Halloween Tales from the Peel!

Welcome to the darker side of real estate, where “location, location, location” meets “beware, beware, beware.” In these shadowy corners of the Sunshine State, property lines blur with paranormal activity, and closing costs aren’t the only things that might haunt you. From cursed online auctions to eternal open houses, these tales prove that in Florida’s real estate market, some deals are simply too good to be true—and some properties never truly let go of their residents.

Investors beware: these aren’t your typical real estate horror stories of bad investments and missed opportunities. These are the chronicles of properties where the fine print is written in blood, and “vacant” doesn’t always mean empty.

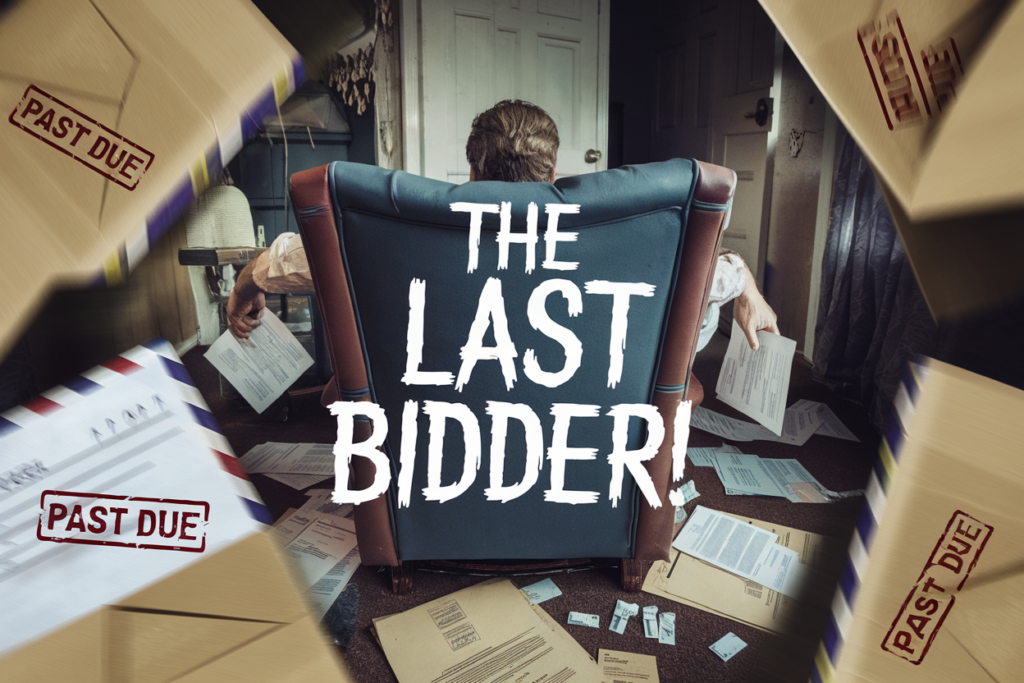

The Last Bid: A Cursed Auction in Florida

Our first horrific tale is courtesy of the Broward County Clerk of Court. Florida’s foreclosure auctions have gone digital, bringing properties to investors’ fingertips with just a few clicks. While the convenience is undeniable, the risks are still very real. But what if a winning bid didn’t just come with a property? What if it brought something far more sinister? This horrific tale delves into one such online auction where an investor’s dream became a terrifying nightmare.

When bidding at Florida’s online auctions, always perform your due diligence, get our title reports to back it up — or you might just find yourself haunted by your own “last bid.”

The Online Auction Temptation

Richard Collins had built a reputation as a shrewd investor, known for his success with Florida’s online foreclosure auctions, particularly in Broward County. From his laptop, he’d won properties all over the state. One October morning in 2023, he logged onto his favorite auction site PropertyOnion, eager to find his next deal at the Broward County Foreclosure auctions.

That’s when he noticed an oddly appealing listing — a waterfront home in decent condition with a maximum bid that seemed too good to pass up. Excited, he shot a text over to his investor buddy, Mark, “Checkout this auction,” with a link to the property details page on PropertyOnion. Mark texted him back: “Don’t bid on this one, Rich. Seriously. Just… don’t.” Richard messaged back, asking why, but Mark’s cryptic response was chilling: “Trust me. You don’t want it.”

