Our New Title Search Report; What’s Inside & Why you Need Them Now!

I don’t write many articles for PropertyOnion.com these days, much to my business partner Damon’s displeasure.

My valid excuse is that, as PropertyOnion.com has exploded, most of my time has been spent on numerous administrative tasks. We are propelling PropertyOnion.com onwards and upwards with more detailed property content and hundreds (yes, hundreds) of new features.

My motivation to write this article was born from my pride in our newly revamped PropertyOnion preliminary Title Search; it was great before, but now it’s incredible!

They say you can tell an ethnic restaurant is tremendous if most of the customers that frequent it are from the same ethnic region.

My humble analogy is that some of Florida’s most respected investors use the PropertyOnion prelimi Title Search.

PropertyOnion.com’s Title Searches Make Your Life Easier

So, what’s the point of ordering a title search from us?

Let me pose this question to you:

Would you walk across a busy road without looking left and right before proceeding?

If the answer is yes, please stop reading now!

If your answer is of course not, then let me draw your attention to the perfect analogy of buying a piece of real estate at a Florida county foreclosure auction without finding out first if there are any encumbrances.

You can perform a title search yourself if you absolutely don’t want to spend the money on purchasing one. Check out my article “Try and Do Your Own Free Property Lien Search,” which is available to free members, as well as the companion how-to video, which is available to premium members only.

However, the preferred method for the busy investor is to purchase a PropertyOnion.com Preliminary Title Search.

How Our Title Search Service Works

These life-saving pre title searches — which are sometimes referred to as title checks, ownership and encumbrance reports (O&E), or pencil searches — cost $50 each. We also offer a pack of 10 for $450, thus making each report $45.

To order a title search, please go to the Order a Preliminary Title Search page on our website; from there, it is self-explanatory.

PropertyOnion.com will deliver a preliminary title search in just one to two business days. We can provide same-day rush service for an additional $30 if the order is submitted prior to 2 p.m. Monday through Friday.

When completed, the title searches are posted to your PropertyOnion.com Title Search Dashboard in your account to view, print, or share by email.

I advise you to order a title search no more than four working days before the Florida county foreclosure auction where you intend to bid on a property.

A fair number of properties at Florida county foreclosure auctions cancel prior to the sale for many reasons, but that is for another article. However, the odds of a foreclosure property canceling drop dramatically about four days before an auction, so you may waste your money on title searches purchased a week or more before the auction.

I can’t help but add that all PropertyOnion.com preliminary Title Searches are prepared by our own USA-trained abstractors who are intimately familiar with the Florida real estate market. Our abstractors have worked in the battle-hardened counties of Miami-Dade, Broward, and Palm Beach, during and after the foreclosure crisis, so they are used to sorting through messy foreclosure title issues.

PropertyOnion.com does not and will never farm any of its title research work overseas like most other places doing these searches! There are even places that produce these reports months in advance and then resell them. This is a terrible practice as it can leave major gaps in the search.

What Information Does Our Title Search Provide?

Let me explain what a title search will show you on any given piece of real estate that you intend to bid on at a Florida county foreclosure auction.

The first thing to understand is the difference between a PropertyOnion.com Preliminary Title Search and a full-year title search that a real estate attorney or closing/title company will provide during a conventional real estate transaction.

The cost of these attorney-based searches ranges from $300 to $1,000. They are primarily used to ensure a title insurance company that there are no clouds (encumbrances) on the property/title.

The seller can then transfer the real estate by warranty deed, special warranty deed, fee simple deed, or quitclaim deed with the buyer guaranteed by a title insurance company (Old Republic or First American Title to name two) that the real estate they are buying is free of encumbrances. . This is a search with a legal opinion attached that is good enough for a title insurance company to insure the title.

At a Florida county foreclosure auction, all you need to know is what encumbrances will remain if you win the bid.

With this information, you can determine the financial viability of clearing the encumbrances so that you can resell the property without any cloud on the title.

It would make no financial sense to conduct a 30-year title search on every property you are contemplating bidding on at a Florida county foreclosure auction. It takes too much time and money.

Our title search instead goes back to the last recorded deed holder of a transaction that had a deed where a title insurance product and attorneys were most likely used for the search. We then piggy-back on that search by closing the title search gap search from that owner until today. This is how you get a cost-saving search done that 95% of the investors use to bid at the county auctions. This is enough to get you 95% of the way there, the rest of the research is on you. Having 95% of the work done is what you need.

Understanding the Little Details Can Make or Break Your Investment

I won’t go into too much depth about the outcome of not understanding various judgments or liens.

I will only comment on a broad basis; there are many articles within the education section of the PropertyOnion.com website that deal with these matters.

