Zillow Projects Dismal Real Estate Outlook as sales dip 60% Overall

If you were hoping for a quick rebound of the real estate market, you might be waiting for a while. The current COVID-19 pandemic has taken a big bite out of the market, and according to Zillow’s recently published housing market projections, we shouldn’t expect this to change until the end of 2021, or later.

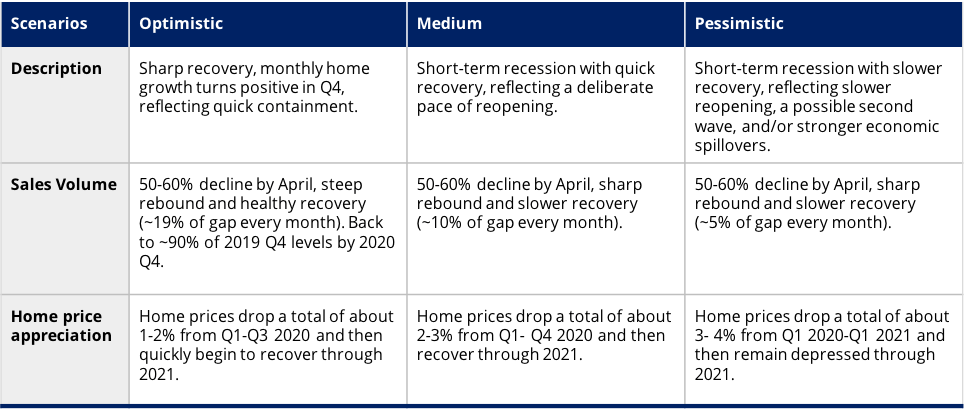

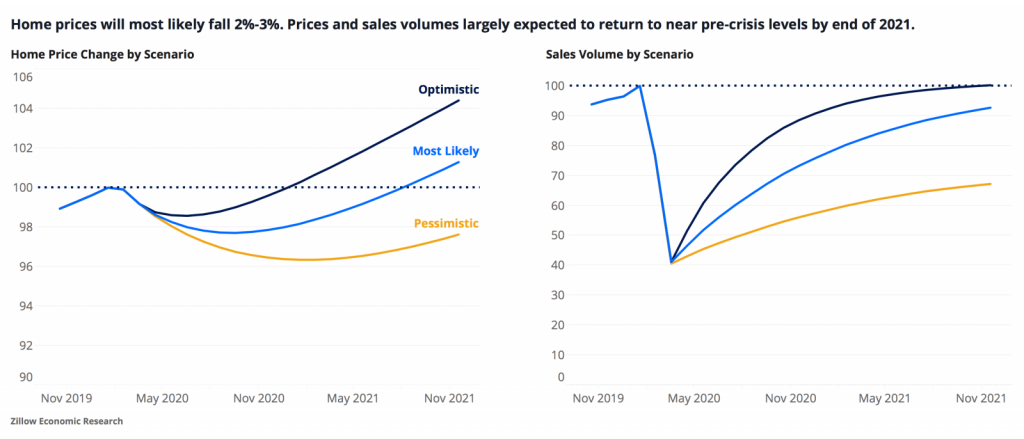

Zillow breaks their projections into three distinct scenarios: Optimistic, Medium, and Pessimistic.

Optimistic Real Estate Projection

Under the Optimistic scenario the economy will experience sharp recovery, leading to a positive monthly home growth position. Home sale volumes will initially decline 50-60% and return to near 2019 Q4 levels by 2020 Q4. Home prices will drop 1-2% through most of 2020 and recover quickly in 2020 Q4 and into 2021.

Medium Real Estate Projection

This scenario projects a short-term recession, with quick recovery, based on a deliberate, staged re-opening of the country. Home sale volumes will initially decline 50-60%, and recover slowly, closing the gap by approximately 10% each month. Home prices will drop by 2-3% through 2020 and recover in 2021.

Pessimistic Real Estate Projection

Under this scenario the economic slowdown will be recovery more slowly. The country will reopen more gradually, and a possible second wave of virus outbreaks will create more chaos in the housing market. Home sale volumes will initially decline 50-60%, and recover slowly, closing the gap by approximately 5% each month. Home prices will drop by 3-4% through 2020 and remain depressed in 2021.

Zillow projects the Medium scenario to be the most likely, while the Pessimistic is the least likely.

Zillow’s projections are based on a mixture of publicly available and their own proprietary data. To read a detailed article of their methods, click here.

In comparison to the current COViD-19 crisis, housing prices fell 30% in the financial collapse of 2007-2008.

Ultimately Zillow warns that we should expect “much more short-term disruption than longer-term.”

To help weather the storm, real estate companies like Zillow and competitor Redfin are relying on technology even more than they traditionally have. New social distancing measures put in place to curb the spread of COVID-19 have created a situation where home buyers are reluctant or simply unable to physically view a potential new home (read more scenarios in our previous Covid-19 real estate update). Video tours and self-tours have become a popular alternative to traditional in-person viewing.

Zillow’s response to the pandemic has been to implement a 25% reduction of expenses for the entire year. They plan to accomplish this by enacting a company-wide hiring freeze, reducing marketing costs and suspending their Zillow Offers business, where select home owners are offered the opportunity to sell their home directly to Zillow, while avoiding the inconvenience of putting it on the market.

Accordingly, Seattle-based Redfin has also temporarily stopped their direct home buying service, RedfinNow. They report that home listings have been cut in half compared to the previous year, but continue to forecast continued recovery heading into the summer months.

Of course, demand for new homes will be highly dependent on unemployment factors and the ability to qualify for credit from lending institutions.

The national unemployment rate rose to 14.7% in April, with 20.5 million jobs being shed in the worst monthly loss on record.

For those buyers with the means, this might be an opportune time to find bargains on the market. The opposite is true of sellers, who should attempt to hold off listing until the market rebounds.