Ignoring Mark’s warning, Richard’s competitive nature took over. He placed his bid, outlasting the competition as the auction timer ran down to zero. His heart raced as the confirmation flashed across his screen: “Winning Bid Placed!” Just as he began to celebrate, a strange window popped up on his screen. It read: “Last bidder isn’t the winner!”

Richard paused, confused. It seemed like a prank from his bidder friend who lost or someone else. Annoyed but undeterred, he muttered, “Nice try,” assuming it was some hacker sore about losing. He closed the pop-up and convinced himself it was nothing to worry about — just another trick of the trade in Florida’s competitive foreclosure auctions.

The House of Unease

Within weeks, Richard received the certificate of title, giving him official ownership. Eager to flip the property quickly, he decided to do some of the initial work himself to save costs. As he entered the house for the first time, a wave of cold air swept over him. He brushed it off as a draft from the old windows.

But the house had other plans. Over the next few days, Richard felt increasingly uneasy. He experienced sudden chills, bouts of dizziness, and growing anxiety that seemed to come from nowhere. The worst moments were in the living room, where he constantly felt watched, as if someone — or something — was there with him.

At night, Richard heard faint whispers, though he was always alone. “Last bidder isn’t the winner,” the voice seemed to say. He began to suffer from vivid nightmares, seeing himself surrounded by faceless bidders, all chanting: “Last bidder isn’t the winner.” As his health deteriorated, Richard decided to research the house’s history.

Uncovering a Dark Past

Digging deeper into the property’s past, Richard discovered that the previous tenant, a man named Frank Marshall, had died just a year earlier when the original foreclosure auction was scheduled. According to neighbors, Frank had a desperate plan: he intended to bid at the auction and win back the property himself so he wouldn’t have to move.

But things didn’t go as planned. The day before the auction, neighbors heard loud commotion and rushed outside to find an ambulance parked in front of the house. As paramedics wheeled Frank out on a stretcher, he was hysterical, crying out, “I’ll be the last bidder! I’ll be the winner! I’m not being forced out of my house, never!” Frank’s death was officially ruled a heart attack, but the neighbors swore they’d never forget the terror in his voice as he made his last vow.

Despite the growing terror, Richard felt compelled to confront whatever haunted the property. In desperation, he listened to his “new age” girlfriend and hired a type of “ghost whisperer,” a local psychic known for her eerie accuracy. As she entered the living room, she froze, then whispered, “I hear him. He’s saying… ‘Last bidder isn’t a winner.’”Suddenly, the ghost whisperer’s eyes widened with horror. She pointed frantically to the wall behind Richard, her voice barely a whisper: “Look… the letters ‘HOA’… they’re written in blood!”

Richard spun around quickly, catching a flash of something red. For a fleeting moment, it seemed like something red on the wall, but as his eyes adjusted to the dim light, he couldn’t see anything but shadows. He stared hard, but the wall was blank — no blood, no letters. His pulse raced, yet he couldn’t shake the feeling that something had been there, even if only for a second.

The Real Curse is Revealed

The ghost whisperer’s words echoed in Richard’s mind, but it was the chilling sight of “HOA” that jolted him back to reality. A quick consultation with a real estate attorney confirmed his worst fear: in Florida, HOA dues aren’t wiped out in a foreclosure sale, even if there’s no recorded lien. Richard was now liable for years of unpaid fees, late penalties, and legal costs.

That same day, Richard received a certified letter from the HOA attorney, informing him of $65,000 in past-due fees, penalties, and attorney costs. The letter concluded with a stark warning: if the amount wasn’t paid in full within 30 days, the HOA would file a new lien and initiate foreclosure proceedings against Richard.

Desperate, Richard tried to negotiate with the HOA, but the board refused any compromise. He was trapped — not just by Frank’s vengeful spirit, but by the crushing financial burden that seemed to tighten its grip with every passing day.

A Terrifying End

Richard’s health continued to decline as the house’s dark presence grew stronger. He spent sleepless nights in front of his laptop, searching for a way out of the nightmare he’d bought into. One rainy night, as he sat staring blankly at the auction site, his screen flickered and filled with text: “Last bidder isn’t a winner. Leave now… or stay forever.”

