The Housing Market Could Crash in 2023

Predicting if the housing market could crash in 2023 involves many variables and is forcing me to dust down my crystal ball. Will we be in for a rollercoaster ride OR a more sedate carousel ride at the fairground?

Many housing market predictions forecasted a cooling-off from the madness of 2021, but according to Fannie Mae, not as fast as buyers would like or expect. In the November 2021 housing forecast, economists at Fannie Mae said the housing market price surge probably peaked, and the market will normalize. The question is, how long will it take?

Top Five Factors That Could Cause a 2023 Housing Market Crash

1. Inflation

If inflation rises, there will be less consumer spending, leading to an economic downturn, economic instability, and a possible recession. This will certainly boost the chances of a 2023 crash.

2. Unsustainable Market Prices Bubble Pops

Sticker shock will eventually take hold and dampen buyer demand by presenting affordability challenges.

3. Rise in Mortgage Interest Rates

With each percentage point hike, the potential pool of buyers will shrink with each point hike, creating a snowball effect on dropping prices as sellers on the sidelines scramble to jump in to catch the falling prices.

4. Pandemic

The lowered economic activity that can come with a pandemic may surge in 2023. People are nervous about moving homes, so they stay home and avoid spending money.

5. Campaigning for 2024 Election

The pre-election year can be fraught with uncertainty for many, and uncertainty is never good for the economy, especially the 2023 housing market.

Inflation Might Be a Factor in the 2023 Housing Market Crash

Inflation is the 800-pound gorilla in any economic recipe and therefore is the most significant risk to the 2023 housing market. Doug Duncan, Fannie Mae Senior VP and Chief Economist, stated in December 2021, “While the economy picked up steam late in the year, unfortunately, so did inflation, and the market expects the Fed to recalibrate its monetary policy as a result.

“The public registered its ill-will toward inflation in our most recent National Housing Survey®, which found that 70% of consumers believe the economy to be on the wrong track — the most since 2011. When the aftermath of the Great Recession weighed down consumer sentiment, the Fed recently acknowledged that inflation is unlikely to be transitory.

“It will now attempt to engineer a soft landing, one in which inflation moderates to acceptable levels and economic growth decelerates but doesn’t contract. Whether the Fed can thread this historically difficult policy needle is shaping up to be one of the most consequential economic storylines of 2022.”

To combat inflation, the Fed will switch to its other favorite tool in its toolbox. What’s in the Fed’s “toolbox” exactly? There are only two “tools” in there: a money printer and an interest rate adjuster.

The Fed has been lowering interest rates and printing money since the 2008 financial crisis to move the economy out of the red and back into the black. Between 2008 and 2014, the Federal Reserve printed more than $3.5 TRILLION out of thin air. That is more than they had printed in the 100 years before the Great Recession COMBINED.

When COVID-19 hit, the Fed and other banks and governments had a collective “Hold My Beer” moment and have since spent 13 trillion dollars to combat the effects of the COVID-19 economic downturn.

With governments printing and spending at record levels, the Fed watched inflation numbers rise slowly and, as supply constraints hit, accelerate to rise at a blistering 40-year record pace. The Fed needs to use their other tool to cool off inflation: interest rate hikes.

Thomas Hoeing, retired president of the Federal Reserve region bank in Kansas City, was concerned about the threat of coming inflation back in 2011. He was worried that the Fed was taking a risky path that would deepen income inequality and enrich the big banks over others. He also warned it could suck the Fed into a money-printing quagmire that could destabilize the entire financial banking system.

Fast forward to 2022 — inflation is rising faster than the Fed believed. We have rising gas prices, higher-priced consumer goods, including groceries and cars, fueled by the Fed’s unprecedented money printing program. To respond to rising inflation, the Fed has alluded that it will start hiking interest rates by the back end of 2022, which could lead to stock and bond markets falling, which could lead to a possible recession that would affect the real estate market in 2023.

