The Monthly Peel Vol.12

The Monthly Peel

Interesting stories, tips & tricks for real estate investors.

How Liens Work & How To Profit with Them

Buying foreclosed property with lots of encumbrances is not for the faint-hearted. Some of us here in the Twilight World of investing in Real Estate purchased from a Florida County Foreclosure Auction seek out properties that have heaps of encumbrances, some seemingly immovable, making a deal untenable, but are they? How Liens work is an important subject every serious investor needs to understand.

Read the entire tutorial and you will understand how the interactions between the liens and the litigation will make or break your deals and even find ones everyone else missed!

Relax, It’s Not the End of the World! – Part Two

The fact that you are reading this shows that you have more than a passing interest in Florida Counties Real Estate Foreclosure Auction’s & Florida County Real Estate Tax Deed Foreclosure Auctions.

Damon and I (Tony) haven’t had much interaction since we both aired our contrasting views in March on the Pandemic crisis. No doubt when he reads this article, and he will have more than an adequate reply, I am sure. I believe the majority of our members, well those that will take the time to read this article, will share my short- to medium-term optimistic views, because who wants to live through unending miserable times with no good-time breaks unless your name is Damon! I am reasonably confident that the Coastal Cities are going to flourish, especially in the luxury end of the market.

Read the rest of why Tony still says to “Relax, It’s Not the End of the World!

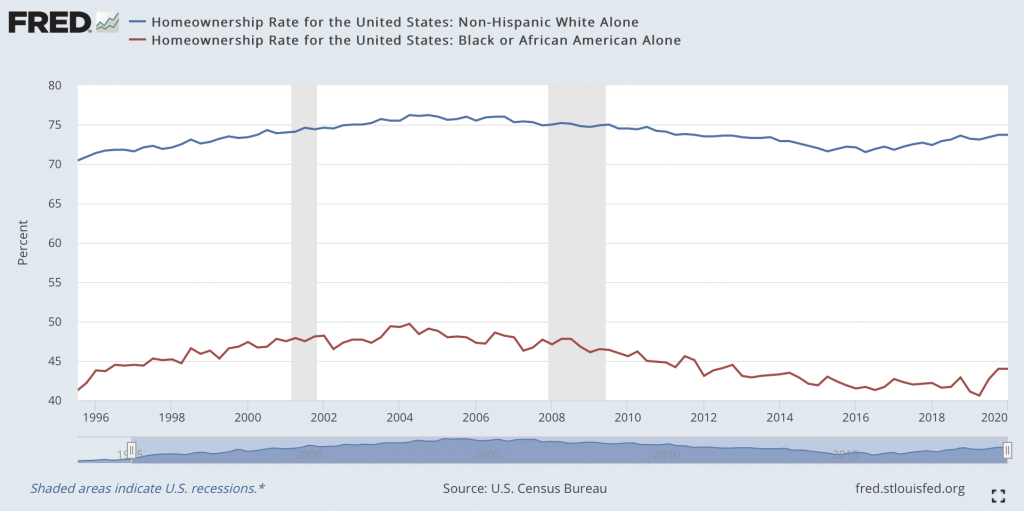

Fixing Economic Inequality in the Black Community with Real Estate

With the backdrop of the Pandemic, we have seen a renewed demand for racial and social justice. Entire books will be written about the social injustices on the Black communities based on this year’s events, however ever, that is not the focus of this article.

Much of the outcry of injustice is rooted in the economic disparages seen in the Black communities. A large part of the solution is financial education, affordable homeownership, and investing primers for first-time homebuyer and investors.

There was a push to open up lending to minority communities during the Clinton era, which culminated in the housing crisis in the last decade. We need to take the hard-learned lessons of the housing crisis and help Black communities stand up financially and achieve their own financial freedom revolution. Read the history, and full anlaysis of how Real Estate can help solve this Black economic crisis!