The next morning, neighbors reported hearing Richard’s terrified screams. By the time police arrived, they found the house empty with Richard’s laptop left open to the auction site, still displaying his winning bid. He was never seen again, and the house returned to the auction site within weeks, still bearing the unpaid HOA debts.

Real Estate Lessons from a Cursed Auction

While this story is fictional, it sheds light on very real risks associated with foreclosure auctions:

- Always Check for HOA Dues:

- In Florida, even when a foreclosure auction wipes out a mortgage, it doesn’t necessarily erase unpaid HOA fees. According to state law, HOA dues “run with the land,” making the new owner liable for past dues and penalties, which totaled over $1 billion in 2023 alone.

- Understand All Liabilities Before Bidding:

- Many investors get caught up in low starting bids, but they often overlook additional costs. Over 20% of Florida’s foreclosure purchases in 2023 came with significant hidden costs like unpaid taxes, code violations, or HOA fees that weren’t immediately clear.

- Use Professional Title Searches:

- Never assume that the absence of a recorded lien means the property is free of encumbrances. Professional title searches and attorney consultations are crucial to identify potential risks before bidding.

- Don’t Underestimate Stigmatized Properties:

- Properties with a history of violent deaths, alleged hauntings, or other unsettling events can be difficult to sell, often taking twice as long to offload and selling for up to 20% less than comparable homes without stigmas.

Would You Place the Last Bid?

The tale of “The Last Bid” may be a work of fiction, but it’s grounded in real risks that can turn a dream deal into a nightmare. When bidding at Florida’s online auctions, always perform your due diligence, get our title reports to back it up — or you might just find yourself haunted by your own “last bid.”

The Open House That Never Ended: A Realtor’s Last Showing

The Perfect Property… Or So It Seemed

In the world of real estate, open houses are meant to sell dreams. But sometimes, the dreams turn dark. When veteran agent Sara McKinney stumbles upon a sprawling yet neglected mansion in a small Florida town, she’s determined to make it her next big sale. The rumors about the house’s past don’t bother her — she’s focused on potential, not drama.

Sara McKinney was an ambitious real estate agent always on the hunt for undervalued properties. When she came across an abandoned mansion listed as a foreclosure in a small Florida town, she saw massive potential. The house, built in the 1950s, was filled with original details — old oak floors, intricate moldings, and a grand staircase that could be restored to its former glory.

Local legends hinted at a dark past, with stories of disappearances linked to the property. But Sara was a no-nonsense agent, dismissing the rumors as local folklore. To her, it was just another deal, and she was determined to find the right investor to transform it into a profitable flip.

Sara tried to guide the attendees to different rooms, but each time she entered one room, she found herself alone, as if the house itself had separated her from the group.

The Open House Begins

Sara eagerly scheduled the open house, sending out marketing blasts to investors. By 10 AM, a small group of curious buyers had arrived, excited by the low asking price and potential for a major return. Everything seemed normal at first. Attendees admired the craftsmanship, commenting on the ornate fixtures and the potential to turn the kitchen into a modern masterpiece.

Then things started to get weird.

As one couple inspected the living room, they noticed a heavy oak armchair in the corner. Moments later, it vanished without a sound, only to reappear on the opposite side of the room. The couple looked at each other in confusion, but before they could speak, the doors slammed shut behind them. Frightened, they tried to open the doors, but they were locked.

In another part of the house, a man was exploring the kitchen. He tried to exit through the back door, but found himself back in the front hallway, as if he had never left. No matter which direction he took, he ended up in the same place.

Sara’s pitch became more desperate. Her once-confident tone turned hollow and mechanical, as if she were merely reciting a script she no longer believed in. “Please don’t leave yet,” she repeated, her voice strangely monotone. “We’re almost finished with the tour.”

Sara noticed that her phone, which she had used to check the time earlier, was now dead. She asked one of the visitors for the time, only to find that his watch was running three hours behind hers. Other guests looked at their phones and watches in disbelief — no two devices showed the same time.

As the open house dragged on, the daylight seemed to hang unnaturally, as if the sun was stuck in the sky. Hours passed, but the afternoon light remained the same. Frustrated but determined, Sara tried to guide the attendees to different rooms, but each time she entered one room, she found herself alone, as if the house itself had separated her from the group.

