With Limited Real Estate Inventory in Florida, Foreclosure Sale Investors Need to Make Smarter Plays

Florida’s real estate market has always been attractive to investors seeking profitable opportunities at tax deed auctions and foreclosure sales. These events offer the chance to acquire properties at discounted prices, making them lucrative ventures. However, recently, the limited real estate inventory in Florida has significantly affected investors’ prospects, leading to both challenges and opportunities in the market.

Investors need to be more strategic and cautious with their bids to ensure they don’t overpay for a property.

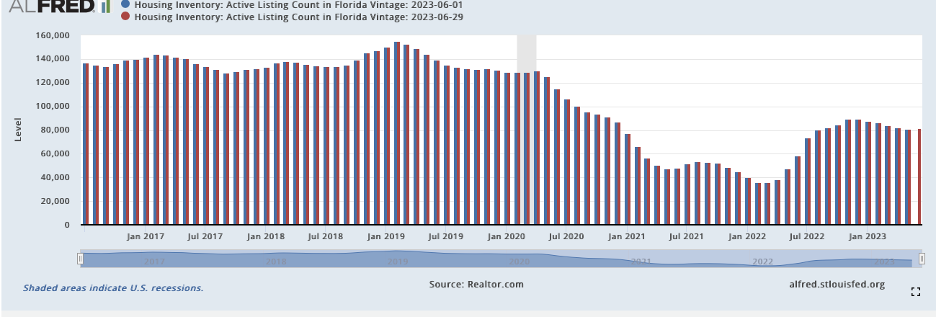

Since COVID, Florida has seen a dramatic shift in housing inventory from a high of 155,000 listings in 2019, to a low of 35,000 listings in January 2022. In June of 2023, the number of listings is back to 83,000, but that is still very low.

The lack of available properties has resulted from a growing demand for housing and investment properties in Florida. The state’s popularity as a vacation destination, retirement haven, and business hub has driven an influx of buyers, both residential and investors, seeking properties. This increased demand has led to a supply-demand imbalance, affecting the number of properties available at tax deed auctions and foreclosure sales.

As inventory remains limited, finding high-quality properties becomes a challenging task for investors.

With fewer properties on the market, the competition among investors at tax deed auctions and foreclosure sales has intensified. Bidding wars are now more common, driving property prices higher and eroding the potential profit margins for investors. As a result, investors need to be more strategic and cautious with their bids to ensure they don’t overpay for a property.

As inventory remains limited, finding high-quality properties becomes a challenging task for investors. Investors need to be ready to make smarter decisions on how to identify profits that others will not see. It could be in rehabbing properties with greater efficiency. It may be identifying legal encumbrances and liens that can be resolved but will usually deter novice investors from taking risks. Investors need to conduct thorough due diligence to identify properties with the potential for significant returns on investment. But with the right education and a deeper understanding of advanced strategies for investing in distressed assets, there are many layers of the onion to peel back. Savvy investors can expose profits other investors will miss.

While the shortage of inventory poses challenges for investors, it also creates opportunities in emerging markets within Florida.

The scarcity of available properties has forced investors to adapt their investment strategies. Some investors have shifted from focusing solely on tax deed auctions and foreclosure sales to exploring other avenues, such as probate properties, pre-foreclosure deals, off-market deals, distressed property purchases, or partnership opportunities with developers.

The lack of real estate inventory in Florida has made it particularly challenging for first-time investors to enter the market. With limited affordable options, newcomers face fierce competition from seasoned investors with deeper pockets and established networks. This makes it vital for first-time investors to educate themselves thoroughly and seek professional guidance.

Despite the challenges, opportunities still exist in emerging markets.

While the shortage of inventory poses challenges for investors, it also creates opportunities in emerging markets within Florida. As urban centers become more saturated, investors are exploring potential in suburban and rural areas. These regions may offer untapped potential with attractive property prices and growth prospects.

The limited real estate inventory in Florida has significantly impacted investors participating in tax deed auctions and foreclosure sales. Intense competition, rising property prices, and a shift in investment strategies have all been consequences of this imbalance. Despite the challenges, opportunities still exist in emerging markets, making it crucial for investors to adapt, strategize, and conduct comprehensive research to succeed in this dynamic environment. As the Florida real estate market continues to evolve, investors must stay informed and flexible to thrive in this competitive landscape.