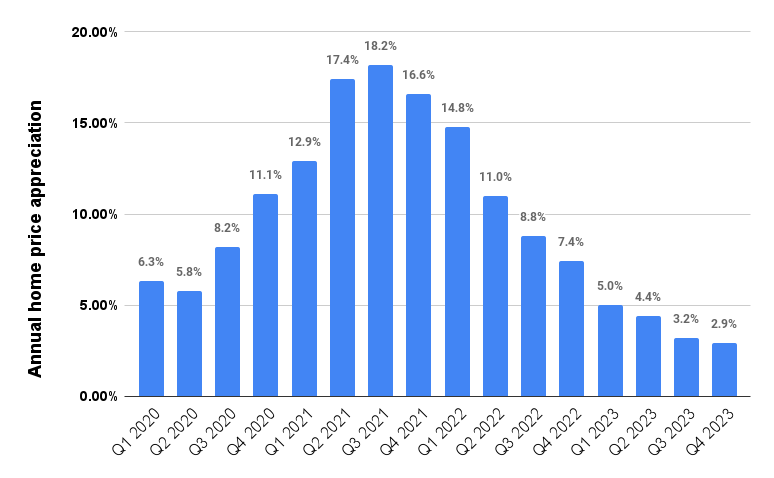

Once the Fed hikes rates, a downturn can occur one to three years later, the forecast notes. Fannie Mae economists see home price appreciation cooling off in the next year, with the annual rate of appreciation dropping back into single digits in the second half of 2022.

The forecast calls for even more chilling in 2023, with home price appreciation dropping below the current inflation rate, which could lead to a 2023 real estate market crash.

Surging House Prices Are Creating a Price Bubble That Could Pop in 2023

Forecast models released in spring 2020 by CoreLogic and Zillow predicted home prices would fall. Boy were they wrong!

U.S. median prices home list prices on Realtor.com went up by 27%, which added $9.1 trillion to the total value of the U.S. housing market in 2021 alone. Some states saw strong jumps, while owners in other states saw massive leaps!

The top five states are Montana, Idaho, Utah, Nevada, and Maine. Zillow forecasts U.S. prices will jump another 11% in 2022, but Redfin and Realtor.com predict a more modest 3% and 2.9%, respectively, in 2022. How does that fare for the 2023 market?

In 2021, mortgage rates were set at a record low. There have still been plenty of stimulus money handouts, which some folks have put aside for home down payments, and we know that inventory has been at a record low.

The 2023 real estate market could catch up once demand becomes closer to supply. Supply may flourish too with potential sellers jumping on the bandwagon to catch the high waves before the tsunami subsides. When building supplies such as timber free up and the labor market comes back to some sense of normality, new builds could once again flood the market. These factors could predicate a change to a buyers’ market in 2023.

According to the Fannie Mae forecast, double-digit home price growth will continue until the middle of 2022. Still, it won’t be until 2023 when home value appreciation returns to the 5% pace, which was the pre-pandemic pace. You could surmise from this that the 2023 market could cause pessimism for prospective investors.

In 2021, home inventory plunged to record lows, sales boomed, and potential investors and homebuyers were forced into frenzied bidding wars with offers way over the asking price. Monthly price growth has somewhat eased, but the year-over-year pace has been at its highest level for more than four decades.

According to Case-Shiller Home Price Index, the previous record for rising home prices was a 14.4% year-over-year gain in the fall of 2005. Those meteoric home prices were surpassed in April 2021, with a new record set every month since. Year-over-year price increases now stand at 19.9%. Case-Shiller reports that home values stand at one-third more than the peak of the last bubble in early 2007.

Mark Zandi, a chief economist at Moody’s Analytics, said he is worried that the housing market is in for a hard landing, but he expects the market and economy won’t crumble like last time.

“The housing market is out of whack, and it’s not sustainable. It is over-valued, stretched, and vulnerable as mortgage rates rise and affordability gets crushed,” he says.

He thinks home prices will level out, falling in some areas of the country while gaining modestly in others for the 2023 housing market. This 2023 prediction seems very plausible vs. the rise in 2022.