One by one, the potential buyers began to panic. A woman screamed from the second-floor bedroom, claiming she saw a mirror image of herself waving from the inside of a closet. Another man bolted down the stairs, insisting he had been trapped in a looping hallway for what felt like hours.

As the visitors made their way toward the exit, they found the front door firmly locked from the outside. Panic rippled through the group, and Sara’s dazed expression suddenly sharpened as if she’d snapped out of a fog. “Wait,” she muttered, her hand instinctively reaching for her pocket.

But when she searched for the front door key, her fingers found only empty fabric. The key was gone.

A wave of fear swept over the group. Some rushed to the windows, pounding desperately, but the glass held firm, reflecting back distorted, warped versions of their own frantic faces, as if the house itself were mocking their futile attempts to escape.

Hours became meaningless. Watches spun backward, phones flickered on and off, and daylight refused to shift. One by one, the guests seemed to disappear, vanishing around corners or into dark rooms, never to be seen again. Soon, Sara found herself alone in the foyer, her voice echoing strangely in the empty space.

Desperate to escape, Sara makes one final attempt to pull open the front door, frantic as she searches her pockets for the missing key. Just then, she spots it — the key lying inexplicably on the floor near the door. She’s walked past it 20 times that day, and now, it was there clear as day.

Relieved, she picks it up, but as soon as the cold metal touches her hand, everything changes. Her panic fades, her face relaxes, and she finds herself turning back toward the entrance, the lines of her pitch already forming on her lips as if someone had hit a reset button on her.

She opened the door and, without thinking, greeted the next group there for her afternoon showing: “Welcome to the open house. Please, step inside and see the potential for yourself.”

Her smile widens unnaturally, her eyes glazed over as she recites the same sales pitch over again, trying to entice her next group of buyers to cross the house’s threshold for their final tour.

The next morning, the front lawn was freshly mowed, the “For Sale” sign stood upright, and the house looked as pristine as ever. The front door creaked open, and a low voice whispered from within: “Open house in progress — please stop by.”

Real Estate Agent Lessons from Fictional Open House Nightmares

While Sara’s story may be fictional, the potential dangers of hosting an open house are very real. Here are some practical tips to help real estate agents stay safe and maximize their success during open houses:

Prioritize Agent Safety:

- Always Bring a Safety Partner: Never host an open house alone. Having a second person not only provides an extra layer of security but also helps manage larger groups of visitors.

- Keep Your Phone Handy: Ensure your phone is fully charged and readily accessible at all times. Use safety apps like Forewarn or SafeShowings to alert colleagues if you feel unsafe.Establish Escape Routes: Before opening the house to visitors, identify all exits and ensure you have a clear path to leave in case of an emergency.Communicate Your Location: Let someone know where you are, how long you’ll be there, and check in with them periodically. Share your location in real-time using apps like Google Maps or Life360.

- Trust Your Instincts: If something feels off about a visitor or situation, don’t hesitate to end the open house early. Your safety is the top priority.

Schedule Open Houses Strategically:

- Best Days for Open Houses: According to the National Association of Realtors (NAR), the best days to hold an open house are Saturdays and Sundays, as they generally see higher attendance. Saturday mornings or Sunday afternoons often have the most traffic.

- Optimize the Timing: For the highest turnout, schedule open houses between 10 AM and 3 PM. This allows potential buyers to visit before or after running errands or attending other weekend events.

- Avoid Major Events: Be aware of local events, holidays, or major sporting events that might conflict with your open house. Avoid scheduling during times when traffic may be disrupted, or potential buyers may be focused elsewhere.

Enhance Your Open House for Success:

- Promote Your Open House Effectively: Use social media, email marketing, and real estate platforms like Zillow and Realtor.com to promote the event in advance. Leverage video tours and virtual walk-throughs to generate interest.

- Use Signage Wisely: Place open house signs at major intersections near the property and direct visitors to the location. Use balloons or flags to catch attention and increase curb appeal.

- Prepare a Property Checklist: Create a list of key features and upgrades for visitors. This helps them remember the property and increases engagement.

Secure the Property Before and After:

- Check All Entry Points: Ensure all doors and windows are secure before visitors arrive and re-check them after everyone leaves.

- Limit Access to Personal Items: Lock away or remove valuables, medications, and sensitive documents to prevent theft during the open house.