Mortgages

One of the things you want to know when bidding on a property at an auction is if there are any mortgages attached. Are they the plaintiff in the foreclosure? If so, what mortgage is being foreclosed — the first, second, or perhaps a third? A PropertyOnion.com Title Search will give you this information in detail.

Understanding each mortgage’s superiority and its relationship to other liens and judgments is essential. I strongly advise that you become intimately familiar with which lien or judgment trumps another, therefore removing them as an encumbrance on a title post-foreclosure sale.

PropertyOnion.com preliminary Title Searches also report extremely important mortgage assignments.

Uninformed bidders at a Florida county foreclosure auction regularly assume that the plaintiff bank is the first mortgagee because it is the same bank that issued the original mortgage.

However, there are many times when a second mortgage has also been issued by the plaintiff bank, and this is the one being foreclosed.

The first mortgage was assigned to another bank or institution and is therefore still open.

Ignorant of this fact, you could purchase a second mortgage thinking it was the first that is useless unless you can pay off the first and still keep the deal profitable.

In truth, this has happened to me when researching my own encumbrances. It was only when I cross-checked with one of our abstractors that these assignments came to light, saving me a lot of anxiety and a ton of money.

Liens and Judgments

Open liens and judgments such as delinquent property taxes or federal tax liens (including IRS or business tax liens) have to be addressed when calculating how much to bid. Property tax liens must be paid no matter what, so you must include them in your calculations if you see any in your title search.

I have written previously on the possibility of removing IRS liens. If you become adept at doing this, you are ahead of the competition that would normally run away from such a lien.

As a rule of thumb, at a Florida county foreclosure sale, all first mortgages have to be satisfied. Any HOA or building association liens together with federal and state liens must also be satisfied.

There is an anomaly to the above. Without getting too technical, if an HOA or building association lien is recorded earlier than a mortgage, then the mortgage is deemed subordinate and expunged in the foreclosure action.

However, at a Florida county tax deed sale, all private liens are expunged, including but not limited to mortgages, credit card debt, vendor debt, and any HOA or building association liens. All state and federal liens remain.

A cautionary note: Buying a tax deed at a Florida county tax deed sale does not mean that any remaining property tax delinquencies are removed in the tax deed sale.

You are only purchasing the tax deed that covers a specific set of property tax liens. There may be other property tax liens that are yet to be foreclosed.

These will be reported on our title search and must be settled post-sale. Otherwise, you could find yourself in a Florida county tax deed sale with the property you just bought.

The same applies to an association foreclosure.

If you win a property at a Florida county foreclosure auction and the association is the plaintiff, there might be other liens in the pipeline for delinquencies which have not been recorded.

When viewing a PropertyOnion preliminary Title Search, it is also essential to look out for all lis pendens. This recorded document alerts the public that there is an impending lawsuit being prepared that will be filed with the county. Our title search lists all lis pendens separately in an easy-to-read format.

You can also review all code violations and mechanic liens that have been recorded at the county.

I have written about how I believe you should try to settle these code violations.

The PropertyOnion preliminary Title Search provides detailed information to help investors make wise, informed decisions on whether to bid on a property at a Florida county foreclosure auction.