Landlords, How to Prepare for The Second Covid-19 Wave

The housing market has been severely affected, as we are all aware. Still, many Landlords have been very heavily hit with thousands of tenants in all states going on ‘rent strike’ as millions are unemployed. Many states have suspended evictions but not rent payments. Without legal forgiveness of rental payments, tenants faced the threat of lawsuits or eviction as soon as housing courts reopened.

Twenty-four states are processing evictions again, and that number is likely to climb to at least 30 states by the end of June. Some Renters Can now be Evicted, Many cannot!

Continue reading how to prepare for the second Covid-19 wave here for analysis and advice!

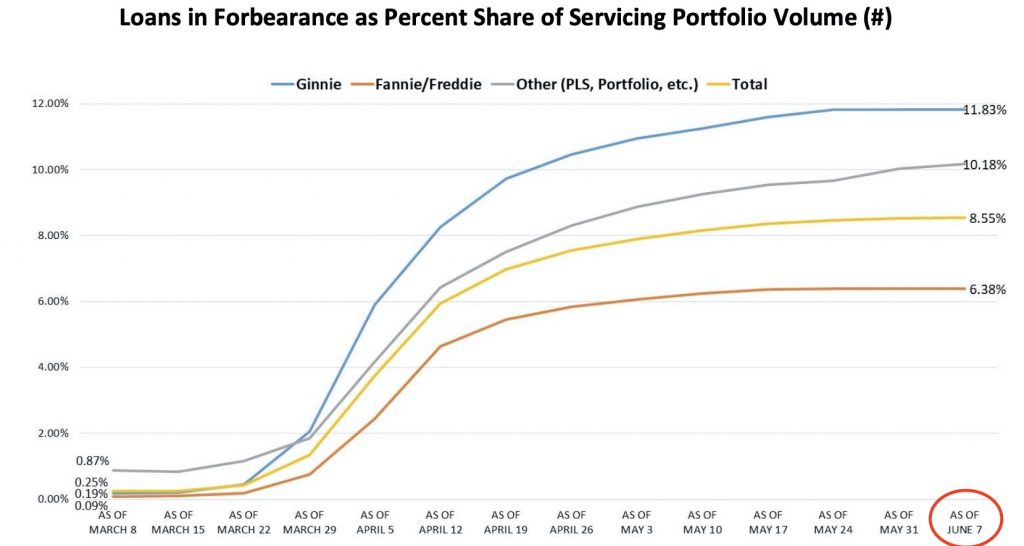

Uh-Oh; June Mortgage Delinquencies Hit 2011 Highs

Based on data from property research & information service giant Black Knight, the mortgage delinquency rate jumped to it’s highest level since 2011. The pandemic is starting to crack the once seemingly unstoppable pre-Covid-19 runaway bullish economy.

The numbers are staggering. Borrowers more than 30 days late have ballooned to 4.3 million from an already high April number of 723,000 delinquencies. According to Black Knight Inc., over 8% of all mortgages in The United States are now past due or in some stages of foreclosure.

Find out what this means for investors, and what is coming next here.

Book Review: BRRRR Property Investment Strategy Made Simple

The BRRR method (makes me feel cold just reading this!) is when you buy a property to fix it up, improve its value, and then refinance. You are, in effect, borrowing against the value of the property at its highest. If you become an expert in this method, you can recover more frequently, all of the money you invested in the property. The acronym for BRRR is BUY, REHAB, RENT, REFINANCE. Read the full book review here.

Absolutely Bonkers, Really Terrible MLS listing Pictures!

These are the worst of the worst real estate listing pictures we could find.These were all grabbed from actual MLS listings.

For each of these pictures, imagine an agent saying “Yep this is good to post to the listing, this will sell sell sell!” What were these people thinking?? What were the sellers thinking?

Here’s some really terrible real estate agent photographs, the worst of the worst!

So happy you read our email, how’d you like it?

If there’s anything you liked or didn’t like about this email, please leave comments below and let us know! We would love to get some ideas of what you might be interested in reading about in our next issue. If we pick your topic we will give you a $25 Amazon.com gift card as a thank you for the idea!

Sincerely,

-Rooty

Official PropertyOnion.com Mascot