- Consider Surveillance: Install temporary security cameras or use motion-sensor devices to monitor areas of the house during the open house.

Prepare for Stigmatized Properties:

- If you’re hosting an open house at a property with a known reputation (e.g., prior crimes, deaths, or paranormal rumors), be ready to address questions candidly and factually. Avoid exaggerating or downplaying issues — buyers appreciate honesty.

These real-world strategies can help ensure safety, improve turnout, and maximize results at open houses. Stay vigilant, plan strategically, and never forget that your well-being is as important as closing the deal.

Zombie Tenants: The Renters Who Wouldn’t Leave

Tom got a new search alert from his PropertyOnion account. There was a newly listed Tax deed sale for a duplex in North Miami where he invests in. Excited for the details, when Tom dug into the due diligence to research the property before bidding at the tax deed auction, something struck him as odd. The duplex had been up for auction multiple times over the last 20 years.

Every three years, it was sold at a Tax deed auction again to a new bidder, only for the property taxes to go unpaid again. It seemed no one ever managed to hold onto the property long enough to pay the property taxes, and the property was repeatedly cycled back to auction like clockwork — almost as if the duplex itself rejected any attempt to own it.

Despite the peculiar history, Tom chalked it up to bad management or poor investment decisions by previous owners. He had no idea that the true reason was far more sinister. He set up his max bid, attended the auction, and won at a great price.

Tom Watkins prided himself on being a sharp investor. The duplex he purchased at auction was in a prime location and offered plenty of potential for rental income.

When Tom took possession of the property, he expected it to be empty like most Tax deed auction properties he won previously. But as he approached the duplex for the first time, he noticed subtle signs of life — curtains that seemed slightly parted, a faint glow from a flickering bulb, and the unmistakable smell of body odor mixed with cologne and perfume wafting from inside.

Feeling uneasy, he knocked on the front door of the first unit, but there was no answer. However, just as he turned to leave, he heard a low, creaking sound from inside, followed by the unmistakable sound of shuffling footsteps.

His heart raced, and he quickly moved to the back unit, where he heard muffled voices — someone having a hushed conversation. He strained to listen, when suddenly, a deep, croaky voice rasped clearly through the thin walls: “We’ve been waiting for you, landlord,” causing him to fall back in shock and disbelief.

Chilled to the bone, and convinced that these were squatters and going to cause trouble, he sped out of there, going directly to his attorney’s office to tell him what happened and to prioritize an eviction filing for him, certain that he could handle the situation just like he had with difficult tenants before. Little did he know, these tenants were far from ordinary.

The attorney told him he saw in his research that there were eviction hearings scheduled as recently as two years ago, but they were always canceled because of non-response by the plaintiff.

The notices Tom posted on the doors vanished overnight, replaced by messages in jagged handwriting: “We won’t leave.”

Tom wasn’t worried. He’d dealt with stubborn tenants before, and no attendants are about to scare him off like they did the previous owners. He sent eviction notices to both units, expecting the process to be straightforward. But as the days dragged on, things took a turn for the worse.

The Unwelcome Resistance

The front unit housed an elderly woman named Mrs. Delaney, who was rarely seen outside. The back unit was occupied by a man named Peter, whom Tom had never actually met — only heard through strange, muffled conversations at night. Despite the eviction notices, neither tenant responded, and when Tom attempted to visit, the tenants never answered the door.

The notices Tom posted on the doors vanished overnight, replaced by messages in jagged handwriting: “We won’t leave.” At first, Tom thought it was a desperate attempt to stall. But when he found his windshield smeared with the words “Get out, landlord” one morning, his unease grew.

Discovering the Tenants’ Dark Past

Tom decided to dig deeper into the tenants’ past. Through old newspaper archives and county records, he uncovered a chilling backstory: Mrs. Delaney and Peter had been evicted from their childhood home years earlier by a ruthless landlord, left destitute and broken. Swearing never to be forced out again, they rented the duplex decades later, with a fierce, obsessive attachment to the property.

Tom’s renovation plans began to falter as the tenants’ refusal to leave turned from frustrating to terrifying. Neighbors shared eerie stories of past owners who tried to remove the pair, only to abandon the property, claiming they were haunted by strange sounds and shadows in the night.