How to Read a PropertyOnion Preliminary Title Search

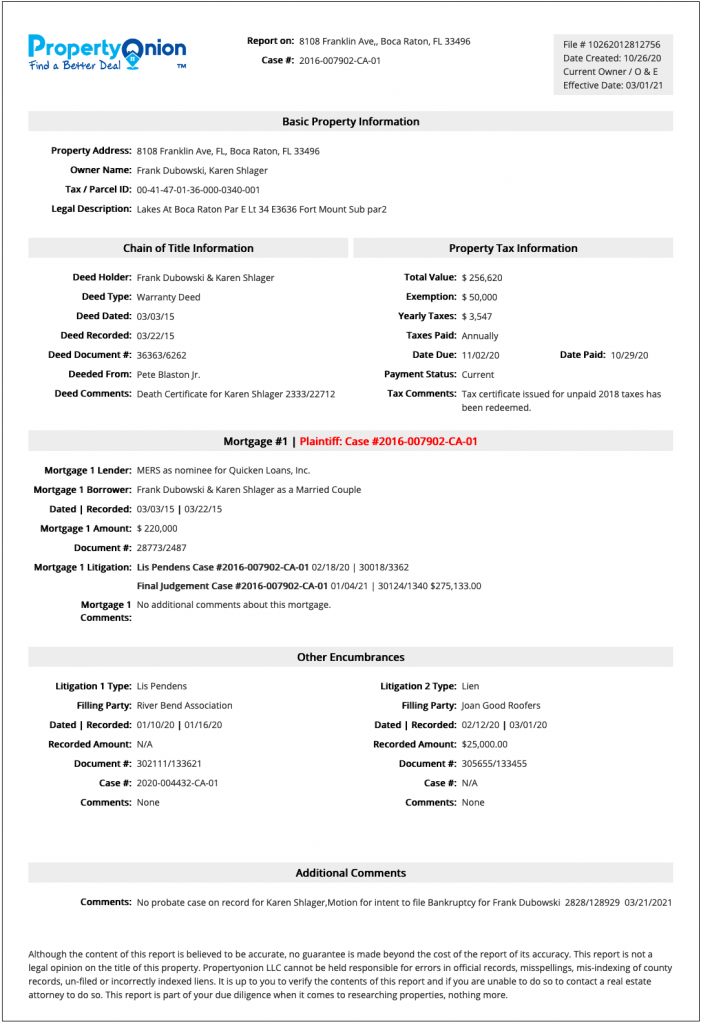

Let’s examine an example our Pre-Title Search.

There it is in all it’s easy to understand glory, organized for viewing by both expert investors and new ones alike.

There are 6 parts to our reports:

- Basic Property Information

- Chain of Title Information

- Property Tax Information

- Mortgages & Mortgage Litigation

- Other Encumbrances

- Additional Comments & Information

Let’s take our sample report apart section by section so you have a better understanding of our new report format and why it’s so great!

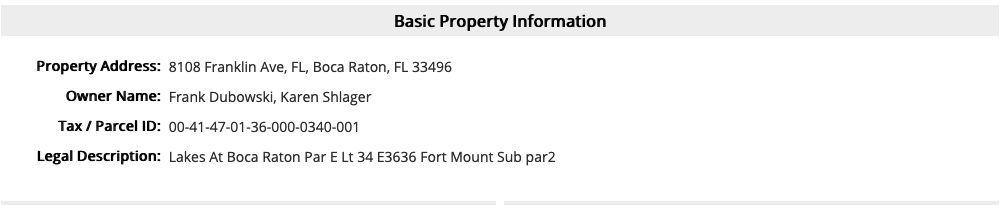

Basic Property Information

In the search’s header is the case number, which an investor can cross-reference with the preliminary Title Search Page and the relevant Florida county website.

Within the “Basic Property Information” section, you’ll find the property address, owner name, tax parcel ID, and legal description.

Chain of Title & Property Tax Information

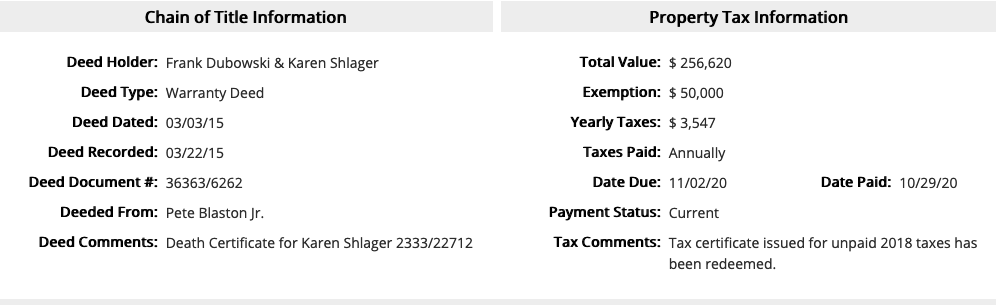

The next section is the “Chain of Title Information,” where you can see that the deed holder was conveyed the property by warranty deed.

On the deed comments, there is a death certificate.

The “Property Tax Information” section tells you that the current property taxes have been paid, although a tax certificate was issued for unpaid taxes, which has since been redeemed.

Mortgages & Mortgage Litigation Information

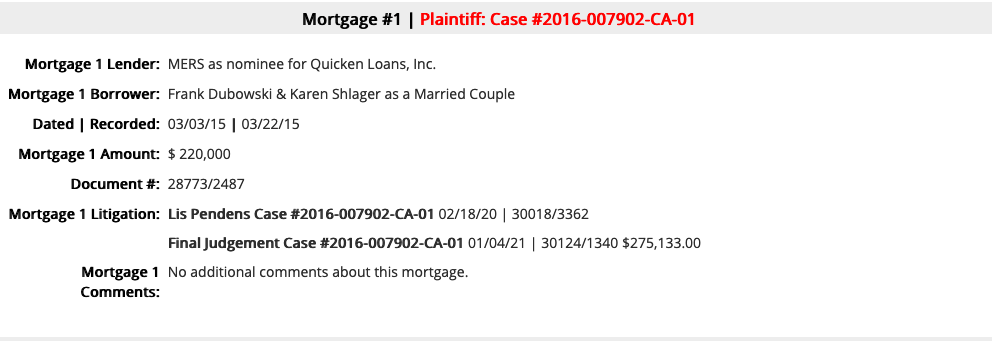

In the “Mortgage” section, you can see who the lending bank is, who the mortgagor is, the dates of recording, and the mortgage amounts.

