding strategies. With the proper preparation and mindset, you can turn Florida’s foreclosure market into a profitable venture.

For further assistance, consider attending our upcoming workshop or exploring more resources on PropertyOnion.com to deepen your knowledge and connect with other successful investors.