A Sinister Revelation in the Attic

Determined to find the tenants and finally confront them, Tom decided to check the attic, the only part of the property he hadn’t yet explored. As he climbed the creaky stairs, a foul stench filled the air. He found dusty mattresses, old furniture, and strange symbols carved into the walls, as if someone had been living there for years.

But that wasn’t the worst of it. Tom stumbled across a crumpled, yellowed lease in a dusty corner. It had both tenants’ signatures, with a final clause written in shaky handwriting: “Rent paid in full — until death.”

Suddenly, Tom heard a low, guttural moan behind him. He turned, and his blood ran cold.

Mrs. Delaney and Peter stood at the far end of the attic. But they were not ordinary tenants anymore — they were decomposing, zombie-like figures, their skin hanging loosely from their faces, eyes milky and vacant. Their mouths moved slowly, repeating one phrase over and over in croaky voices that gurgle between each chant: “We’ve been waiting for you, landlord… We’ve been waiting for you, landlord.”

Tom’s heart raced, and he stumbled backward, tripping over debris as the zombies advanced. Mrs. Delaney reached out, her bony fingers curling toward him, while Peter’s decaying form shuffled closer with terrifying persistence. “We’ve been waiting for you, landlord…”

Panicking, Tom tried to flee, but the attic door slammed shut behind him. The air grew colder, and the zombies’ groans became louder, filling the small space. He swung his flashlight desperately, but the dim beam only revealed their rotting forms closing in.

Tom’s screams echoed through the duplex as the zombie tenants grabbed hold of him. The last thing he saw was Mrs. Delaney’s rotting smile and Peter’s decaying hand gripping his throat. In one final, horrifying moment, Tom realized the truth — he was the next victim of the tenants’ curse, never to leave the property.

Real Estate Lessons from Fictional Zombie Tenants

While this story is fictional, the struggles of removing problematic tenants are very real. Here are some important lessons:

- Screen Tenants Thoroughly: In 2023, over 15% of eviction filings in Florida were due to non-paying tenants with questionable histories. Proper tenant screening — including background checks, credit reports, and rental history — can prevent costly evictions and prolonged vacancies.

- Understand Local Eviction Laws: Florida’s eviction process can be lengthy, often taking months to fully resolve. Understanding the legal timeline and requirements is crucial, as more than 12% of landlords experienced extended vacancy periods due to legal delays in 2023.

- Consider “Cash for Keys” Offers: To avoid drawn-out legal battles, some landlords offer tenants a “cash for keys” deal, paying them to leave quickly. In 2023, nearly 30% of landlords successfully used this approach to expedite evictions, minimizing losses and saving on court costs.

- Plan for Unexpected Delays: Tenant-related delays can cost landlords significantly, especially in foreclosure acquisitions. It’s important to factor potential delays into your investment strategy, as 20% of distressed property investors faced unexpected tenant holdovers this past year.

- Be Prepared for Squatters: While ghostly tenants are fictional, squatters are not. Abandoned properties can attract squatters, who are difficult to remove without a formal eviction process. Squatter cases increased by 10% in 2023, complicating many investors’ plans.

While “Zombie Tenants” is a fictional tale of paranormal renters, it’s rooted in the real-world challenges of managing rental properties. From stubborn tenants to legal roadblocks, the world of rental investing can be filled with surprises — some less visible than others. Always do your due diligence, or you might find yourself dealing with tenants who refuse to leave, long after they should have.

Whispers in the Walls: The Haunted History of Florida’s Foreclosure Boom

Our next horrifying tale takes place in the sun-soaked streets of Florida, where palm trees sway and tourists flock, a darker tale lurks beneath the surface. It’s a story of economic despair, shattered dreams, and… whispers in the walls. Welcome to the haunted history of Florida’s foreclosure boom.

The Rise and Fall

The early 2000s saw Florida’s real estate market soaring to dizzying heights. Investors flocked to the Sunshine State, drawn by promises of endless growth and easy profits. But as we now know, this boom was built on a foundation of sand.

In 2008, the bubble burst. Florida found itself at the epicenter of a nationwide foreclosure crisis. According to RealtyTrac, in 2009 alone, a staggering 516,711 Florida properties received a foreclosure filing. That’s one in every 17 housing units — nearly six times the national average.

But as families were forced from their homes and neighborhoods emptied, something strange began to happen. The abandoned houses, it seemed, were not as empty as they appeared.