In this example, a lis pendens was issued regarding this mortgage and the final judgment issued upon the same mortgage, which resulted in the current Florida county foreclosure sale.

The title search gives the final judgment amount that, depending on the property’s value, provides some indication of whether the bank is ‘upside down’ or not.

This will provide you with some guidance on how much you may want to bid when you assemble all the other key financial components.

Your decision-making will, of course, be influenced by all the other encumbrances reported.

Other Encumbrances

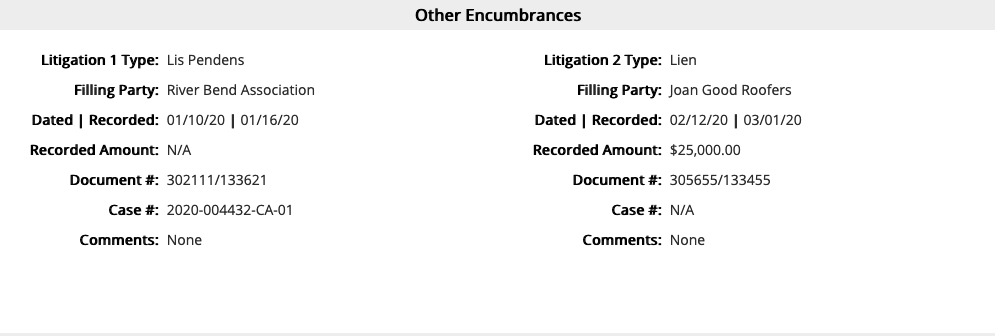

The lis pendens issued by the HOA will be a significant determining factor and will set you the task of finding out how much is currently owed.

Another lien has been issued at the county by a vendor, but this lien will be wiped out at the foreclosure sale and will not be payable.

It is only the HOA that will need to be settled post-foreclosure sale.

Additional Comments & Information Section

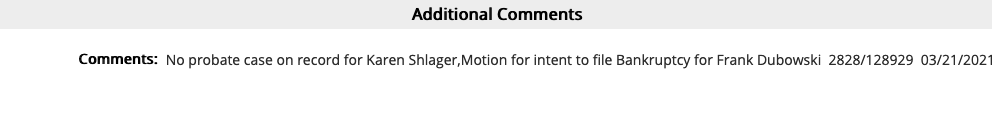

You can see in the “Additional Comments” section that there is no probate case on record. However, the deed holder has entered a motion for bankruptcy, which tells you that this foreclosure sale will likely be canceled.

Experience will tell you that when there is a suggestion of bankruptcy, more often than not it is a frivolous attempt to delay the inevitable instigated by the defendant’s attorney in an effort to buy some time.

This ploy is used to try to urge a loan modification with the bank or find some other remedy to satisfy the delinquency.

My experience tells me that 90% of the time you will see this property back on the auction block within 60 to 90 days.

A Proper Preliminary Title Search Is a Must for Any Investor

If you are a serious property investor, you need to be confident that your title search will give you all the salient points so you can make a rational, well-informed decision.

I consider myself an expert in the art of trawling through the various counties’ judgment records to search for encumbrances.

However, I always revert to a properly abstracted PropertyOnion preliminary Title Search compiled by an American property expert who knows what’s what and where’s where; there is no substitute for comprehensive knowledge.

My fellow investors, whether you use the PropertyOnion preliminary Title Search service or, and I am going to hate myself for even suggesting this, another provider’s, please, please GET A TITLE SEARCH before you buy a property at a Florida county foreclosure auction or a Florida county tax deed sale.

I have no end of stories to regale you with of the financial tragedies I have witnessed.

These tragedies came about mostly because the investor thought $50 was too much money to spend on finding out whether the property they eventually won with their hard-earned money had any encumbrances.

Along with our panel attorney, Jeff Harrington of Harrington Legal Alliance, I took on the cause of a semi-retired teacher (who is now heading back to full-time employment) based in Miami who decided to purchase five properties at the Miami-Dade County tax deed sale with her life savings. All were horribly encumbered.

It just so happens that one particular property that she won (she won all of them quite easily, go figure) should not even have been in the auction as it was a totally flawed tax deed parcel.

You will be able to read more about this in the coming months as Jeff and I take on the establishment to try to get her money back on one of these properties.

God forbid I should tell your story next; get a PropertyOnion.com preliminary Title Search!