A Rise in Mortgage Interest Rates Could Tip the Housing Market in 2023

Fannie Mae expects the average 30-year mortgage rate to climb marginally to 3.5% at the end of 2023; the average rated pre-pandemic was 3.7%. Low borrowing costs offer buyers marginal relief as prices rise higher, which is good news for investors looking to flip. While prices aren’t forecasted to decline, Fannie Mae predicts price growth during 2023 will be slower than average.

If we compare the 2023 market to the end of 2021 and the coming year, 2022, a cooling trend would be a positive development after such an overheated past year. A slowdown in home price appreciation and maybe more inventory could help avoid a 2023 real estate market crash.

Home prices have risen so exponentially that many potential buyers, especially millennials, have been priced out of the market. This has been great for house flippers, but it could change for the 2023 housing market.

The Pandemic Might Push the 2023 Housing Market to the Brink

Overall economic stability also plays a massive role in predicting future trends; even during the worst of the COVID-19 pandemic, the U.S. economy soldiered on. We all know that the real estate market thrived during the pandemic.

In August 2021, the Bureau of Labor Statistics reported that the nation’s unemployment rate had fallen to 5.2%, down from a high in April 2020 of 14.8%. Of course, this is not unexpected, but we know there are still substantial labor shortages.

Consumer spending has been on the rise too. Deloitte forecasted consumer spending to rise by 8.1% in 2021 after a 3.8 % contraction in 2020, aided by vaccinations and a stable economic recovery; Deloitte forecasted consumer spending to increase by 3% in 2022.

Fannie Mae’s first forecast of 2023 envisions an economy that is likely to have entered “the mature stage of the business cycle,” with the next recession perhaps looming on the horizon, which could affect the 2023 housing market.

“A mature stage means growth has received back to trend, the labor market is at ‘full employment,’ and the Federal Reserve is in the process of tightening monetary policy,” said the Fannie Mae forecast.

“At that point in the business cycle, recession risk moves into focus, as there is no longer pent-up demand or excess production slack providing momentum. Therefore, the economy is more vulnerable to being knocked off its growth trend by ensuing shocks. Additionally, imbalances or inefficiencies become more exposed in an environment of slower growth and tightening monetary policy.”

Even a best-case scenario with the pandemic declared officially over could have a negative effect on the housing market. Suppose everyone is back at work and offices open up in force in downtowns across the country.

What will happen to all the suburban and rural areas snatched up during the pandemic when everyone went remote and left busy cities in droves? One could imagine a fire sale where there was once a smoking hot market in the most remote housing markets.

Presidential Election 2024 Causing Uncertainty in 2023 Real Estate Market

Presidential elections can lead to massive shifts within the government, impacting all industries, including real estate. Historically, election years are good for buyers because home prices tend to rise more slowly. In past presidential election years, the typical drop in home price was 15%.

A new president can create initial uncertainty, which impacts home prices; some buyers are hesitant to invest in a home.

As we know from recent divisive presidential campaigning, opinions and sentiment can run hot on both ends. The campaigning for the 2024 presidential election will start in 2023, which can lead to a divided and inflamed voter base that can also influence the real estate market.

Back in 2020, Chief Economist of Realtor.com Danielle Hail explained that there would be two very different outcomes with two juxtaposed administrations. “When voters make a decision, the choices are largely preserving the status quo in the housing market versus expanding opportunities for minorities, low-income, and lower-middle-class households.”

Consumer confidence before an election can also fluctuate. The health of the economy and housing are closely linked. When consumers feel confident, they are more likely to spend. Still, with consumers on the fence about the economy due to the uncertainty of the election outcome, it can create more pessimism than optimism. This uncertainty and pessimism could lead to a volatile 2023 housing market. Florida real estate investing is a bit hotter than most of the county in most bubble markets, and history shows when Florida’s market jumps highest, it tends to fall the lowest after the crash! Be careful Florida investors and have backup plans.

In conclusion, each of these variables could have a domino effect, leading to a 2023 real estate market crash, but a crash so soon after the highs of the past 18 months seems unlikely. I wonder if my crystal ball will tell me the possible candidates running in 2024? Happy investing!