## The Whispers Begin

Local real estate agents were the first to notice. Sarah Martinez, a veteran realtor from Miami, recalls her first encounter:

“I was showing a foreclosed property in Coral Gables. Beautiful Spanish-style home, but it had been empty for months. As we walked through the master bedroom, I heard what sounded like someone whispering. I turned to my clients, but they hadn’t said a word. When I asked if they heard it too, they just looked at me like I was crazy.”

Sarah’s experience wasn’t unique. Across Florida, reports began to surface of strange occurrences in foreclosed homes. Lights flickering without electricity. Doors slamming in still air. And always, always, the whispers.

I was showing a foreclosed property in Coral Gables. It had been empty for months. As we walked through the master bedroom, I heard someone whispering. I turned to my clients, but they hadn’t said a word. When I asked if they heard it too, they just looked at me like I was crazy.

The Ghosts of Broken Dreams

Paranormal investigators soon took notice. Jack Thompson, founder of Florida Phantom Finders, has a theory:

“These aren’t your typical hauntings,” he explains. “We believe these are manifestations of the emotional trauma left behind by families forced from their homes. The whispers? They’re echoes of arguments over missed payments, of parents trying to explain to their children why they have to move.”

While skeptics scoff, the reports continued to pile up. In Tampa, a maintenance worker claimed to see the translucent figure of a child, clutching a teddy bear, standing in the doorway of an abandoned home. In Orlando, neighbors reported hearing phantom piano music coming from a house that had been empty for years.

The Numbers Don’t Lie

As the foreclosure crisis deepened, so did the reports of supernatural activity. Consider these chilling statistics:

- In 2010, Florida saw 485,286 foreclosure filings — and a 37% increase in reported paranormal activity compared to the previous year.

- Counties with the highest foreclosure rates, like Miami-Dade and Broward, also saw the highest concentration of reported hauntings.

- A survey of Florida real estate agents found that 23% had experienced something they couldn’t explain while showing a foreclosed property.

Coincidence? Perhaps. But for those who’ve experienced it firsthand, the connection is undeniable.

The Lingering Effects

Even as Florida’s real estate market recovered, the echoes of the foreclosure crisis lingered. Some neighborhoods never fully bounced back, with boarded-up homes standing as silent reminders of what was lost.

And in these areas, the whispers persist.

“It’s like the homes themselves are grieving,” says Elena Rodriguez, a paranormal sensitive who’s been studying Florida’s haunted foreclosures for years. “They’re mourning for the families they lost, the dreams that were shattered within their walls.”

A New Generation of Ghost Stories

As time passes, the foreclosure crisis is fading into history. But its legacy lives on in a new generation of Florida ghost stories.

Children dare each other to spend the night in the “banker’s house” — a sprawling mansion foreclosed on during the crisis, now said to be haunted by the spirit of a disgraced financier. Urban explorers swap tales of shadow figures glimpsed through the windows of abandoned subdivisions. And real estate investors trade tips on how to cleanse a property of negative energy before putting it back on the market.

The Future of Florida’s Haunted History

As Florida’s real estate market continues to evolve, what will become of these haunted foreclosures? Some, no doubt, will be renovated and resold, their troubled histories papered over with fresh paint and new mortgages. Others may linger, their whispers growing fainter with each passing year.

But for those who know where to look — and more importantly, where to listen — the echoes of Florida’s foreclosure crisis will always be there. A reminder of the human cost behind the statistics, and a warning about the dangers of unchecked speculation.

So, the next time you’re driving through a Florida neighborhood and spot a house that looks a little too quiet, a little too empty, listen closely. You might just hear the whispers in the walls, telling tales of a boom gone bust and the ghosts it left behind.

As the sun sets on our collection of real estate nightmares, remember that while these tales may send shivers down your spine, they serve as ghostly reminders of the real horrors that lurk in hasty decisions and unchecked due diligence. Whether you’re bidding at auction, hosting an open house, or dealing with tenants who seem to have supernatural staying power, the Florida real estate market holds mysteries deeper than any foundation. So the next time you’re about to sign on the dotted line, take a moment to listen—really listen. That whisper in the walls might just be trying to tell you something. After all, in this market, it’s not just the price that could be killing you.